You could call Daniel Kahneman the unicorn of economics. As a psychologist, he had a profound influence on people who criticized the homo economics, the theoretical notion that our economic decisions are always perfectly rational, instead showing how people actually make decisions. His insights forever changed the field, paving the way for what’s now called behavioral economics.

If we want to understand and shape the system, Kahneman claimed that we need to understand the humans who act inside of it first. Long-time companion Amos Tversky and Kahneman dedicated their academic lives to the psychological phenomena around judgement and decision-making, establishing a new way of thinking about human errors based on heuristics and biases.

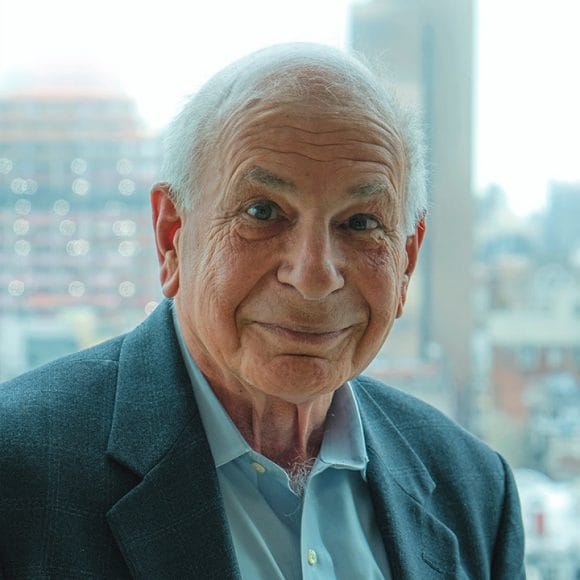

Daniel Kahneman

Daniel Kahneman

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, 2002

At a glance

Born: 1934, Tel Aviv, Israel

Died: 2024 (age 90 years), New York, United States

Field: Psychology, Economic Psychology

Prize-winning work: Prospect theory; integration of cognitive psychology into economic analysis

First steps: As a 10-year-old, he wrote his first essay on the psychology of religion

The author’s secret: Doesn’t like his

best-selling book "Thinking Fast, Thinking Slow"

Attitude: Deeply pessimistic about everything

One rainy day in Manhattan

One rainy day in Manhattan

When you snagged an appointment with Kahneman, you wanted everything to be perfect. This means flowers, comfortable seats, lunch, even the right room temperature. While waiting for Kahneman in a downpour in front of a downtown Manhattan hotel, trying to spot his limousine, there was a tap on the shoulder. "Hi, I’m Daniel." And well, there he was. Cloaked in a long black coat, shaking his wet umbrella. He had walked.

What did Kahneman discover about happiness in his research?

What did Kahneman discover about happiness in his research?

Taking a taxi in the unpleasant weather might have resulted in a happier outcomes, but Kahneman admitted that happiness was actually the biggest disappointment in his career, at least when it came to his research. "I was very much expecting to find one thing," he said, casting an air of suspense. "But we found exactly the opposite." Kahneman was referring to the Day Reconstruction Method (DRM), a process he invented that is still in use today. DRM assesses how people spend their day and focuses on their emotions.

"We were convinced that if we looked at the difference between teachers in good schools and in bad schools, we’d find a much bigger difference in emotions than in satisfaction,” he says. “It turned out the opposite was true. We found that it’s emotionally miserable to be poor, but beyond a certain level of poverty, it stops making any difference. But for life satisfaction, the more you have, the more satisfied you are with your life."

Can a single question reveal what we’re thinking?

Can a single question reveal what we’re thinking?

In general, Kahneman was critical of how surveys on happiness were devised. A political question at the beginning could lead to an overall unsatisfactory result or particular wording could change the course of the conversation.

Does question wording impact survey results?

Single questions in psychology are of high relevance but not without controversy. He introduced Linda as an example. All we know is that she’s 41, has studied philosophy, was very active in political movements and marched in antinuclear protests. "The question is," Kahneman began. "How likely is she to be a bank teller? Or how likely is she to be a bank teller who’s also active in the feminist movement?" He said that 90 percent of people surveyed think she’s more likely to be a feminist bank teller, even if it’s not logical. "Because if she’s a feminist bank teller, she is a bank teller. You can give people hints and then they won’t make the mistake." It’s not just the question you ask, but the way you ask the question.

Can we rely on our intuition?

Can we rely on our intuition?

Kahneman was confronted with this question while serving in the Israeli army in the 1950s. He recognized that recruiters were relying heavily on intuition when recruiting soldiers. His first job as a psychologist entailed making significant updates to the process, which is still enforced today. "People were asked not to worry about the general impression of that person, but to ask specific, very detailed questions about certain topics," he said. He explained the six traits that were rated included things like punctuality or masculine pride. At the end, all interviewees had to close their eyes and write down their overall evaluation.

"Intuition is okay, but you don’t want to have it too early," he said. "This is what we’re working on today. To work out instructions for people who are making decisions in businesses or in government in exactly the same way. To break up a problem into elements and to delay intuition until the end."

How can organizations reduce noise in decision-making?

How can organizations reduce noise in decision-making?

When talking about studies based on judgments, he used a pivotal word: noise. "Judgment is much less stable and much noisier than most people think,” he said. “I call noise an invisible problem. Intuition feels just the same when it’s wrong and when it’s right, that’s the problem.”

