Megatrends and disruptive innovation

A thematic take on the key factors driving economic and societal change

![]()

header.search.error

A thematic take on the key factors driving economic and societal change

Thematic equity investing shuns the idea of using a benchmark or index as a starting point for constructing a portfolio. Angus Muirhead explains why focusing on secular growth trends can make sense in a complex and interconnected world, increasingly driven by megatrends.

The world order is shifting. Triggered by COVID supply-chain related shortages and geopolitical fears, countries are starting to unwind decades of globalization. Capitalism and democracy face serious challenges for the first time in several generations. Adding to the tension, demographics around the world are vastly divergent, with more than half the global population growth to 2050 projected to occur in Africa,1 and while global wealth continues to rise on average (measured by GDP per capita), that average conceals an increasingly wide gap between rich and poor.2

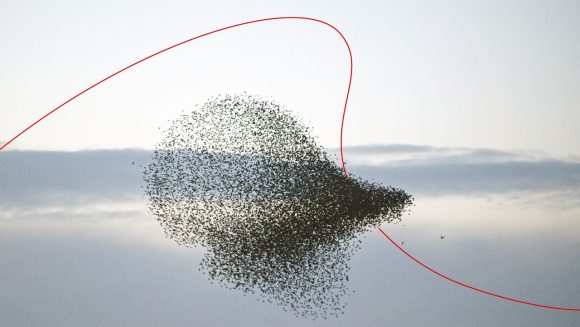

These are examples of 'structural forces of change,' the powerful tectonic shifts in the way we live, our cultural norms, our environment, our health and safety. These forces of change, sometimes known as 'megatrends,' typically occur over several generations and can impact certain industries or communities, or be more far-reaching in nature, touching the lives of many and impacting entire industries and economies.

The structural forces of change at work in the world today are colliding to create an environment of tension and uncertainty.

The structural forces of change at work in the world today are colliding to create an environment of tension and uncertainty. Protests around the world continue to increase in number at a steady rate,3 global military spending has risen to new highs after nine consecutive years of increases,4 and the Earth’s temperature continues to rise.

Against this apparently bleak backdrop, we find both hope and opportunity. In fact, many significant technological advances and innovations have been born out of conflict, confrontation or necessity. Current geopolitical tensions are clearly intensifying competition between countries and driving efforts, often government sponsored, to push the boundaries of science and know-how.

The race is now on for countries and companies to develop the most powerful artificial intelligence, build the most robust cyber-security systems, attract the smartest talent, achieve the lowest carbon footprint in agriculture and manufacturing, and develop the most efficient healthcare and welfare systems. As a result, more semiconductor fabs are being built and expanded today (more than 70 globally) than ever before.5 Five decades on from the last Apollo missions, the Moon is once again a target for space exploration,6 and quantum computers and hypersonic missiles are now close to becoming a reality after decades of research.

As the innovation cycle accelerates, disruptive forces will inevitably take hold, and such change can present attractive opportunities for the patient long-term investor. Dislocations between how things have been done until now and how they might be done in the future can open-up fissures of intrinsic value.

Dominant companies of the day outgrow their market and gradually become legacy incumbents, unable to react fast enough, while being closely watched by regulators. Each year, winners of today are challenged and over time some are replaced by newcomers, unencumbered by legacies and free to design business with a clean-slate, using the currency of new technology, innovation and business models.

Over the coming decades, there will be further acceleration as technological innovation increases. And if the atoms, bits and cells are the foundations of the modern world, three innovations in particular will shape the future: AI, biotech and climate tech.

In what follows, I look at six disruptive themes driving the world forward in ways investors should take note.

AI and robotics

Computer controlled robotics and automation systems have existed in factories since the 1960s. However, as technology advances, becoming easier to use and cheaper, the established market is being disrupted and its market size greatly expanded by new, smarter robotic and automation solutions. “Automation is the new electricity. It’s transformative, and it’s going to change everything” Ken Goldberg, University of California, Berkley.

