Eligibility

If you’re an existing digital banking client who is eligible for UBS Securities Trading, you’ll be automatically enrolled.

If you don’t have a digital banking account, please contact your client advisor for more information.

All UBS cash and custody accounts are eligible for online securities trading with the exception of our UBS ManageTM clients.

You can place orders on a wide range of asset classes and securities, such as equities, exchange-traded funds (ETFs), bonds, and funds. To find out more about trading in specific instruments, please contact your client advisor.

Trading hours depend on the availability of exchanges and are time-zone-dependent. For more information, please contact your client advisor or call the UBS Digital Banking hotline.

All the major global markets that are currently available to you via your client advisor will also be available on UBS Securities Trading.

English, Traditional and Simplified Chinese.

Note: Some product documentation is available only in English.

For any queries on UBS Securities Trading or UBS Digital Banking, please call our UBS Digital Banking hotline.

Buying, selling and canceling orders

Watch this video to learn how you can buy/sell and cancell orders online.

Unable to place a buy order

If you can access UBS Securities Trading but are unable to complete a buy order, please check for any errors or read the on-screen notification message.

Some common reasons why a buy order may be declined:

- There’s insufficient cash or credit available to fund the purchase.

- When you place a buy order, an indicative market price is used to determine the net settlement amount, inclusive of fees. If you have an insufficient cash or credit balance in the chosen account at the point of order placement to fund the transaction, the order will not be executed.

- Please note that cash held in short-term cash investments is not available for order placements.

- The instrument is blocked due to a risk, regulatory, market or exchange rule.

- For more information, please contact your client advisor.

- The instrument is not available on UBS Securities Trading.

- Not all asset classes, investment types and instruments are available on the platform. If you wish to place an order on an instrument that is not available on UBS Securities Trading, please contact your client advisor.

- There is a technical platform issue.

- Please call the UBS Digital Banking hotline for assistance.

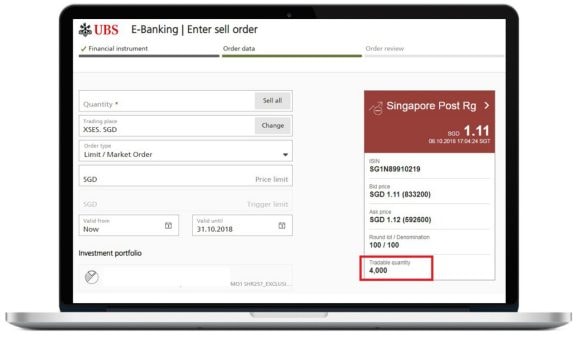

Unable to place a sell order

If you can access UBS Securities Trading but are unable to complete a sell order, please check for any errors or read the on-screen notification message.

Some common reasons why a sell order may be declined:

- There’s an insufficient quantity of the selected stock to execute the sale and short selling is not permitted.

- Some or all of the selected position is blocked for collateral or other commitments.

Market order

A market order is a request to buy or sell a security at the best available price in the current market. It guarantees an execution but not the exact price.

