Opportunities in UK commercial real estate

Navigating a rebounding market

![]()

header.search.error

Navigating a rebounding market

As we’ve previously discussed, the UK commercial real estate market is showing promising signs of recovery, making it an attractive option for investors. According to our newest forecast, various segments within the market are expected to deliver robust returns driven primarily by local supply and demand dynamics rather than yield compression.

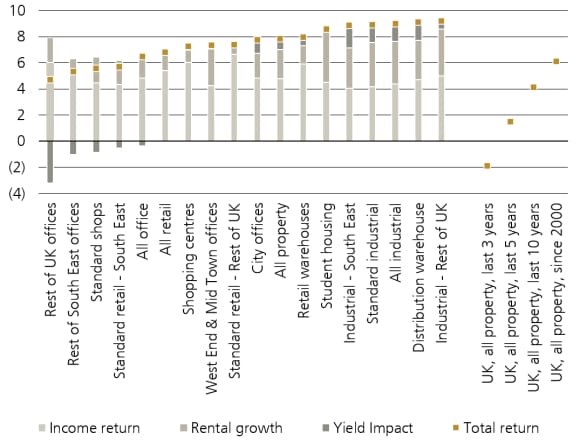

Figure 1 illustrates these projections clearly. For instance, industrial properties in both South East and Rest of UK regions are anticipated to offer strong rental growth and stable income returns. Similarly, student housing and distribution warehouses are also poised for significant gains. The life sciences real estate sector, driven by its mid- and long-term fundamentals, is also poised to perform well, both in the UK and Europe as a whole.

We can also see that multiple segments of the market are expected to outperform the long-term average All Property returns. This is normal, as the first phase of recovery is often the strongest phase due to the repricing dynamics. After that, the returns normalize once more towards the mean.

Figure 1 – UK forecast p.a. 2025-2027 total returns (%) by sector and All-Property returns over various look-back periods

However, it's essential to be mindful of potential risks that could impact these forecasts. Increased tariffs may affect construction costs and supply chains whereas elevated inflation could influence interest rates and borrowing costs.

Despite these risks, focusing on segments with high rental growth potential can contribute towards mitigating these uncertainties. Furthermore, and importantly, risk spreads are healthier again after the yield correction two years ago. This reduces the risk of higher yields even if inflation surprises on the upside. Higher construction costs would push up asking rents on new builds, thereby making existing assets more competitive. Sector selection is also important. Industrial properties stand out due to their robust demand, even if new assets are coming online with high asking rents. Likewise, student housing remains resilient due to consistent demand from both domestic and international students. On that point, note that the number of applications from US students to study at UK universities has doubled over the last decade, a key reason being high US tuition fees.

While there may be challenges ahead, the UK commercial real estate market offers opportunities for investors willing to navigate its complexities strategically. By targeting high-growth segments like industrial properties, life sciences and student housing, investors can capitalize on favorable local supply-demand conditions.

Want more insights?

Subscribe to receive the latest private markets perspectives and insights across all sectors directly to your inbox.