Retirement planning

- Lifestyle review

- Risk review

- Pension and/or Social Security benefit analysis

- Retirement income account assessment

- Retirement income plan

- Beneficiary review

Family needs planning

- Comprehensive financial planning

- Education planning

- Special needs child assessment and planning

- Elder care planning

Credit and lending

- Home loans

- Securities-based lending

- Personal credit management

Business succession planning

- Business needs review

- Cash management and capital needs assessment

- Business valuation

- Succession plan documents

Executive compensation

- Concentrated stock services (monetization, hedging)

- Stock option solutions

- Restricted securities (liquidation and risk management)

- Expertise in highly regulated areas (collateral loans, OTC option collars, etc.)

- Estate planning with executive compensation

Insurance and liability management

- Goal protection: Life insurance and long-term care

- Income protection: Disability insurance and business overhead insurance

- Look to spending needs vs. capital campaigns to aid in fundraising efforts

Estate planning considerations

- Do you have will(s) (living wills)

- Do you have a durable Power of Attorney for healthcare

- Trusts

- Gifting

- Philanthropy

- Assess asset titling

- Estate tax funding

- Family dynamics and family meeting facilitation

Confidence to pursue your goals

Confidence to pursue your goals

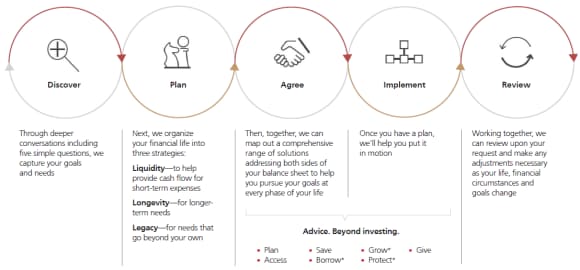

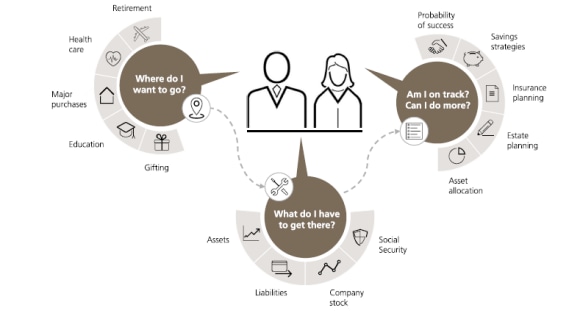

Our comprehensive structured advisory approach puts you in charge of your future by helping you address the financial goals and concerns that matter most to you. As part of this special offering with Applied Materials and UBS, you have the opportunity for a private discussion to help us understand and create a roadmap for the financial future you have always envisioned.

Get a clearer view of your wealth

Get a clearer view of your wealth

What if there was a more convenient way to view your various accounts—from inside and outside UBS—in one place? With My Total Picture, a feature of UBS Online Services, you’ll be able to see your financial information all at the same time.

- Simplify your financial life—Bring together your accounts from multiple institutions into a single view.

- Deeper insight, better collaboration—This snapshot allows you and your Advisor to gain better insight into your finances and helps you make more informed decisions together.

- Stay on track—When you see both your assets and liabilities in one place, you’ll be able to plan for your future more confidently.

Get started. Go to ubs.com/onlineservices

Get started

- Log on to Online Services

- Register for UBS Online Services if you haven’t before

- From the home page, select the My Total Picture tab

- Follow the simple on-screen instructions

Helpful tip:

Before you enroll, gather the key information for all your accounts, including usernames and passwords.

Want to know more?

Download the fact sheet