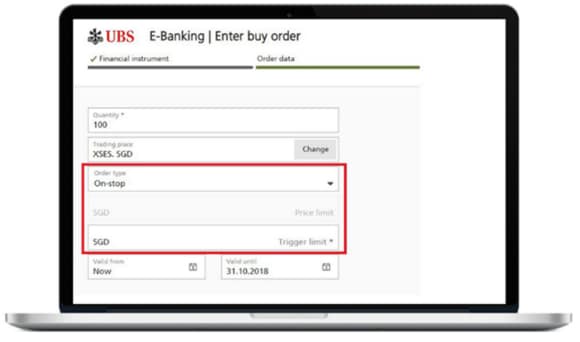

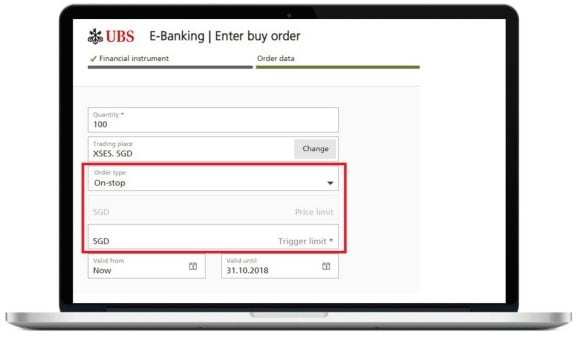

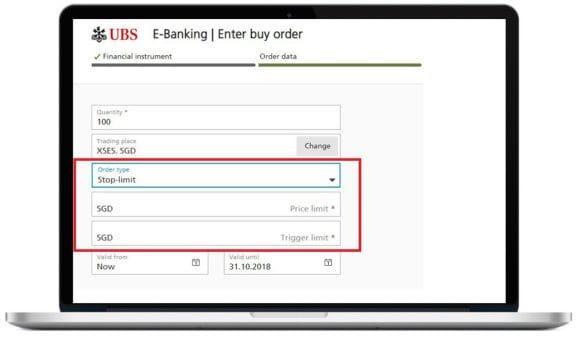

On-stop/Stop-loss order

An on-stop/ stop-loss order is an order to buy or sell a security when it reaches a certain price. This order guarantees a pre-determined price but not an execution.

Limit order

A limit order allows an order to be matched at a specified price. A buy limit order cannot be higher than the current price, whereas a sell limit order cannot be lower than the current price.

If you are unsure which order type is suitable for your intended trade, please contact your client advisor.

No. Limit orders cannot be placed on investment funds.

Multiple orders

You can buy or sell only one instrument in each order. If more than one instrument is required, simply create a new order for each. You can also place more than one order for the same instrument.

Minimum investment quantity

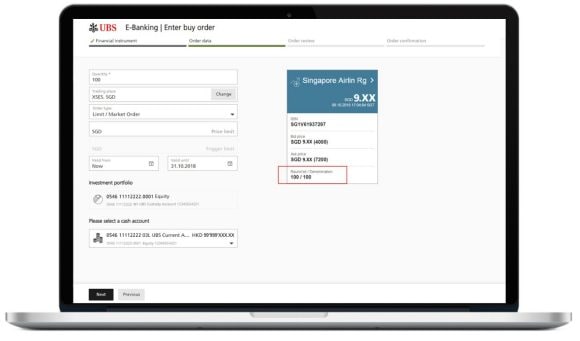

The minimum tradeable quantity or round lot will be displayed on the instrument overview. It differs from instrument to instrument.

Timing

You may place an order at any time but the order will only be executed during the official market trading hours.

For equities, structured products and financial instruments, standard market opening hours apply.

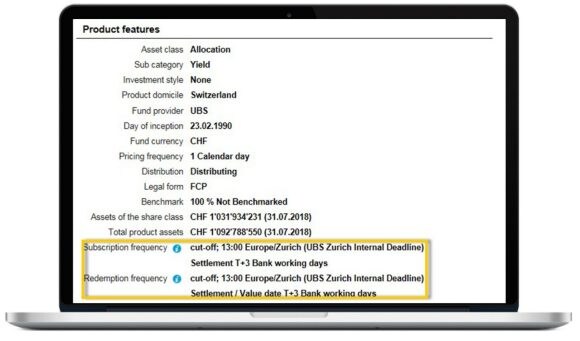

For funds, cut off times may vary. You can find the relevant cut off time in UBS Quotes, under the product features of the instrument.

Single-day validity

If you place an order with single-day validity, the order will expire at the end of trading hours on the relevant exchange day.

Multiple-day validity

If you set the validity period over more than one day, the order will remain open until it is filled or canceled, or until the validity period has expired, whichever is sooner.

Limit order

You may choose to execute the order when a pre-determined limit is reached. However, it is possible that the order may not be executed when the limit is reached. This is because limit orders are executed on a “first come, first served” principle at the exchange and there could be an insufficient volume of your selected instrument where it is listed.

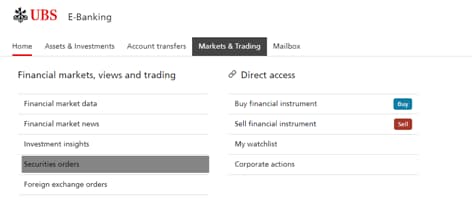

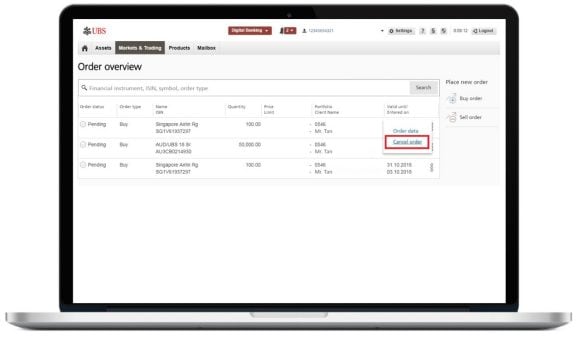

To cancel a pending order:

1. Select “Markets & Trading”.

2. Select “Securities”.

3. On the overview page, select the pending order and click “Cancel order”.

Note: Any order that has not been executed may be canceled. The cancelation is confirmed when the order status is changed to “Cancelled”.

