Uranium – a powerful element in energy transition

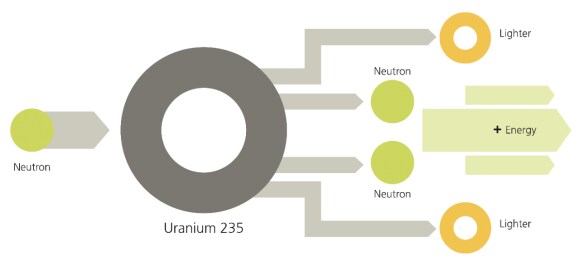

Uranium – a naturally occurring radioactive element – is one of the critical ingredients in decarbonizing the energy system and providing energy security. Since 2020, uranium prices have doubled due to a concentrated and insecure supply.