The market for exits may be turning

The market for exits may be turning

US election implications

The Republican sweep of Congress and the White House is generally regarded as positive for risk assets, led by higher potential for tax cuts and expectations for a de-regulated, business-friendly environment. US private equity firms we have spoken to are bullish on the prospective operating environment, with many of these factors, including a stronger dollar, limited to domestic private equity.

Operating environment and valuations

Today’s operating environment has supported good fundamental performance at most privately-held companies, and sponsors generally report positive top- and bottom-line numbers. A small percentage of companies are still suffering supply chain and labor-cost overhangs, but most businesses seem to be performing on plan.

Where marks seem to lag public markets performance, we view this as largely due to reluctance to peg valuations too tightly to public comparables, as many funds were burned on this during the 2022 pullback. With the benefit of hindsight, we can say most general partners (GPs) took a middle-of-the-road approach of mild mark-downs which resulted in balanced portfolio valuations when paired with the quick market rebound (but things were looking pretty sober until the public markets recovery took hold). With this fresh in the minds of both GPs and limited partners (LPs), we expect to see more mark-ups at exit and fewer valuation swings, even though operating performance and comparable valuations are both quite positive.

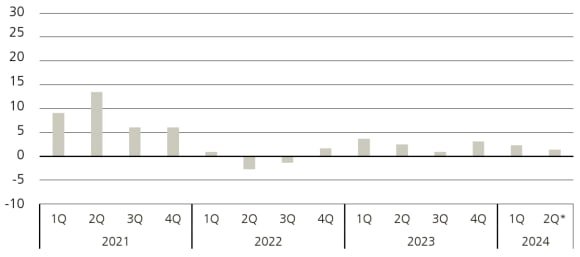

Figure 1: Venture capital quarterly fund returns (%)

Searching for liquidity

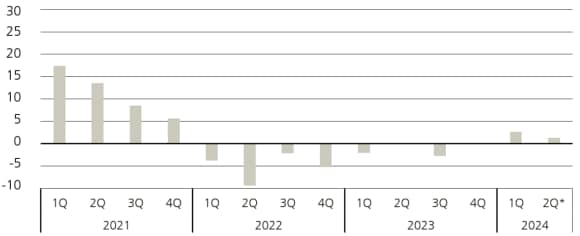

Liquidity has become the number one issue for LPs in today’s private equity market. As holding periods stretch longer than anticipated (46% of global buyout-backed companies have been held for four years or longer) and unrealized values reach record highs (USD 3.2 trillion),1 investors are pressing GPs to return capital.

While there are early signs of recovery in deal activity – 1H24 M&A is up from 1H23, but still far from 2021 levels2 – and a few notable IPOs, overall private equity exit volumes have yet to meaningfully recover. High quality ‘trophy’ assets are changing hands, but the median company is still struggling against a mismatch of seller and buyer valuation expectations. Sentiment is improving, with one mid-2024 survey showing that 73% of sponsors expect activity to increase.3

This demand has driven GPs to explore innovative strategies to create liquidity options for LPs, and sponsors continue to turn to secondary markets and especially continuation funds to drive DPI. Such transactions have increased by over 50% in the last year, and secondary volumes overall have increased by nearly 60% year-over-year, on pace to set a record in 2024.4

If realized, market expectations for a more active IPO market in 2025 would have knock-on effects spread over a several-year period, eventually reaching smaller funds and companies as capital flows back to LPs and is reinvested. As it is, fundraising has been concentrated among the largest funds, a function of both flight to quality and the types of LPs that have capital to deploy.

Figure 2: Private equity quarterly fund returns (%)

In the first half of 2024, over USD 5 billion funds accounted for more than 50% of total capital raised. Notably, European mega funds have benefited from earlier interest rate cuts from European central banks and their share relative to global funds has been increasing, from 23.1% of capital raised in 2023 to 34.1% in 1H24.5 Meanwhile, smaller and first-time funds are faced with a challenging fundraising environment. Dry powder is close to record highs, again mostly concentrated in large funds.

New value creation paths

Two key drivers of private equity returns over the last decade have been multiple expansion and cost-effective financing. Both are in short supply today, and sponsors are having to pull new levers to meet investor expectations. These are generally not new (in fact, quite well known among private equity investors), but are playing a new role in driving returns.

GPs are increasingly turning to mid-market companies, implementing buy-and-build and add-on acquisitions strategies as central pillars of value creation. By integrating smaller add-ons, a company’s entry multiple can be ‘bought down’, provided these smaller businesses can be successfully integrated into the platform investment. The rapidly-growing platform then becomes more attractive to buyers and can hopefully command a higher valuation at exit, thereby earning back the multiple expansion which had previously been a given.

Another angle is the corporate carve-out, the purchase of a non-core or unloved business from within a large company. These are especially popular where the larger organization is viewed as inhibiting growth, or the business unit is burdened with a less-favorable valuation. Companies have been divesting non-core businesses at a rapid pace in recent years, a buying opportunity for private equity which has always existed but is growing as part of GP sourcing strategies.

Venture Capital

With the end of low interest rates and a tougher fundraising environment, venture activity remains at muted levels. US venture firms have announced USD 56 billion in new fundraising (down 65% from 2023) and so far closed on USD 35 billion, including USD 14 billion for funds still raising from last year.6 Those LPs that actively deploy during the current cycle favor large, well-known brand name firms. Thus, over USD 1 billion funds have accounted for ca. 34% of all venture funds raised this year, which is nearly double the share of last year. Despite venture capital investment dollars halving from their peak, in nominal terms, there is still more money flowing to founders than over most of the past decades. With the more measured pace of investment, the pace of mega-deals (over USD 100 million) has significantly slowed since 2021, though AI-related themes stick out as having the potential to selectively drive mega deals.

Private equity sector performance outlook

Country | Country | Negative | Negative | Neutral | Neutral | | | Positive | Positive | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

Country | Americas | Negative | N/A | N/A | Neutral | Venture capital | | N/A | Positive | N/A | |

Country | Europe | Negative | N/A | N/A | Neutral | N/A | | Venture capital, Growth equity, Buyouts | Positive | Secondaries | |

Country | Asia | Negative | N/A | N/A | Neutral | Venture capital | | Growth equity, Buyouts | Positive | Secondaries |

The Red Thread – Private Markets

Our semi-annual insights into private markets

Our semi-annual insights into private markets