You can cancel the order if it is pending execution (Refer to Cancel order).

When an order has already been executed, you can use the transfer function to resolve the account discrepancy. Any trades or transfers between accounts with different base currencies will incur an FX rate set by the bank.

The instrument might not be listed at the exchange, or the data stream for that exchange might not be open.

Instrument search

Please contact your client advisor if you would like to subscribe or change your CIO Research subscription.

Instrument name, ISIN, RIC, Valor, and Symbol.

Search results are grouped by asset class for easier identification. If there are many similar instruments in the same asset class, please check the ISIN to ensure that you’ve selected the required instrument.

Pricing and fees

You can get an estimate of how much you’ll be charged on the “Order review” page when making an order. The full financial details of the trade will be displayed, including fees and the estimated debit/credit amount. Please note that this amount is based on an indicative market price that may differ from the actual price at execution.

When the order is updated to “Settled” status, the final executed price and actual debit/credit amount will be displayed.

For more information, refer to the securities trading section.

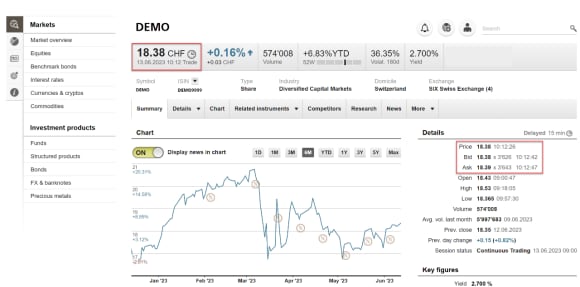

The date and time of the applicable price is indicated just below or next to it. For most exchanges, there is an approximate delay of 15 minutes on any given price.

You may contact your client advisor to open an account in the trading currency. Only FX transactions performed by your client advisor can be amended on a discretionary basis.

Alternatively, for most currencies you may use an account in a different denomination and we will perform an automatic FX transaction on your behalf. This foreign exchange conversion will be completed at a rate calculated automatically by the bank, using a standard spread on the market FX rate, and may be less favorable than foreign exchange transactions conducted via your client advisor.

No, only cash and drawn-down credit facilities will be considered for trade settlement.

Validation messages and suitability checks

Before accepting a buy order we will verify it in a number of ways. These include checking that:

- You have sufficient cash or credit to allow the order to be placed.

- The product is suitable and in line with your risk profile and product knowledge.

- The order meets cross-border and regulatory rules.

If we find an issue during these checks, we will either:

- Highlight the issue and allow the order to be placed.

- Prevent the order from being placed and ask you to contact your client advisor.

Sell orders are subjected to checks that prevent short selling.

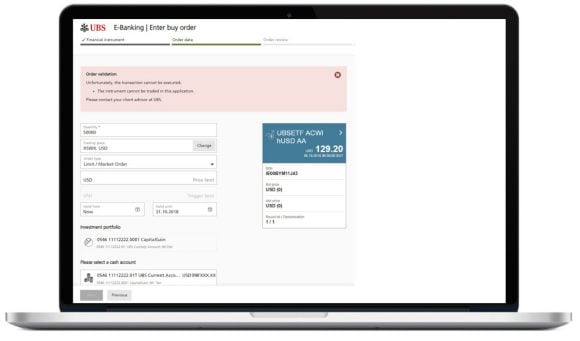

Hard block

If you see an on-screen notification in a red text box (‘hard block’), the order cannot be placed and you should contact your client advisor.

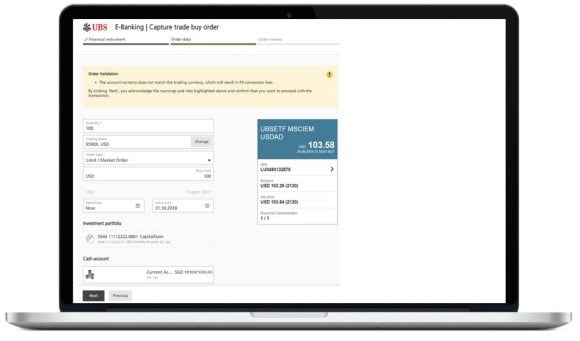

Soft block

If you see an on-screen notification in an amber text box (‘soft block’), you should read the message first before deciding whether to proceed with the order placement or to abort the order. If you have any doubts or concerns about the message, please contact your client advisor.

