Retirement

OASI 21 accepted – much remains to be done

The reform to stabilize old-age and survivors’ insurance (OASI 21) has been approved by the Swiss electorate. Read this article to find out what it means for you.

![]()

header.search.error

Retirement

The reform to stabilize old-age and survivors’ insurance (OASI 21) has been approved by the Swiss electorate. Read this article to find out what it means for you.

The adoption of the OASI 21 reform will have a positive impact on the long-term financial stability of pillar 1. It reduces the current financing gap by more than one-third (see chart below). The increase in value-added tax by 0.4 percentage point is the factor that contributes most to the reduction, at 20.3 percentage points. The core element of the reform, harmonizing the reference age for women with that of men at 65, reduces the gap by 17 percentage points. The compensation measures for the first nine cohorts of new pensioners counteract the reduction of the financing gap by 0.9 percentage points. By contrast, the measures on flexible retirement and incentives for longer working lives do not have a significant impact on the financing gap.

The bill will be enacted in 2024. The retirement age will be gradually increased by three months per year, starting in 2025 and concluding in 2028.

OASI 21 reduces the financing gap

Forward-looking signal

Following the adoption of OASI 21, the retirement age will be increased for the first time in 25 years. As a result, there is a chance that Switzerland will join other European countries in the future and continue to adapt the retirement age for men and women in line with demographic change.

Making the reference age more flexible was the first important step in this direction, as it signals to both companies and employees that it will be necessary for people to work for a longer period of their lives in the future. As a positive side effect, this could also alleviate the shortage of skilled workers in Switzerland.

Even if the financial situation of the state pension system is stabilized for the time being, however, it will only allow a short breather, as demographic change continues unabated: according to calculations by the Federal Social Insurance Office (FSIO), old-age and survivors’ insurance is expected to show an apportionment deficit again as early as 2029.

Expand your financial knowledge

Would you like to learn more about “Retirement”? Then subscribe to our “Retirement” learning path today.

Old-age and survivors’ insurance in the clutches of demography

Switzerland is getting older and older. The number of people aged 65 and over will increase by around 80 percent by 2060. Yet the number of people of working age will virtually stagnate over the same period (forecast by the Federal Statistical Office, see chart below). Whereas in 2020 there were just under 3.2 persons of working age for every person of retirement age, in 2040 there will only be 2.3. Further reforms are therefore essential.

Sharp rise in the proportion of people aged 65+

OASI indebted to the tune of over 900 billion francs

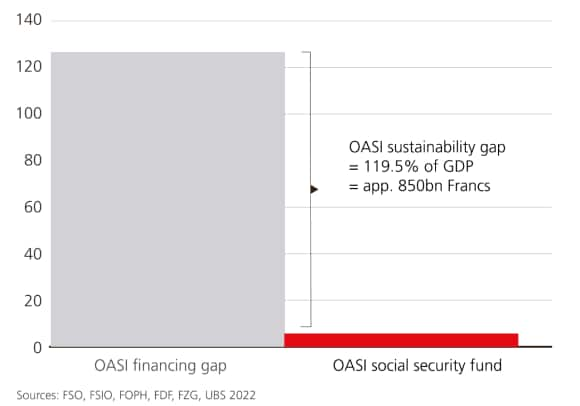

Even before the vote, the present value of total OASI pension promises exceeded the present value of future pillar 1 revenue by 125.7 percent of Swiss gross domestic product (GDP). This means that the implicit debt amounts to over 900 billion Swiss francs (in 2019 prices). If we take into account the assets of the OASI compensation fund, which seem huge at around 50 billion francs, we are still talking about a sustainability gap of 119.5 percent of GDP.

After the reform is before the reform

In the long term, the OASI pay-as-you-go system still disregards the intergenerational contract (see chart below). This is because the law grants the right to an OASI pension solely on the basis of the payment of contributions. This ignores the fact that this only fulfills the duty to the parent generation. In order to be entitled to a pension according to the intergenerational contract, the generation of children would have to be sufficiently large.

Intergenerational contracts in simplified form

Burden on the younger generations

Even though this reform was urgently needed and is a step in the right direction, it is problematic in terms of intergenerational fairness. This applies in particular to the increase in value-added tax, because this consumption tax, as a proportion of income, disproportionately affects low-income and young households. Most of the remaining OASI financing gap will also be a burden on the younger generations.

Each and every one of us can do something

This makes it especially important for people under 50 to address their private pension situation as soon as possible. With or without reform, personal responsibility is increasingly important. In the event of another reform, people over 50 can probably rely on an up-to-date pre-calculation of their pension and the protection of vested rights. But they, too, will sleep better if they obtain a clear overview of their situation through a comprehensive pension check. In addition, they should think about the future of their children in the debate about further reforms.

Solutions that are fairer in terms of distribution policy and therefore quick to implement are needed to ensure that children not only embody our future, but also have a future of their own without having to carry a heavy financial burden on their shoulders. Possible measures that involve the cohorts close to retirement age and pensioners participating in the restructuring process include a shortening of the period for drawing a pension, a reduction in pension amounts or a temporary attenuation of OASI pension increases.

The fundamental political challenge is to broaden the perspective of the over-50s, who are strong voters, and to let the younger generations participate in the social narrative about the future of the Swiss pension system. This applies to any reform of OASI.

Because a personal conversation is worth a lot

What can we do for you? We’re happy to address your concerns directly. You can contact us in the following ways: