Our expertise

We provide fully customized separately managed portfolios to meet your particular risk and return tolerance. These portfolios can be established quickly and provide flexibility to change investment guidelines as conditions change.

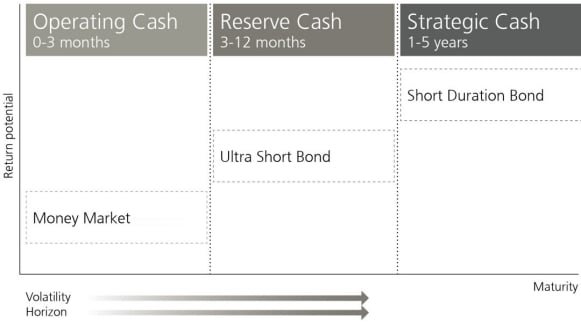

UBS AM manages a variety of customized liquidity portfolios for a wide array of clients including corporations, governments, family offices and high net worth individuals globally. The Liquidity Management Team manages portfolios with particular expertise on clients whose liquidity needs require solutions for their operating, reserve and strategic cash “buckets”, all with the objective of limiting principal volatility in a focused risk managed manner, while providing client mandated liquidity. In concert with these two objectives, the team strives to deliver performance in excess of portfolio benchmarks.

What sets us apart

Customization

- Fully customized portfolios tailored to meet your unique liquidity needs and risk tolerance

- Comprehensive investment policy integration including pre and post trade compliance testing

- Customized Reporting and Portfolio analysis

- Dedicated Portfolio management and Client Service teams

Flexibility

- Flexibility to change investment guidelines as liquidity needs, market conditions or risk parameters evolve

- Ability to add "sub" strategies/tranches with different risk/return profiles

Performance

- Based on client guidelines coupled with our team’s assessments of credit quality, relative value and interest rate outlook, we strive to deliver investment solutions which:

- Deliver consistent performance over the long-term

- Manage risk

- Adhere to our clients’ investment guidelines

Stability

- Our experienced portfolio management and credit analyst teams provide the focused expertise and attractive long-term GIPS compliant track records that investors seek when partnering with an investment manager

We will work with you to determine the right investment approach to meet your liquidity management needs.

Contact our experts

Joe Abed

Head Liquidity Sales Specialists