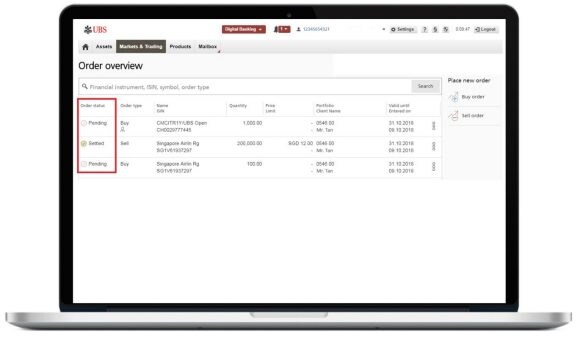

Query post trade (notifications, overview)

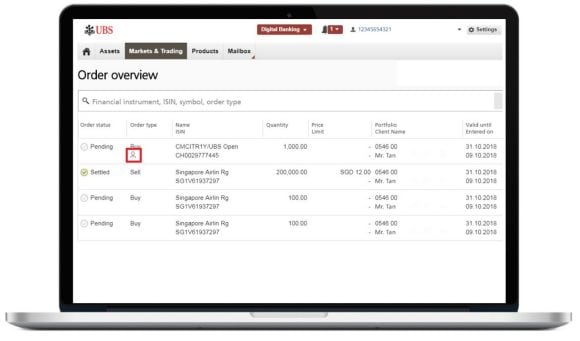

You can check the real-time status of all orders entered by yourself or your client advisor on the order overview page. Simply click ‘Markets & Trading’ on the top navigation bar then select “Securities orders” to go to the “Order overview” page.

If you attempt to place or cancel an order when the market is closed, the status of the order will remain as ‘Pending/Cancellation pending’ until the market opens and the order is executed.

You can check which orders are executed by your client advisor by looking for the icon in the ‘Order type’ column.

If you have placed an order but cannot see the transaction on the overview page, you should reset the filter. If the order still cannot be seen, please contact your client advisor or call the UBS Digital Banking hotline.

The time taken to process a transaction and for funds to be credited to your account depends on the settlement cycle of the selected instrument. Most equity transactions have a t+2 settlement cycle, meaning funds will be credited two days after the date of order placement.

However, some instruments such as funds may have settlement cycles as long as 30 days. The value (settlement) date of all orders can be seen on the order overview page.

Transaction confirmations will be sent to you in the same manner as trades ordered via your client advisor. You cannot print trade confirmations directly from UBS Securities Trading.

Please check your “personal settings” in the notification tab. You may have elected not to receive confirmations/notifications previously.

Please call the UBS Digital Banking hotline at the earliest opportunity. The hotline team will inform your client advisor and initiate the investigation process. Please note that you may experience restricted access to your online portfolio while investigations are ongoing. Trading and transfers will continue to be available via your client advisor. Either the hotline team or your client advisor will contact you when the investigation is complete and full access has been restored.

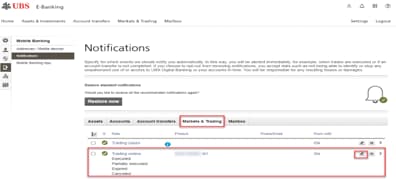

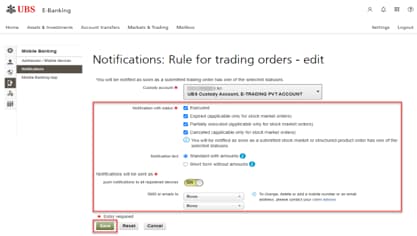

You can customize a number of notification events including: order executed, order partially executed, order expired and order canceled. The available notification delivery channels are email, SMS and in-app push notification. You may choose to receive notifications over multiple channels.

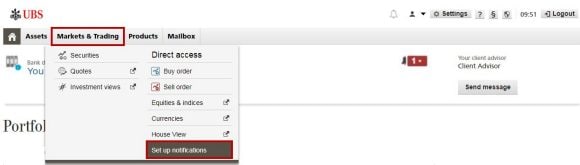

- Select “Mailbox”.

- Select “Set up notifications”.

3. Select “Markets & Trading” tab.

4. Select “Edit” icon on the respective trading notification rule.

5. Set your preferences and select “Save”

We’re here to help

We’re here to help

UBS Digital Banking hotline

Available from Monday - Friday: 7am - 8pm; Saturday: 9am - 5pm