Getting ahead with private equity secondaries

Private equity secondaries investment is an important tool used today by many General Partners (private equity fund managers) to circumvent time and capital limitation. It has since become part and parcel of the private equity investment ecosystem.

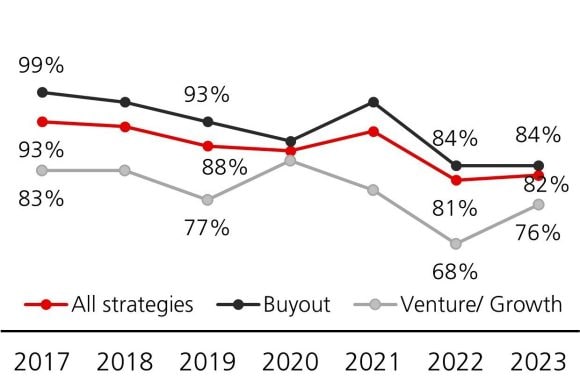

Private equity secondaries investing is not niche anymore

- 0 x

growth in transaction volumes¹ from USD 18b in 2007 to USD 111b in 2023.

- 0 x

capital overhang ratio² at record lows

What are private equity secondaries?

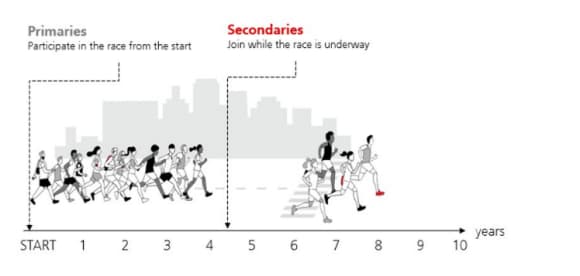

Private equity secondary buyer acts as liquidity provider to private equity investors who wish to sell their positions and do not have the time or desire to hold on to their investments until the end of the regular lifespan.

Background to private equity investing

3 reasons to invest

1. Quick ramp up of exposure

For new entrants to the asset class, the private equity secondaries market allows them to scale-up a diversified exposure three to five years faster.

At the time of purchase, acquired positions are typically fully or close-to-fully invested and committed.

2. Generate liquidity, but quicker

Secondary-focused strategies, can generate liquidity much quicker than traditional multi-manager investment solutions.

3. Purchase at a discount

Secondary buyers often have the ability to buy positions at discounts to the reported net asset values leading to initial book gains at closing due to the transaction mechanics .

Why UBS-AM for private equity secondaries?

UBS Asset Management (UBS-AM) has been managing open-ended, semi-liquid solutions in various asset classes since 2000s and is one of the most experienced operators of semi-liquid investment solutions globally.

USD 14.1 billion

invested and committed across various client mandates and products in Private Equity

Since 2003

Track record of investing in secondaries on an opportunistic basis

Disclaimer:

For marketing and information purposes by UBS.

This document and its contents have not been reviewed by, delivered to or registered with any regulatory or other relevant authority in any jurisdiction. This document is for informational purposes and should not be construed as an offer or invitation to the public, direct or indirect, to buy or sell securities. This document is intended for limited distribution and only to the extent permitted under applicable laws in any jurisdiction. No representations are made with respect to the eligibility of any recipients of this document to acquire interests in securities under the laws of any jurisdiction.

Using, copying, redistributing or republishing any part of this document without prior written permission from UBS Asset Management (Singapore) Ltd. is prohibited. Any statements made regarding investment performance objectives, risk and/or return targets shall not constitute a representation or warranty that such objectives or expectations will be achieved or risks are fully disclosed. The information and opinions contained in this document is based upon information obtained from sources believed to be reliable and in good faith but no responsibility is accepted for any misrepresentation, errors or omissions. All such information and opinions are subject to change without notice. A number of comments in this document are based on current expectations and are considered “forward-looking statements”. Actual future results may prove to be different from expectations and any unforeseen risk or event may arise in the future. The opinions expressed are a reflection of UBS Asset Management (Singapore) Ltd's judgment at the time this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed.

You are advised to exercise caution in relation to this document. The information in this document does not constitute advice and does not take into consideration your investment objectives, legal, financial or tax situation or particular needs in any other respect. Investors should be aware that past performance of investment is not necessarily indicative of future performance. Potential for profit is accompanied by possibility of loss. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Source for all data and charts (if not indicated otherwise): UBS Asset Management (Singapore) Ltd. (UEN 199308367C )

© UBS 2024. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.