Bucking the trend(s): An indexing and active view of Chinese equities

Many investors are questioning their Chinese investments this year amid negative headlines and market volatility.

The Chinese economy is slowing down dramatically after decades of high growth, but does slower growth mean lower stock returns in future? Research suggests not necessarily, and the results can be interpreted as perplexing or even counter intuitive.

More importantly, we are still finding attractive investment opportunities in the A-share market. We believe China is too large an economy to write off, and the overall China investment case still holds true – both for index and active investors. Here we use both investment lenses shed light on where we see opportunities and risks in Chinese equities.

The index/rules-based equity view

The index/rules-based equity view

Boriana Iordanova, Head of Index Research

Having consulted on (and rejected) the inclusion of Chinese stocks trading in mainland China, known as China A-shares, in MSCI Emerging Markets Index for three years in a row, on 20 June 2017, MSCI announced their long anticipated partial inclusion (at 5% inclusion factor), which was implemented in 2018. Other index providers followed suit. In 2019, MSCI increased China A-shares inclusion factor to 20%, while FTSE Russell included China A-shares for the first time in their emerging markets indexes (at 25% inclusion factor).

Five years after the China A-shares initial index inclusion in MSCI EM Index, while they have performed better than other Chinese stocks, index investors’ excitement on this topic has somewhat cooled, and been replaced with questions about when, and if at all, the China equity market will deliver steady robust returns. Some index investors have even started opting for emerging markets indexes excluding China as benchmarks for their index portfolios. This sombre sentiment is understandable, given the China equity market has lagged both the global emerging markets and the global developed markets indexes, and trailed the US equity market by around 17% per year, over the past five years period (Chart 1).

Chart 1: China equity market has lagged global equity markets over the past five years

Chart 1: China equity market has lagged global equity markets over the past five years

Particularly frustrating and perplexing for investors has been the continuing disconnect between China’s GDP growth and its equity market performance, as illustrated in Chart 2. While in the US and in Developed Europe real GDP annual growth in low single digits (circa 2% and less) has been accompanied by healthy equity market returns, in China, 5%+ real GDP annual growth rate is yet to materialise into strong equity market returns.

Chart 2: Mind the gap – China robust GDP growth not yet materializing in strong equity market returns

So what are the options for index/rules-based investors who want equity exposure with potentially better risk-adjusted returns compared to the broader China equity market?

If you had asked us this question 3-4 years ago, we would have suggested investors consider excluding China state owned enterprises (SOEs) stocks. China SOEs are an important component of China’s economy, with total revenues accounting for approximately 70% of China’s GDP and with around 70% market share in foundational and security related sectors such as energy, infrastructure, public utilities and finance. They are also a major component of China equity indexes. For example, more than 300 out of total 700+ MSCI China Index constituents are SOEs, with aggregate index weight of approximately 30%.

But these companies are often perceived to be less efficient than their private sector peers, and have historically been associated with weak corporate governance and the principal-agent problem since they (agent) and the state (principal) could have a conflict of interest or priority. Similarly to SOEs in other emerging markets, China’s have historically tended to underperform their private sector peers (Chart 3), and index and rules-based strategies excluding these stocks have benefitted.

Chart 3: China SOEs underperformed the broader China index historically

However, this historical underperformance pattern now appears to be reversing (Chart 4). Recent reforms aim to make Chinese SOEs more competitive and strengthen their returns by improving aspects of technology, efficiency, and branding. This could lead to enhanced financial performance, and potentially better stock returns.

China has a long history of SOE reforms dating back to the 1970s, but this time the Chinese government is under fiscal pressure. Strengthening returns to SOEs’ government shareholders could potentially alleviate some of this and help economic growth.

The latest round of reforms aims to: re-purpose excess capacity by closing companies with weak fundamentals and merging companies to create national champions; enhance SOEs’ core functions, improve capital efficiency, and strengthen key competitiveness; focus on digitalization, green transformation and technological breakthroughs. China’s central government has started using return on equity (ROE) to evaluate performance of central SOEs management, and regional authorities, which oversee local SOEs, are expected to adopt similar guidelines.

