A short guide to index selection

A multi-step process requiring both quantitative and qualitative inputs.

![]()

header.search.error

A multi-step process requiring both quantitative and qualitative inputs.

Multi-step iterative process

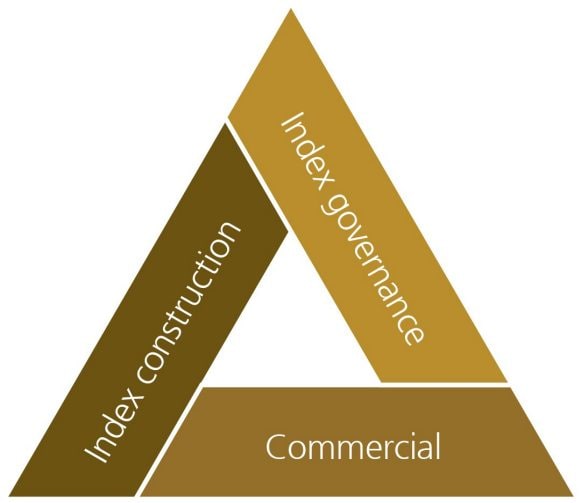

Selecting a standard or custom index for an index or rules-based equity portfolio, similar to the overall index investing process, is a multi-step iterative task comprising a set of quantitative and qualitative criteria. Exhibit 1 highlights our in-house selection analytical framework that spans three dimensions: index construction, index governance, and commerciality. In the following two sections, benchmark selection and index provider selection, we elaborate on these criteria and outline some of the key consideration points in selecting an index for an index or rules-based portfolio.

Multi-step iterative process comprising quantitative and qualitative analysis

Benchmark selection

It is estimated that more than three million indexes are calculated daily by the major index providers.1 With such multitude of indexes available, a methodical and objective approach to benchmark selection is helpful in selecting a suitable benchmark for an index portfolio.

The index equity investable universe could broadly be viewed alongside three dimensions: market, size, and strategy, shown in Exhibit 2. As a first step in selecting an index, investors would need to decide in which of these three dimensions their benchmark should fit.

Market: investable markets are organised in three geographical groups (developed, emerging, frontier) and each group comprises a number of countries.

Decision points:

Size: investable markets are organised in three size segments (large cap, mid cap, small cap), with large and mid-cap typically combined in what is known as ‘standard index’.

Decision points:

Strategy: relates to the stock selection and/or stock weighting methodology of an index. Some of the key strategies include: market capitalization weighted, risk premia factors, sustainable factors, thematic, diversified (e.g., equal weighted or a more complex approach to diversification). Other strategy indexes include: currency hedged, derivative (leverage, inverse, protected), and active strategies embedded in an index.

After a decision regarding the relevant components of the investable universe is made, investors would typically consider a number of points related to the index construction, including:

Index delivering on its objective: this might sound obvious, but there are cases of indexes being marketed by the index providers with a particular objective, yet upon analysing the data it is evident that the index does not actually meet such objective. For example, if an index claims to be ‘low volatility’, analysis of the historical volatility of returns should provide an indication of how this compares to the volatility of the underlying market cap weighted index.

Simplicity and transparency: one of the attractions of index investing is that indexes are typically constructed via clear unambiguous rules. If the construction methodology for an index is obscure, this could leave room for interpretation of the rules, and could potentially impact the tracking accuracy of the index portfolio.

Rebalancing frequency and turnover: another attraction of index investing is lower cost compared to active management. Indexes with more frequent rebalancing and/or higher turnover would lead to higher transaction costs associated with the rebalancing trades.

Capacity and liquidity: market cap weighted indexes with large- and mid-cap developed markets equity exposure tend to be highly liquid with high capacity, while some non-market cap weighted indexes and/or indexes with emerging markets and small-cap equity exposure could have lower liquidity and lower capacity. This point is particularly relevant for larger mandates.

Breadth: this point relates to the market and size dimensions of the investable universe outlined above.

Risk models (proprietary vs. industry-wide adopted): more complex indexes involving optimization/tilts are typically constructed using a risk model. Indexes constructed with an industry-wide adopted risk model (e.g., Barra, Axioma, etc.) allow their construction methodology to be analyzed/tested more accurately by investors, while indexes constructed with proprietary risk models are more akin ‘black boxes’.

Back-tests vs. live track record: this point is particularly relevant for some of the more recently launched factor and sustainable indexes where the performance and other metrics presented by the index providers are based on back-tests rather than live data. In some cases, the back-tested data might have been overfitted, and the risk-return profile of the index after launch might differ from the back-tests.

Rules-based strategy or an index: this point relates mainly to non-market cap weighted indexes, including factor and sustainable, when clients might opt either for a third party factor and/or sustainable index, or select market cap weighted index and achieve the factor exposures via screens and/or tilt on the portfolios, i.e. via a rules-based strategy.

Index provider selection

The requirements for market, size, and strategy exposure of the benchmark noted in the above section would typically influence the selection of an index provider. Index providers tend to offer their indexes in two main groups, local and global, as outlined below.

Local indexes are the so-called ‘flagship’ indexes covering a specific geographic segment. Examples include: S&P 500, Dow Jones Industrial Average, Russell 3000, FTSE 100, EUROSTOXX 50, DAX, SPI, etc. These indexes could be viewed as ‘stand-alone’ as they are not constructed with a building block approach in the context of the global investable universe – i.e., these indexes are favored by investors aiming to gain exposure to a specific geographic segment via the flagship/blue chip local indexes associated with that segment. For example, if an investor would like to gain exposure to the US large- and mid-cap equity market, and are not interested in gaining exposure to other markets/size segments, they would likely consider S&P 500.

Global indexes aim to capture the global investable equity universe via indexes constructed by a building block approach, allowing investors to gain exposure to one, more, or all market and size segments globally without gaps or overlaps. These are suitable for investors who either want to gain exposure to the global investable universe from the onset of launching their index equity portfolio (via a global index) or gradually via combining different market and size segments (building blocks). MSCI Global Investable Market Indexes (GIMI) and FTSE Global Equity Index Series (GEIS) are some of the most popular global index series. In Exhibit 3 we outline the typical building block approach in constructing global indexes.

In addition to mainstream, long established index providers such as MSCI, FTSE Russell, S&P DJI, and STOXX, there are more niche, specialist index providers such as Scientific Beta and Research Affiliates, focusing on construction of factor indexes, as well as index disruptors such as Solactive, offering high degree of customization.

In addition to deciding on local vs. global index provider, investors should also consider index governance and commercial aspects as part of their index provider selection.

Index governance

Commercial