Until recently robots and automation systems were 'automatons', rigidly following a pre-programmed code. That is now starting to change. Over the last 20 years, the power of computer processors has increased exponentially, and thanks to economies of scale, costs have also fallen. At the same time, platform technologies, such as fast mobile and fixed line internet, cloud service providers offering data storage and compute services on demand have evolved, and advanced processors together with a huge increase in digital data are allowing AI algorithms to be far more powerful and useful today than ever before.

As a result, robots are becoming smarter, AI-enabled, and as they do so, their usefulness in industry and in society is growing rapidly. You can think of AI as the 'brain' of the robot: as the AI becomes more capable, the robot can perform tasks with greater autonomy, sensing and reacting to changes in its surroundings, and learning from its own mistakes and those of its robot co-workers.

Until recently robotics and automation solutions catered to a very small market segment of companies which produced large volumes of goods with very limited variance in mix, such as autos, semiconductors, processed foods, flat panel screens for TVs and computers, and chemicals.

However, as automation systems become smarter and more autonomous, they become easier to set up and program and generally safer to use. Each one of these benefits, together with more affordable prices, allows robotics to be employed as an economically viable option in an ever-expanding range of use case. Robots continue to be used in production lines on the factory floor, but are also being deployed in different areas of the factory and in collaborative use cases where the system might support and enable a human worker. They are also increasingly being deployed beyond the factory, in the service industry, in agriculture, logistics, security, transportation systems, as well as in purely digital automation applications such as software used to simulate plant operations, enhance industrial designs and accurately predict when machines need to be serviced, to avoid downtime from unexpected breakage.

As AI and other technologies develop further, smarter automation solutions will continue to emerge to meet the growing challenges faced by business, governments and society, and this disruption driven by innovation presents a range of compelling opportunities for the patient investor over the long term.

Against the backdrop of heightened geopolitical tensions and imbalances in wealth, security and safety has become a highly relevant and very powerful theme. IT security is just one aspect of this theme. While the benefits of digitalization are starting to bear fruit for society, thanks to increased productivity and wealth creation, the related cyber-risks are also rising. As we store more sensitive and personal information online and become reliant on digital services such as banking or payments, we become increasingly vulnerable to the risk that our access might be compromised or that our passwords, and critical information, and even our identity, may be stolen.

According to the CrowdStrike Global Threat Report 2024, the 'good enough' approach to cybersecurity is no longer adequate against modern threats. As organizations move more applications and data into the cloud, adversaries are specifically targeting their attacks to exploit and abuse features unique to cloud computing. The report cites a 75% increase in cloud intrusions year on year and a new record in 'eCrime' breakout time at just two minutes seven seconds.

Cyberattacks are becoming more prevalent, more sophisticated, and faster. Adversaries use techniques such as interactive hands-on-keyboard attacks and legitimate tools to avoid detection. To further accelerate their attack tempo, credentials can be accessed in multiple ways, including purchasing them from access brokers on the 'dark-web' for a few hundred dollars. As a consequence, organizations have no choice but to continue to invest more into IT security going forward.

IT security has never been a winner-takes-all market. In fact, considering the idiosyncratic nature of attacks in the cyber world, it is not even a “winner-takes-most” market. Since technologies both in defense and offense continue to evolve, we believe the market opportunities remain underpenetrated by any single vendor and that growth opportunities for specialized companies will continue to develop for many years to come.

It is not only IT security that is important for our society, but also physical and psychological safety. Professor Abraham Maslow’s “Hierarchy of Needs”, first published in the 1970s, describes the need for 'safety' as one of the very basic human needs, together with the physiological basic needs of food, water, warmth and rest. Beyond these are the more evolved, psychological needs such as belonging, self-esteem, and self-fulfillment.

We think the structural drivers such as the ongoing digitization of our society, adoption of robotics and automation and increasing complexity, tension and inequality in the world make security and safety and all associated tools and services increasingly valuable and therefore compelling as a long-term investment.