Chart 4: China SOEs historical underperformance is reversing

The theme of resurging China SOEs could be captured effectively via an index/rules-based strategy by screening the SOE universe based on one or more financial metrics – e.g., ROE – to select companies with less attractive fundamentals vs global sector peers that are likely to experience re-rating in the near term.

We constructed a sample rules-based portfolio (Chart 5) by screening the underlying China index for SOEs using the SOE flag from the MSCI ESG Metrics database, excluding Real Estate securities, and from the remaining universe selected stocks with ROE below the global sector average which we weighted equally. The resulting fund comprises 198 stocks (from roughly 700 in the underlying China index), mostly towards the smaller tail of the index, with more than half of the names having investable market capitalization of USD 1 billion and below.

The portfolio has sector average ROE of approximately 5% compared to15% for the global sector average ROE. Despite the smaller market capitalizations, a USD 10 million trade appears fairly liquid with more than 75% of the trade being below 3% of the average daily volume.

Chart 5: UBS China Select SOE sample index fund

The active equity view

The active equity view

Ian McIntosh,Head of Active Equities & Bin Shi, Head of China Equities

SOEs – But, not so fast...

Chinese SOEs were previously abandoned by investors, leading to extremely low valuations. Revenues and earnings growth have stabilized this year, and when coupled with appealing dividend yields this has led to the valuation gap narrowing.

Yet, many SOEs come with their own challenges. The primary concern is the long-term misalignment between management's objectives and shareholder interests. SOEs prioritize consistent growth and returns, often resulting in a more slow-moving approach, and structurally lower returns than the private sector. Their revenues are predominantly domestic, lacking opportunity for international expansion. As the Chinese domestic economy slows that also limits the growth prospects for SOEs.

In our view, selectivity remains of paramount importance. For instance, we have high conviction in a consumer staples company renowned for its superior brand equity, but where there is substantial state involvement. Additionally, we are investing in SOE property developers that are gaining ground as numerous private developers exit the market.

At this time, without a clear indication that profitability is improving, it would be difficult for any further re-rating to materialize. A shift back in investor attention towards privately-owned enterprises (POEs) is possible if the valuation differences with SOEs diminish further.

Lower GDP growth, lower equity market returns?

In our view, there is plenty more upside to come from urbanization, and with the country’s GDP per capita remains low by developed economic market standards – there a long way to go before the country hits a ceiling in GDP per capita.

However, it is clear the era of double-digit growth is behind us. Having said that, China moving to a lower growth regime of low to mid-single digit real GDP growth does not necessarily mean lower equity market returns going forward.

The relationship between GDP growth and stock returns has been well studied and the results are counter intuitive. The correlation is weak and for some countries negative. This is illustrated by looking back at the real GDP growth and equity market returns in US and China the over the last 30 years. The strongest 10-year period of growth in the S&P 500 was accompanied by relatively modest real GDP growth in the US, far lower than real GDP growth in China over the same period.

Chart 6: Real GDP growth vs. equity total returns

Rolling 10 years from 2003 to 2022

The reasons are varied. Corporate earnings of public companies are not the same mix as gross domestic product. For instance, the US equity market has significant international exposure, which has grown over the last 30 years. Improving governance and better market and information efficiency, impact the market multiple. Sector composition also makes a big difference to market returns and the US leadership in technology has been a key driver of US outperformance.

And, importantly, valuation starting point for the market is key to long-term returns. Ultimately, the market is a discounting machine, and expectations of future GDP growth are embedded into prices. Equity market returns are better predictors of future GDP growth than the other way around.

Equity market returns are better predictors of future GDP growth than the other way around.

We believe the that best managed companies will be able to adapt and thrive to a lower growth environment. One sign of management competency is the return of excess cash to shareholders, rather than mis-spend on capital projects. Chinese companies are now trading on high cash flow yields and have begun to embrace buybacks. Not only are they adapting to the various external challenges in this volatile environment, they continue to invest in technology, research and development, control costs and grow their business.

Not only are they adapting to the various external challenges in this volatile environment, they continue to invest in technology, research and development, control costs and grow their business.

