Sustainable investing:

How UBS helps Financial Advisors support clients and grow their business

How UBS helps Financial Advisors support clients and grow their business

We are guided by our ambition to be a leader in sustainability.1

At UBS, clients remain at the heart of what we do. It is our commitment to be their wealth manager of choice and support them with offerings that meet their evolving needs.1

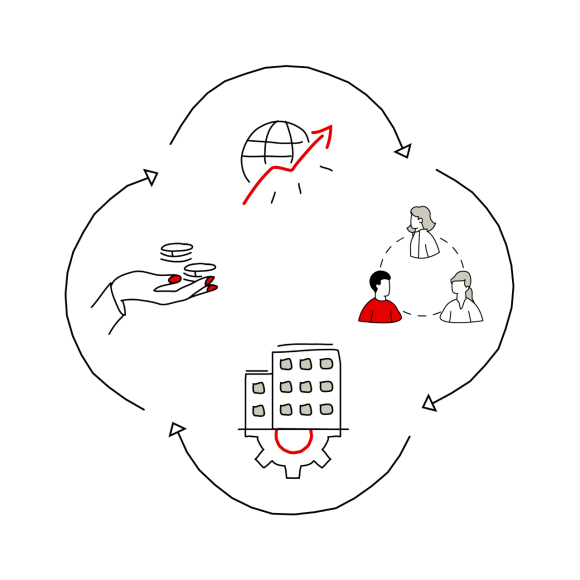

Within the last few years, we have seen continued demand for sustainable and impact investments as this style of investing allows clients to align their portfolio to their mission or their preferences. We believe sustainable investing offers investors the ability to pursue market-rate returns, manage downside risk2, focus on long-term opportunities and innovation, and make an impact.

In our view, sustainable and impact investing present an opportunity for Financial Advisors to meet client needs, deepen existing relationships, capture new assets and attract new clients.

You don’t need to navigate it alone. At UBS, we have dedicated teams of professionals to support you and your clients through around-the-clock insights and education, comprehensive range of investment choices and tailored portfolio construction capabilities.

The industry is evolving at such an incredibly rapid pace and you have to evolve with it.

Sustainable investing may help you capture new assets and acquire new clients. In our experience, sustainable investing is top-of-mind for key client segments and can serve as a differentiator in your client and prospect conversations.

Continue reading to see how sustainable investing can help you grow your business and learn more about the resources available to you and your clients.

Many investors express interest in sustainable investing but do not have a clear idea of how they can pursue both sustainability or impact objectives and financial returns in diversified investment portfolios.

At UBS, we help our clients:

As a Financial Advisor at UBS Financial Services Inc., a division within UBS Global Wealth Management, you have access to our global scale and footprint in wealth management with USD 6.1 trillion in assets under management, in addition to our end-to-end research-driven investment value chain1. Content from our Chief Investment Office (CIO) includes dedicated sustainability-focused investment research, including current sustainability trends and topics, asset class research and guidance, and thematic investment ideas. Through other available resources, this can then be translated into high-conviction instrument selection and advice.

Thought leadership: Our GWM CIO identifies actionable sustainability-related investment opportunities and publishes a regular series of client-facing sustainable investment views. Additionally, our GWM CIO and the Wealth Management USA Asset Allocation Committee have created a differentiated sustainable investing framework and dedicated set of Sustainable Investing Strategic Asset Allocations designed to provide investors with diversified exposure to strategies with distinct and explicit sustainable investing purpose, as well as estimated volatility-adjusted returns comparable to traditional portfolios over the long run.

Product shelf: While our sustainable investing offering begins with research, it does not stop there. Financial Advisors have access to a robust open architecture sustainable investing product shelf, including options across asset classes and vehicle types (e.g., exchange traded funds, mutual funds, separately managed accounts, and alternative investments) for eligible clients.

Specialists: Our GWM US CIO Sustainable & Impact Investing team has dedicated professionals to support Financial Advisors and clients with research and solutions. There are several other teams who play important roles when it comes to sustainable investing at UBS, across research, due diligence, investment selection and portfolio construction. In addition, we also have teams ready to help clients who want to align their investment and philanthropic strategies. We can help you deliver the best our firm has to offer.