With global average life expectancy almost doubling over the last 100 years, it is evident that great advances in healthcare and basic sanitation have already been achieved. However, beyond this upbeat headline, the reality is rather less rosy. Healthcare spending, which now accounts for more than 10%7 of global GDP and 17% in the US, is on a rising long-term trend, and many countries appear to have hit a ceiling in life expectancy despite spending more.

Healthcare is also prohibitively expensive in many countries, with the most advanced treatments only available to the wealthy minority or the very well insured. And, despite large healthcare budgets, many national or government-funded healthcare schemes are understaffed and have high 'avoidable mortality' and 'treatable mortality' rates.8

The opportunity to increase efficiencies, lower costs and improve patient outcomes in healthcare are significant across every step of the health value chain. As technologies from different fields converge, IT combines with OT,9 biology and material sciences, new innovative ways to detect and diagnose illness, treat and manage disease, and discover and develop novel therapies are coming to the market.

Systems that allow earlier and more precise diagnosis, and sophisticated drug-development platforms that offer personalized, perhaps gene-specific, medicines, might allow the healthcare sector a paradigm shift from the treatment and care of patients, to an age where health is preserved and disease is predicted in advance, allowing for remedial action to be taken, to avoid the disease from taking hold. Meanwhile, digitally driven efficiencies can be achieved immediately in how hospitals are run, how patient information is used and how we interact with our care providers.

As our healthcare solutions become more digitalized, automation, robotics and AI will be used to improve efficiencies and to enhance human capabilities in drug development, disease diagnosis and in surgical procedures. Yet as we use more digitization and automation, the more critical it becomes to ensure that systems are safe and secure from cyber-attacks.

Advances in medicine and rapid productivity gains throughout the industrial revolution drove unprecedented growth in world population from 2 billion in 1920 to 8 billion today.10 With 57% of people living in cities,11 generating more than 80% of global GDP today,12 global resource consumption has been pushed beyond planetary boundaries. To cater for the growing demand in basic needs for resources, energy and finished goods, we need to rethink the traditional way of living, manufacturing products and providing services to customers.

The switch from finite to renewable resources is reshaping businesses across a number of industries.

As the effects of climate change are becoming ever more visible, the switch from finite to renewable resources is reshaping businesses across a number of industries, such as electrification of the transportation, construction and industrial sectors to enable wide-ranging emission reductions. This trend is propelling meaningful innovations and opportunities for investment in the 'climate solutions' theme.

As an example, related to the earlier mentioned growth spurt in demand for AI technology, liquid cooling solutions are enabling a step change in cooling performance while delivering up to 50% energy savings compared to conventional cooling solutions in data centers.13 With connectivity gaining importance in the consumer world, logistics and manufacturing sector, Internet of Things (IoT) devices are forecast to grow at a 16% compound annual growth rate (CAGR) between 2021 and 2027. As these devices are the cornerstone of efficient resource management in water supply, lighting, and waste management, 'climate solutions' providers see their addressable market expanding. Finally, leading research in biosolutions offer substitutes for traditional plastics and the biorefining of organic waste and starch, supporting circularity in natural resource use while having the potential to reduce global emission by 8% in 2030.14

As populations grow, driving demand for energy, affordability and security of the energy supply become ever more important. This has become all too clear in light of recent geopolitical developments, which saw energy prices spike while putting energy independence firmly on top of political agendas. Furthermore, governments, companies and consumers are increasingly focused on mitigating climate change through policies, process changes and shifting consumer preferences. Moving from an economy and society so dependent on hydrocarbons for its energy needs, to a cleaner, greener energy system is the most economical way to achieve the dual objective of ensuring energy security at affordable pricing, while also combating climate change. A key aspect of the energy evolution is electrification: making devices in our everyday lives run on electricity rather than oil, gas or coal. Think of cooking or heating with electricity, driving an electric vehicle, or powering a data center with clean energy. Electrification is facilitated by rapid developments in technology: innovation in renewable energy generation has lowered the cost of renewable energy significantly, making wind and solar power generation cost competitive with traditional fossil-fuel-based forms of energy.

