Q4 2024 Performance review

Q4 2024 Performance review

Unified Global Alternatives Hedge Funds (UGA HF) Broad Based Diversified (BBD) and Broad Based Neutral (BBN) portfolios generated positive results in Q4, experiencing profits across our four main strategies (Equity Hedged, Trading, Credit / Income, and Relative Value). Equity Hedged was the top contributing strategy, mainly driven by performance from the technology sector. Healthcare was one of the few detractors in the quarter, as a result of idiosyncratic short positions that were squeezed. Within Trading, positive performance was led by commodities, with natural gas trading producing notable gains. Discretionary trading also contributed positively as many managers benefited from the stronger US dollar following Trump’s reelection. In Credit / Income, we continued to benefit from income earned from reinsurance and real estate lending. Longer-biased corporate long / short managers also outperformed amid a generally supportive backdrop. Within Relative Value, we had better-than-expected performance from fixed income relative value (FIRV) managers as rate volatility increased.

In 2024, our BBD and BBN portfolios generally outperformed their respective hedge fund benchmarks. We are pleased with this outcome but remain humble and diligent as we prepare for an eventful year ahead.

Q1 2025 Outlook

Q1 2025 Outlook

We think that US policies and commensurate foreign policy responses are likely to dominate market activity in 2025. Moving forward, we predict it will be hard for the Fed to ignore the potential inflationary impacts of the new administration’s policies, thus moderating expectations for monetary policy easing. We believe that higher-than-expected rates, in conjunction with extremely compressed risk premia, could leave financial markets prone to a correction in the near term. While Trump’s return to the White House is largely expected to disrupt the status quo, slim majorities in both chambers of Congress will require GOP lawmakers to move in lockstep to effectuate most change. As investors assess the Republicans’ ability to further their agenda, we foresee a meaningful level of uncertainty in markets, especially in the crucial first months of Trump’s office.

Despite rising volatility, we expect economic fundamentals and investor sentiment to generally remain supportive of risk assets. We believe that a moderate amount of beta in portfolios is warranted but intend to be selective on our sources given a wider range of outcomes with a Trump administration. After a strong 2-year rally for risk assets, we plan to right-size some of our top-performing fundamental exposures within Equity Hedged, potentially opting for more opportunistic approaches in the future. We still maintain high conviction in themes in the technology, energy, and financials sectors. While we expect valuations for AI-related stocks to remain under scrutiny in 2025, we are firm believers in the durability of this theme and seek to broaden our exposure. In 2025, we anticipate Trump’s pro-business agenda will benefit capital markets activity and thus, we may increase our exposure to equity event, with a focus on ECM (equity capital markets).

CIO model portfolio and sub-strategy outlook

Equity Hedged

Sub-strategy | Sub-strategy | Q1 2025 | Q1 2025 |

|---|---|---|---|

Sub-strategy | Fundamental | Q1 2025 | - 19 |

Sub-strategy | Opportunistic Trading | Q1 2025 | + 11 |

Sub-strategy | Equity Event | Q1 2025 | 3 |

Sub-strategy | Equity Hedged Total | Q1 2025 | 33 |

Relative Value

Sub-strategy | Sub-strategy | Q1 2025 | Q1 2025 |

|---|---|---|---|

Sub-strategy | Quantitative Equity | Q1 2025 | 4 |

Sub-strategy | Merger Arbitrage | Q1 2025 | 1 |

Sub-strategy | Cap Structure/Vol Arb | Q1 2025 | - 3 |

Sub-strategy | Fixed Income Relative Value | Q1 2025 | 8 |

Sub-strategy | Agency MBS | Q1 2025 | 5 |

Sub-strategy | Relative Value Total | Q1 2025 | 21 |

Credit / Income

Sub-strategy | Sub-strategy | Q1 2025 | Q1 2025 |

|---|---|---|---|

Sub-strategy | Distressed | Q1 2025 | 1 |

Sub-strategy | Corporate Long/Short | Q1 2025 | 8 |

Sub-strategy | Reinsurance / ILS | Q1 2025 | 3 |

Sub-strategy | Asset-Backed | Q1 2025 | 6 |

Sub-strategy | Other Income | Q1 2025 | 6 |

Sub-strategy | Credit/Income Total | Q1 2025 | 24 |

Trading

Sub-strategy | Sub-strategy | Q1 2025 | Q1 2025 |

|---|---|---|---|

Sub-strategy | Systematic | Q1 2025 | 1 |

Sub-strategy | Discretionary | Q1 2025 | + 13 |

Sub-strategy | Commodities | Q1 2025 | + 7 |

Sub-strategy | Trading Total | Q1 2025 | 21 |

Niche & Other

Sub-strategy | Sub-strategy | Q1 2025 | Q1 2025 |

|---|---|---|---|

Sub-strategy | Niche & Other total | Q1 2025 | 1 |

Fundamental, Opportunistic Trading

After a strong 2-year rally for risk assets, we plan to right-size some of our top-performing fundamental exposures within Equity Hedged, potentially opting for more opportunistic approaches in the future.

Cap Structure / Vol Arb

We plan to reduce our allocations to convertible arbitrage strategies. Our outlook remains positive, but it is less constructive than last quarter’s, driven by an influx of capital in the space (particularly from managers in highly levered multi-strategy firms), tight spreads in convertible credit, and modestly richer valuations.

Discretionary

Post-US election, our outlook for DM discretionary trading managers has improved as we expect GOP policies to benefit cross-asset volatility and dispersion. In our opinion, Trump 2.0 is likely to have significant impact across industries, increasing the prevalence of sector / thematic alphas, and as such, we think that equities could be one of the best ways for managers to express views on policy outcomes

Commodities

We maintain high conviction in commodities, particularly in energy (natural gas) and power, and plan to grow our allocations.

