Trumponomics and European real estate

The incoming US administration isn’t all bad news for Europe’s real estate investors

![]()

header.search.error

The incoming US administration isn’t all bad news for Europe’s real estate investors

On 5 November, the American electorate voted for Donald Trump to become the next US president, while also securing Republican majorities in the House and the Senate.

Many investors are expecting that Trump’s political plans will lead to higher inflation than under a Democratic president and a further increased budget deficit as the likely agenda includes tax-cuts, brakes on immigration, possible deportations of sans papiers, and tariffs on goods, including from the EU. It’s the tariffs in particular that are likely to affect the European macroeconomic landscape and consequently the European real estate markets. But there are various levers that are moving at the same time – including how Europe is going to react to a new Trump administration.

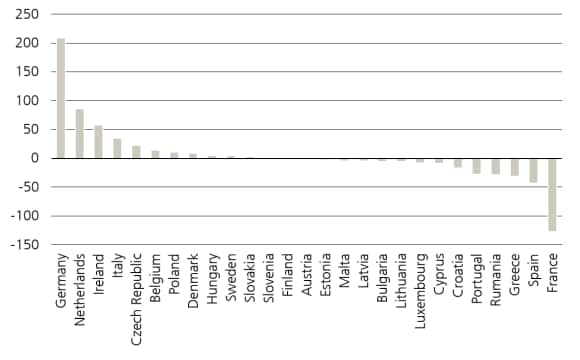

At the high level, the America-first approach including the tariffs announced is no good news for the European economy. Though the planned fiscal boost to the US economy is likely to produce positive spillovers for the European economy in the short run, the tariffs, as well as possible retaliations, are likely going to hurt. While the exact conditions, timing and amount are unknown, the introduction of tariffs are expected to impede growth in Europe, particularly growth of the export-oriented countries, first and foremost the already buffed German economy.

Trade balances of EU countries in 2023 (EUR billion)

Slower economic growth would, all things staying equal, negatively impact commercial real estate markets in Europe via the leasing market as European export-oriented firms would see their business decelerate. Furthermore, an increase in material costs and potentially imported inflation from the US might also pressure the European Central Bank to react on the interest rate side again, which would put pressure not only on the income side, but also on capital values. Slower growth, higher inflation and interest rates is poison for most asset markets, including real estate.

However, the picture is not all dark: all things do not stay equal.

As an obvious example, Trump's return has implications for Europe's security as he continuously threatened to withdraw the US support of NATO countries which do not meet their spending target of 2% of the GDP for defense. Europe will thus need to step up and there are already plans in motion to build a European Defence Union, appoint a Commissioner for Defence and ‘spend more, spend better, spend together’ on defense.1 While likely to react with some lag, logistics and manufacturing real estate would be a clear winner of regionalizing defense contracts.

In 2022, Europe spent EUR 240 billion on defense and would spend approximately EUR 80 billion more assuming all countries spent close to 2% of their GDP on defense, putting Europe’s defense expenditures at EUR 320 billion per year.2 However, estimates exist that are almost double, so the number may be much higher.3 But sticking to the lower estimate: between June 2022 and June 2023, EUR 75 billion, i.e., about one third of the defense budget, was spent on materiel. Nearly four-fifths of this was however procured outside Europe, mainly the US.4 Assuming that defense spending reaches 2% of nations’ GDP and the procurement share stays approximately constant, European defense procurement could be close to EUR 100 billion.

Clearly, if regional procurement increases, as is the EU commission’s aim, European defense contractors will likely need to expand their manufacturing capabilities, which may include larger real estate footprint, particularly in manufacturing. The demand for warehouses capable of facilitating the necessary changes in defense supply chains is likely to increase as well. This would come on top of any geopolitically-driven changes focused on e.g., securing the supply of critical raw materials and inputs in e.g., electricity generation and distribution, water supply and protection, sewage and waste management and other critical industries such as pharmaceuticals (which we covered in detail here).

Furthermore, history moreover suggests that Trump brings volatility, which fuels demand for safe haven assets. Among others, that includes residential real estate, which is far less cyclical than the commercial segments. The residential sector in Europe is therefore likely to become a relative winner amongst different sectors of commercial real estate, especially as the shortage of housing is already acute and rents stay under an upwards pressure.

Trumponomics is likely to become an additional test for the European economy during a time where structural challenges are ongoing even without a change in the transatlantic partnerships. For the real estate sector, there are upsides too however as structural changes create opportunities for real estate investors. Real estate investors should thus follow the development attentively to benefit from structural changes in the European economy and the real estate sectors that serve the needs of the changing European economy.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.