Increased electrification and growing penetration of renewable energy will increase the need to spend on electricity distribution grids, making them more decentralized, and capable of accommodating small-scale two-way transmission and distribution. This will not only require investments in smart grid technology, but also in the building blocks for a resilient grid: critical energy transition materials such as copper and aluminium for connections and wiring, lithium, cobalt, nickel, manganese, and graphite for batteries to accommodate storage of electricity on the grid for when the sun does not shine or the wind does not blow, will become sought-after commodities. Hence energy transition investing is about more than renewable energy, clean technologies or electric vehicles and related infrastructure – it is also about looking for opportunities in minerals developers and chemical technology companies.

Modern, resilient, and reliable infrastructure is critical to all the themes I have described previously. Infrastructure is the backbone of any economy. The building blocks of our civilization and society. These long-term assets allow us to move people and goods, to generate and transmit energy, to supply fresh water and remove waste, and to store and share data (digital media, news, health records, corporate and government information, and so on).

The need for ever greater productivity, decarbonization, electrification and digitalization is driving global infrastructure investments.

The need for ever greater productivity, decarbonization, electrification and digitalization is driving global infrastructure investments. To avoid catastrophic climate change, the world must achieve net-zero carbon dioxide (CO2) emissions in all sectors of the economy by 2050, with a focus on energy generation, buildings, industry and transport.

This means a large proportion of our fossil-fuel power stations will need to be decommissioned and replaced with hydro, wind, solar, wave and safer forms of nuclear power. According to IRENA, the number of electric cars will grow to over 2 billion by 2050, and this will depend on the global deployment of charging infrastructure. In homes and offices the number of heat pumps is expected to grow to approximately 800 million by 2050.15

The unabated increase in data volumes and the demand for ultra-fast data connections, to support autonomous driving and any applications of artificial intelligence, require the expansion of 5G and fixed line fibre networks, as well as a huge fleets of data centers.

Disruption is driving many sectors of the economy towards a golden age of innovation. The megatrends are powerful long-term trends which cut through the economic cycle and short-term noise of the equity markets. They demonstrate secular growth characteristics which can provide highly favorable tailwinds for investment strategies.

Some caution is due, however. While the long-term outlook may be compelling, the short-term view may be more challenging.

The economic cycle, politics, interest rates, taxes, regulation, trade disputes and more, may push performance off course in the near term. However, if the long-term thematic thesis remains sound, and the underlying health of a business is strong, then periods of underperformance can often be seen as a buying opportunity.

In some themes and markets this could be the case today. War has put clean energy and environmental concerns on the back burner. COVID caused a devastating loss of human life, but also burdened the healthcare sector with significant debt, such that spending today on innovative and digital health solutions remains at anaemic levels. And since our pure-play approach gives all our strategies reasonable exposure to smaller companies, the last 18 months has been a tough environment for many, with rising interest rates taking a disproportionately high impact on the valuation of small companies relative to large and mega-caps.

But within the short-term challenges, there is always the promise of long-term opportunity. Investors need to identify the correct long-term themes, and find the key innovations likely to accrue the most value through the period of creative disruption.

While opportunities for some businesses proliferate, legacy incumbents may face ever greater challenges.

As industries face dynamic change, companies react, restructure and adapt, and often governments and regulators intervene and change the natural course of things. While opportunities for some businesses proliferate, legacy incumbents may face ever greater challenges. In order to select the long-term winners, while avoiding the inevitable losers, the thematic investor needs to understand the industry and the technologies at a fundamental level and to be highly selective.

Given the urgency and persistence of the megatrends, the long-term themes I have described above may all offer the potential for above-market returns over a market cycle.

Investing through change

An exploration of disruptive and innovative forces shaping economies and markets.