Strategies

Trading

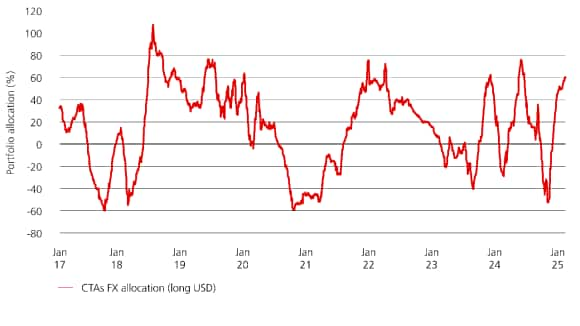

Post-US election, our outlook for developed market (DM) discretionary trading managers has improved, and we plan to increase our allocations as we expect GOP policies to benefit cross-asset volatility and dispersion. In our opinion, Trump 2.0 is likely to have significant impact across industries, increasing the prevalence of sector / thematic alphas, and as such, we think that equities could be one of the best ways for managers to express views on policy outcomes. While we expect global growth to remain intact, growth in emerging markets (EM) could be negatively impacted by Trump’s policies. In addition, we predict that US exceptionalism and a stronger USD would likely overshadow EM country fundamentals, challenging rates and FX trading.

CTAs FX allocation (long USD)

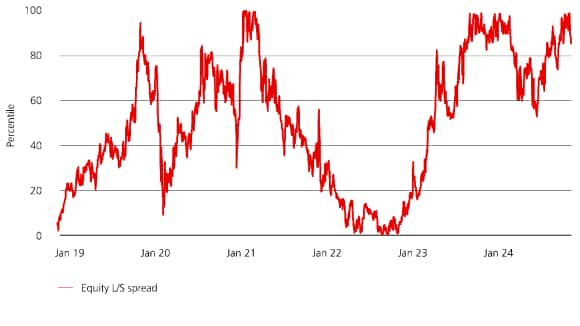

Equity Hedged

Despite rising volatility, we expect economic fundamentals and investor sentiment to generally remain supportive of risk assets. We believe that a moderate amount of beta in portfolios is warranted but intend to be selective on our sources given a wider range of outcomes with a Trump administration. After a strong 2-year rally for risk assets, we plan to right-size some of our top-performing fundamental exposures within Equity Hedged, potentially opting for more opportunistic approaches in the future. We still maintain high conviction in themes in the technology, energy, and financials sectors. While we expect valuations for AI-related stocks to remain under scrutiny in 2025, we are firm believers in the durability of this theme and seek to broaden our exposure. In 2025, we anticipate Trump’s pro-business agenda will benefit capital markets activity and thus, we may increase our exposure to equity event, with a focus on ECM (equity capital markets).

Equity L/S spread 1-year rolling performance (percentile)

Relative Value

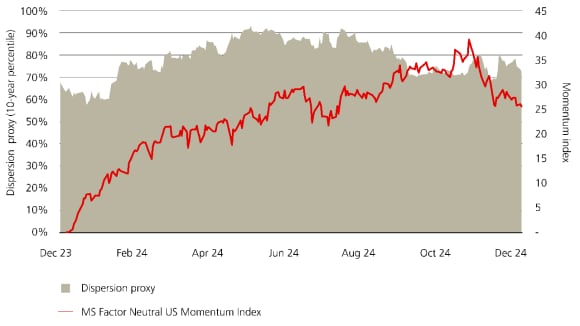

In Relative Value, we plan to maintain our allocations to FIRV as rate volatility could continue to moderate, especially with more certainty around the monetary policy path in the US and broader DM. However, if there are large dislocations, we may potentially add to the strategy. In merger arbitrage, we are optimistic for the opportunities that deregulation may bring but are less positive than consensus given the uncertainty from a new administration. We plan to reduce our allocations to convertible arbitrage strategies. Our outlook remains positive but is less constructive than last quarter, driven by an influx of capital in the space (particularly from managers in highly levered multi-strategy firms), tight spreads in convertible credit, and modestly richer valuations. We plan to redeploy some capital in quantitative equities (statistical arbitrage) as interesting bottom-up opportunities emerge. We remain encouraged by most quantitative equity managers’ ability to navigate recent market reversals.

Momentum vs. strength of dispersion

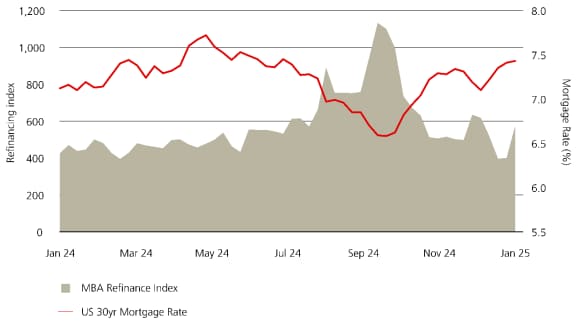

Credit / Income

In Credit, all-in yields are still attractive, yet credit spreads have broadly compressed, making it more difficult to deploy capital in areas that we believe have limited impairment risk. As such, we expect our asset-backed and other income strategies to marginally amortize over the year. Within this bucket, US residential real estate lending and reinsurance remain our highest conviction themes. We recently took some profits in the collateralized reinsurance space, and plan to maintain our exposure from here as risk-adjusted returns are still materially above average historical levels.

Refinancing Index vs. 30-year mortgage rate

Endnotes

Endnotes

Index descriptions

The use of indices is for illustrative purposes only.