2025 Fixed Income Default Study

An examination of our bottom-up default outlook and total return forecasts for 2025

![]()

header.search.error

An examination of our bottom-up default outlook and total return forecasts for 2025

This paper examines our bottom-up default outlook and total return forecasts for 2025 within global high yield, Asia and emerging markets. The fixed income default study is based on a proprietary, bond-by-bond analysis conducted by our credit analysts. The team utilizes reference indices to form a comprehensive, bottom-up estimate of defaults and distressed exchanges by industry.

High Yields | High Yields | Expected default rate | Expected default rate |

|---|---|---|---|

High Yields | EUR HY | Expected default rate | 3.3% |

High Yields | USD HY | Expected default rate | 4.8% |

High Yields | EMD Corporates | Expected default rate | 0.9% |

High Yields | EMD HY Corporates | Expected default rate | 2.4% |

High Yields | Asia ex-Japan | Expected default rate | 0.8% |

High Yields | Asia ex-Japan HY | Expected default rate | 5.7% |

These projections translate into the following total return forecasts (also taking into account our rates and spreads forecast):

EUR high yield defaults expected to be 3.3%

Our forecast for EUR high yield is to continue to see suppressed default rates amid well-telegraphed special situations. We expect defaults to be marginally higher than 2024, driven by two large distressed exchanges which we expect to play-out this year. We have taken a more conservative approach versus some sell-side strategists. Importantly, when excluding these two large debt structures we expect defaults to drop to 1.2%, which is well-below long-term averages.

Sluggish economic growth and the possibility of a more aggressive US trade policy stance balances out easing policy rates and healthy demand for income in credit, not to mention the many avenues of non-traditional liquidity such as sponsor support, non-distressed exchanges, and private credit. Moreover, issuers continue to proactively term out amortization requirements with the 2025 and 2026 maturity walls approximately 40% and 25% lower than a year ago, respectively.

The main negative outliers are the telecommunications and capital goods sectors, both of which are heavily influenced by single issuers with large and complex debt structures. Real estate, while it pivoted positively in 2024 as rates moved lower, still has one specific issuer under scrutiny.

USD high yield defaults expected to be 4.8%

Our expectations for USD default rates are for them to be somewhat higher versus last year but, similar to the European forecast, the actual number will be highly contingent on two distressed and outsized capital structures where working groups have already assembled. Excluding these special situations, the default forecast comes in at 3.1%.

Key negative outliers are the healthcare and telecommunications sectors. However, as both are heavily influenced by single constituents, there is no particular concern around the fundamentals. Telecommunications in particular worked through its growth challenges and addressed heavily leveraged capital structures in 2024.

As with the European forecast, credit fundamentals are skewed to the downside, but current spread levels likely offer more return potential in light of the new pro-growth government. In any event, default rates should remain suppressed given easing lending standards, the availability of private credit and a smaller cohort of issuers trading at distressed levels.

Asia ex-Japan high yield defaults expected to be 5.7%

Within Asia ex-Japan high yield, our forecast is lower than last year as the primary candidates for default have already materialized. For 2025, we expect two large Chinese real estate issuers to default which are already trading at highly distressed levels. We also identified other issuers that are starting to show signs of credit stress, but as they have limited debt servicing requirements in 2025 we do not anticipate a default yet. A significant amount of issuers are trading already at distressed levels and when viewed from a market value basis the default rate drops to approximately 1.8%. Outside China, we do not anticipate any defaults given where these issuers stand in the credit cycle and continued availability of local funding which has facilitated refinancings over the past several years.

Emerging market high yield corporate defaults expected to be 2.4%

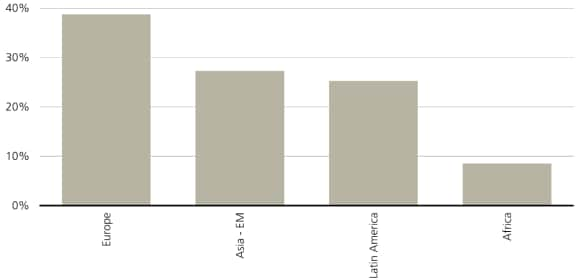

We expect an improvement in the default rates compared to 2024. Our forecast is in the middle range of estimates from several sell-side strategists; this reflects our view of slightly more restructurings in China real estate and higher EM Europe defaults driven by Ukraine.

We continue to feel a ripple through effect from the ongoing war with Ukraine representing the main country where we expect defaults to materialize driven by a large issuer.

Outside of these areas, we generally see defaults driven by idiosyncratic factors at the individual issuer level as opposed to country-wide or industry-wide trends.

Positive total returns driven by carry

Our Fixed Income Investment Forum is broadly constructive on high yield and emerging markets overall, and we forecast expected total returns to be positive for these sectors; this is consistent with a favorable carry environment. Our base case is for Asia high yield to generate returns of just under 12% but with larger dispersion, followed by EM corporates and USD high yield with an attractive range between 6-8%, and lastly EUR high yield between 4-7%. The EUR high yield market is impacted by the lower overall yields in EUR terms relative to the other three sectors which are in USD, however the EUR high yield market should benefit from a higher overall credit quality than USD high yield.