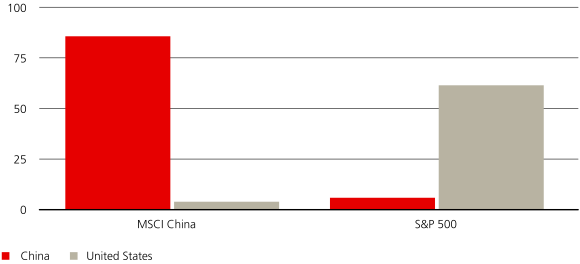

China goes global

China's economy is famously export centric. Yet, its equity revenues are surprisingly domestic, with 86% of MSCI China company revenues originating domestically, compared to 62% for the S&P 500.

Chart 7: Geographic revenue exposure of the China and US equity markets

Many companies have enjoyed spectacular growth in the domestic market. To keep growing strongly, these companies now need to look overseas. They are doing so already. Increasingly, Chinese companies are thriving internationally in areas such as online gaming and ecommerce. And because these firms have survived fierce domestic competition, We believe they are well placed to succeed in the international market. This is a theme for some of our investments because Chinese companies are only just starting to go global.

In many cases, their success is already striking. Automobiles are not traditionally China’s strong suit, but it is now the largest car exporter in the world by sales volume and is one of the clear leaders in electric vehicles. In the long run, we expect to see many more Chinese cars on the streets of other countries. Chinese automakers are pushing ahead of the global brands, spending aggressively on R&D and introducing new technology and features. It is a matter of time before international customers realize that the Chinese brands can offer better cars at more competitive prices.

Healthcare companies are also becoming globally competitive, partly because conducting R&D is cheaper. We are seeing more licensing out from Chinese pharmaceuticals companies instead of only licensing in from global companies as in the past.

Overall, we expect Chinese companies to continue to advance in their technology, sophistication and understanding of the international market. And so long as they are quick to adapt and learn, they should be able to compete successfully abroad.

In our view, many of the industry-leading companies can still deliver 15-20% CAGR in the long run by controlling expenses and expanding into international markets.

Investing in uncomfortable times

Expectations for China equities are at a low ebb. Global investors are neutral or underweight China, US hedge fund exposures to China at a decade low.

Yet, the China market has characteristics that make an attractive setting for active managers. It is deep, with many companies to choose from. Retail investors own almost half of the free float market capitalization, a level that is twice the US market, and are prone to hubris and hysteria, amplifying market overreactions.

We have gone through wild sentiment swings before. History tells us that the best time to invest has been when investors feel the most uncomfortable.

The China complex

The China complex

This special edition of Panorama is dedicated to China and offers a richer way of looking at it from the geopolitical, sustainable, economic and market lenses.

About the authors

Boriana Iordanova

Index research analyst in the Systematic & Index Investments team

Boriana Iordanova is an index research analyst in the Systematic & Index Investments team. She is responsible for research across the index equity spectrum, including market cap and non-market cap weighted (e.g. factor, sustainable) indices.

Ian McIntosh

Head of Active Equities at UBS Asset Management

Ian McIntosh is Head of Active Equities at UBS Asset Management, responsible for overseeing more than USD 166 billion in assets across actively managed equity strategies globally. Ian was promoted to the role in 2019, having served as Deputy Head since 2016. In his long investment career in Equities at UBS-AM, Ian has performed a variety of senior investment roles as a fundamental portfolio manager and quantitative analyst.

Bin Shi, CFA

Head of China Equities

Years of investment industry experience: 28

Bin Shi is a member of the Emerging Market and Asia Pacific Equities team, located in Hong Kong. He is the lead Portfolio Manager for the China equity strategies.

Bin Shi is a member of the Global Emerging Market and Asia Pacific Equities team, located in Hong Kong. He is the lead Portfolio Manager for the China equity strategies.

Bin joined UBS in January 2006 and has managed the Greater China Fund since April 2006. He also manages the China Opportunity, China A and All China strategies since inception in July 2010, March 2007 and May 2018 respectively.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.