UBS Advisory Solutions

How advisors can grow their advisory business by 18%*

How advisors can grow their advisory business by 18%*

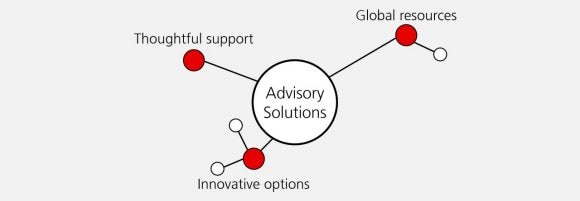

The industry provides more than ample resources to help financial advisors with high-net-worth and ultra-high-net-worth clients looking for advisory relationships. But it can also feel like a sea of sameness. Three reasons to consider UBS:

With flexibility to choose among numerous options – from client directed, advisor discretion, separately managed accounts, or a combination thereof – you may find powerful tools to help clients pursue their goals at UBS, the world’s largest wealth manager.

Gain innovative new options for serving your clients

UBS Advisory Solutions offers a wide range of offerings, enabling you to transition assets to a direct match—or an even more alluring alternative. Enjoy enhanced capabilities to tailor your approach to each client, based on their circumstances, financial objectives or preferences:

The CAP portfolio can include trusts, LLCs and individual assets, even alternative investments such as hedge funds, private real estate or private equity investments, regardless of whether they are held at UBS or elsewhere.

My UBS Advisory Consultant has been instrumental in helping me design and implement my Campaign Strategy. My advisory compensation increased 18% in less than a year.

Get thoughtful support for your transition – and as you grow

UBS specialists guide your transition with in-market expertise, knowledge of the competitive landscape and familiarity with each firm’s nomenclature. Your dedicated Advisory Sales team will provide guidance as they assist you in transitioning your current platforms and investments onto the UBS Advisory ecosystem.

And once you’re on board, the support you can expect from UBS has only just begun. Our approach includes four pillars:

UBS maintains category dominance of the single contract separate account segment...

Put our global resources to work for you

Clients continue to use fee-based Advisory solutions and there are plenty of worthy firms for financial advisors to join. We believe our broad platform, with a variety of account types and product offerings can provide an advantage. As a Financial Advisor at UBS, you will gain access to innovative new offerings and in-market support to help serve your high-net-worth and ultra-high-net-worth clients.

Plus, you and your clients will have access to proprietary and timely insights from the world’s largest global wealth manager. Our Chief Investment Office works with over 180 investment specialists in 11 key financial hubs to identify the latest investment opportunities and market risks around the world. The UBS House View is a locally activated, 24-hour, globally connected perspective that no other firm can offer.

With UBS, you can leverage a global POV, timely insights and innovative offerings that can help clients pursue their financial goals. And behind all of it, enjoy the holistic support you need to manage and help grow your business. Your clients can feel as if they are the center of your advisory practice, each with a bespoke approach—yet sharing the UBS ecosystem.

You will hear a lot about how much support you’re going to get, and you may question if it’s real…They answered more questions and did more heavy lifting than you can even begin to hope for. There has not been one person at UBS that has overpromised and underdelivered.

To learn how UBS can help you grow your business by doing more for your high-net-worth and ultra-high-net-worth clients, submit your contact information today.