A new cycle commences

It’s darkest before dawn in European real estate markets

![]()

header.search.error

It’s darkest before dawn in European real estate markets

The last two years have been testing for real estate investors in Europe. From the post-pandemic highs to a sharp reversal driven by inflation and interest rates, the investment environment feels as cold as the year to date has been warm. But just as past cycles turned, so will this one. And there are indications that it is.

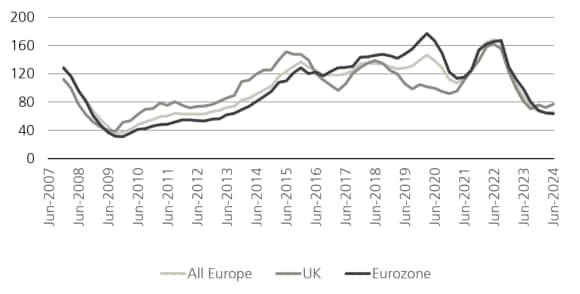

Investment volume is bottoming out

A key characteristic of a market going through capital value correction is lower investment volumes. Buyers are wary of entering markets where price developments are negative as not many want to risk catching a falling knife. At the same time, sellers are uncomfortable not receiving many offers, especially if those they do receive are below newest property valuations. Consequently, transaction volume contracts. A self-sustaining feedback loop forms as lower investment volumes discourage more buyers, shrinking the potential buyer pool further and so on.

But as valuers update their estimates of market values, sellers’ expectations of sale prices are adjusted. Willing buyers and sellers find themselves with a more similar set of expectations. Deals happen. Investment volume picks up. Prices stabilize. A new cycle starts.

Looking at the annual investment volume in Europe by different market segments, we see that we are close to the pick-up phase (see Figure 1). The UK, where valuations are adjusted quicker to transaction market fundamentals than in continental Europe, leads the pack: annual investment volume in the UK grew 6.5% QoQ in 2Q24. The UK investment volume growth pushed Europe’s growth number to 1.6% QoQ. The eurozone acts as a drag, however, with QoQ investment volume contracting by 1.9% in 2Q. This is not surprising: appraisal values in the eurozone are adjusted slower than they are in the UK, which means that sellers’ expectations have not been reset as they have across the Channel. Consequently, the price gap between potential buyers and sellers is wider and the pick-up in investment volume slower. Nevertheless, the quarterly contraction in annual investment volume in the eurozone was the smallest it has been during this downturn. It looks as if it is merely a question of time when it starts increasing again.

Prices are back to favorable risk-adjusted levels

Another sign of stabilization comes from relative risk and pricing measures. Looking at our risk-adjusted yields, which reflect risk-adjusted pricing in real estate markets (lower yields indicate higher pricing), and the deviation between them and actual market yields, we see the following picture: the pressure from higher interest rates on yields has all but faded.

We can see the deviation between our estimates of risk-adjusted yields and actual transaction yields in Figure 2.1 In short, the probability of a yield compression increases the higher the deviation is. The probability of a yield expansion increases the lower the deviation is.

We can see that the probability of yield expansion increased sharply in early and mid-2022 when interest rates increased as inflation became a problem. Indeed, yields increased as prices fell. Now, however, inflation has dropped, interest rates have stabilized and the probability of a further yield expansion has dropped significantly. Parallel to that, we see that yields are flattening in some sectors: repricing to new norms has run its course.

There are important details to keep in mind though. The key ones relate to underlying leasing market fundamentals: weak leasing market fundamentals in low-quality office markets are still driving repricing trends in those markets, pushing yields upwards. The German residential market is, however, one of the sectors that is seeing yields and prices flatten. A key driver is the attractive leasing fundamentals in the sector, which underpin the expectations of attractively priced cashflows from residential assets in the near future.

This will be further discussed in an upcoming article on German residential fundamentals.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.