When contemplating a move, finding the right match can be challenging. To aid you in that process, here’s what we see in Advisors who tend to be most successful here at UBS.

When contemplating a move, finding the right match can be challenging. To aid you in that process, here’s what we see in Advisors who tend to be most successful here at UBS.

UBS Financial Advisors are among the most productive in the industry. That’s in part because of our selective process and also because of the level of support our Advisors receive in serving clients and growing their business.

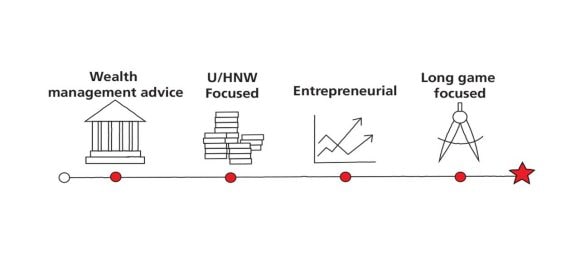

Here is a list of the top four attributes among successful UBS Advisors and how we support them:

Focused on wealth management advice

Focused on wealth management advice

Wealth management is our core business at UBS. It is central to all we do, and successful Advisors here are also focused on providing wealth management advice to their clients. Specifically, they have demonstrated:

- A strong track record of planning-based advice

- Advisory a major revenue stream

- The value of banking and lending solutions to anchor client relationships

- A drive to improve on behalf of their clients

- Clear client targets and business model

Experienced in the HNW and UHNW space

Experienced in the HNW and UHNW space

In addition to our premier wealth management services for HNW clients ($1 to $10 million in investable assets), our Private Wealth Management division is dedicated to serving the needs of clients with a minimum of $10 million of investable assets. To augment the level of sophisticated advice HNW and UHNW clients require, UBS has centers of excellence with highly specialized knowledge in portfolio advisory, family office services, philanthropy, trust and estate planning, and more. Together with our team approach, this collective knowledge and experience supports Advisors in serving the most complex and sophisticated needs of some of the world’s wealthiest clients. On average, UBS Global Wealth Management Americas Advisors see about $1.7 million in revenue on $253 million assets as of December 31, 2022.1

We were impressed by the independence and open architecture of the UBS platform and the investments that have been made into the asset management arm (low fee basis, structure of the fee schedule), Family Office Solutions and investments in the Advisory side of the business where our primary focus is.

Entrepreneurial spirit

Entrepreneurial spirit

We pride ourselves on our advisor-centric culture, which supports Advisors in creating and pursuing their business vision. UBS Advisors typically take advantage of our robust support for a team approach that is ideally suited to serving HNW and UHNW clients.

Eye on the long game

Eye on the long game

At UBS, we aim to be the firm that Advisors join, grow with and retire from. To that end, we support Advisors with an industry-leading succession program, the Aspiring Legacy Financial Advisor Program (ALFA). That means our Advisors tend to be in for the long game and want to stay at UBS for the remainder of their careers.

From day one UBS felt like a very high-end boutique with the resources of a very large firm, which is what we were looking for. Everything has been absolutely as advertised during the recruiting process.

Key attributes

In summary, UBS Advisors tend to have many if not all of the following attributes:

- Strong track record of planning-based advice

- Practice is rooted in fee-based Advisory revenue

- Embrace lending and banking

- Have ambitious growth targets

- Have demonstrated loyalty throughout their career

- Highly productive given their length of service in the industry

- Deliver advice from a teaming model

- Strong reputation

- Adept at leveraging platforms and resources

- Have developed UHNW and HNW referral network

If you’re looking to join one of the world’s leading global wealth managers, we could be the right next—and lasting—move.

To learn more about joining one of the world’s leading global wealth managers, submit your contact information to be connected with a Field Leader.

To learn more about joining one of the world’s leading global wealth managers, submit your contact information to be connected with a Field Leader.