In organizations, which Kahneman referred to as factories of decisions and judgments, reducing noise is very important. "If you have different people who are going to reach a decision together, the noise reduction technique is to have every one of them write down their answer before the discussion," he said. "Because otherwise the first person who talks has too much influence."

Why do some people take more risk than others?

Why do some people take more risk than others?

There’s another frequent margin of error concerning judgment and decision-making in organizations, which Kahneman referred to as inherent predispositions.

People who rise in an organization are likely to be optimists.

He added that these people are usually more willing to take risks as well. "They’re the people who get things done,” he said. “A few decisions are successful, people think you can walk on water, and they promote you further.”

Can we trust our judgement when facing risk?

Can our eyes reveal what we’re thinking?

Can our eyes reveal what we’re thinking?

To understand decision making, people need to better understand their own thinking first. Kahneman’s research on what he’d later call the two systems, started with a eureka moment in a laboratory, and strangely, with an eye.

“It’s the single best measure of mental effort," he said. Kahneman insisted it’s better than heart rate, blood pressure or skin conductance, referring to the observance of a test subject’s pupil as the "most elegant findings" he ever came across. When she was asked a question, her pupil dilated and contracted. But by accident, he noticed that when she was simply talking to somebody sitting in the lab, nothing happened. "Having a conversation is easier than remembering your phone number,” he said. “I became very interested in effort from that kind of observation. What is strenuous, what is effortless."

Can we rely on our two thinking systems for decision making?

Can we rely on our two thinking systems for decision making?

Kahneman later developed the two systems to describe our mental life. System one defines the effortless, intuitive part of our thinking while system two explains the kind of concentration that involves effort. "My favorite example is making a left turn into traffic," he said with excitement. "You’ll stop the conversation. When you’re putting effort into one thing, you cannot do other things at the same time. System one doesn’t have that limitation." Because in life, we learn intuitively and apply it.

What people need to know about their thinking

When making decisions, we have the choice between those systems. "You could run or you could walk," Kahneman said. "Our mental life is like walking slowly. Mental life is easy, mostly. We can concentrate, but mostly we don’t like to, we avoid it."

"Intelligent people who can solve many problems effortlessly can get away with being more lazy," he added.

How should we make important decisions?

How should we make important decisions?

Kahneman shared some advice on how to make important decisions. "You should slow down and get advice from a particular kind of person. Somebody who likes you but doesn’t care too much about your feelings. That person is more likely to give you good advice."

What determines our decisions?

How does Kahneman's Prospect Theory change the way we think about financial decisions?

How does Kahneman's Prospect Theory change the way we think about financial decisions?

Kahneman pointed to the fact that one has to be extremely cautious in financial decisions. He called it risky, if not dangerous, when people who have little knowledge of the financial system need to make decisions about which stocks to buy for their retirement, for example. "That becomes silly," he quipped. "The assumption that individual investors are rational. That leads to serious mistakes."

With Prospect Theory, the work for which Kahneman won the Nobel Prize, he proposed a change to the way we think about decisions when facing risk, especially financial. Alongside Tversky, they found that people aren’t first and foremost foresighted utility maximizers but react to changes in terms of gains and losses. "Gains and losses are short-term," he said. "They’re immediate, emotional reactions. This makes an enormous difference to the quality of decisions.”

He argued that when people think of the future, they think of the near future far more than the distant future. Changing the perspective from people looking to obtain long-term wealth, to people not wanting to lose tomorrow, significantly alters our understanding of behavior. "People put much more weight on losses than gains. People hate losing."

Where do political beliefs come from?

Where do political beliefs come from?

As a psychologist, Kahneman investigated where our beliefs come from. Especially when reading the news, being confronted with religious conflict and discrimination and the dramatic consequences of political choices, his thoughts roamed back to the psychology of single questions.

Subjectively, it feels like you believe in something because you have the arguments for it," he said. "But it works the other way around. You believe in the conclusion, and then you create supporting arguments. That’s fundamental.

Where do populist beliefs come from?

Why do people believe in these conclusions? Partly because people we love and trust believe in the same conclusion. Kahneman called this being "emotionally coherent." It’s psychologically coherent, but not in the sense that it provides solid evidence. Voting, he said, is emotionally driven and one of the most powerful emotions is anger. It leads people to seek out a shared enemy.

Kahneman shared a story of his childhood in Paris, where he grew up Jewish in World War II. "I’d gone out to play with a friend and I had my sweater with my star on it," he said. He’d turned it inside out, so no one would see it. "I saw a German soldier in a black uniform, and I knew that those were absolutely the worst,” he continued. “We walked towards each other and then he called me. I was afraid that he would see the star inside the sweater, but he didn’t. He hugged me and showed me pictures of a little boy. And he actually gave me some money."

Both went their separate ways, but the significance of the interaction remained with him. "It showed the complexity of people. He would have killed me easily, but in that context, he was just a father of a little boy."

Even in our present society, Kahneman claimed that society has no historical memory. All sides use powerful emotional triggers, they speak to people’s fear and direct their anger towards the unknown.

Will we learn from the history of mankind and avoid mistakes?

Will we learn from the history of mankind and avoid mistakes?

Can we ever get to a place where the mistakes of the past can be avoided in future? Kahneman claimed he was an eternal pessimist and not able to solve such problems. But, as he said, this wasn’t his job. "I am only a psychologist," he said. He put on his black coat again, opened his umbrella and stepped out into the downpour. In this context, it was definitely not a lazy decision.

Why do countries have to find better ways to grow?

Hear Michael Spence's view on how countries can grow sustainably while having a long-lasting positive impact.