UBS Wealth Advice Center

Helping advisors gain 19% new business growth*

Helping advisors gain 19% new business growth*

With a staggering $84 trillion in wealth transfer expected to take place through 2045, more advisors than ever are looking to focus on HNW/UHNW markets. However, in upscaling their business, advisors with multi-segmented clients face a challenge: how can they dedicate the time and resources to grow their HNW/UHNW business while continuing to effectively serve their affluent clients?

At UBS, our Wealth Advice Center (WAC) offers a mutually beneficial solution. We provide your affluent clients with a team of wealth management professionals dedicated to their needs, as well as a robust online platform, freeing you up to focus on your HNW/UHNW accounts.¹ The WAC provides transparency into the relationships you migrate or refer,² all while providing ongoing compensation for eligible accounts.

Like other advisors who partner with the WAC, you can expect more time to focus on growing your HNW/UHNW practice, segmenting your business in a way that benefits you financially. As well, your affluent clients can continue to receive the advice and guidance they need.

UBS stands apart on FA compensation, paying full production credit at FAs applicable incentive rate (on an ongoing basis) for eligible migrated and referred accounts.

Why reduce your smaller, affluent clients?

Advisors who reduced households in their book under $500k by 15% gained both capacity and time, allowing them to serve, retain and grow their client base of $1M+ households. By reducing their less affluent clients, Advisors:

Having more time to devote to HNW/UHNW clients means you can provide the personal advice clients seek. Our WAC clients also receive personalized advice from a dedicated advisor team—a key factor in client satisfaction, according to a 2023 Wealth Management Trends study. The research found that 70% of clients believe that the degree of personalization given to their individual wealth is one of the most critical factors when deciding on a wealth management advisor.

A deep bench of professionals

Our broad and diverse team of wealth management professionals at the WAC includes 190+ financial advisors, relationship managers and client service associates. They are all dedicated to providing individualized advice and financial solutions to your affluent clients so you can focus on growing your HNW/UHNW accounts.

At the WAC, we combine guidance from our highly trained team with powerful digital tools to offer an industry-leading hybrid digital advice model—all while continuing to offer ongoing compensation to you as a referring advisor.

I can’t overstate how much I benefited from migrating my affluent clients to the WAC. The personalized attention they delivered to my clients, the freed up time and resources I had to focus on my HNW base and my compensation not being negatively impacted—this was the umbrella solution I needed to effectively grow

my business.

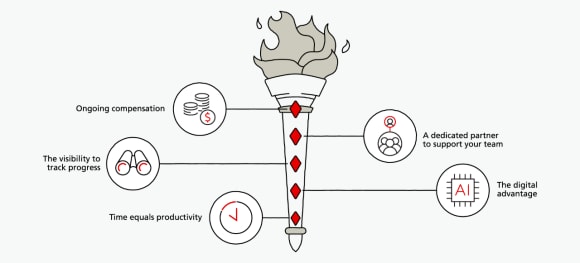

5 reasons to refer affluent clients to the UBS WAC

Our compensation model is where our innovative partnership shines. Currently, we pay ongoing compensation for new clients and existing clients to be transitioned to the WAC, and referred accounts are eligible for full production credit at FAs applicable incentive rate.

UBS’ unique model sets us apart from many of our competitors, giving our advisors the edge to grow and expand their HNW/UHNW business, while continuing to receive income from migrated and referred accounts.

It can be difficult to cut ties with clients that don’t fit your expanded business model. At UBS, we understand you’ve spent years developing personal relationships with your affluent clients, and they deserve to receive an exceptional wealth management experience.

Your affluent clients are served by the WAC as a partner to your team, getting ongoing guidance and attention from our dedicated team of 190+ experts ready to meet their needs. At the WAC, we’re champions of education and expertise, with many of our advisors holding or pursuing the CFP® designation, putting us in an exceptionally strong position to help clients face the future with confidence.

Referred or migrated accounts enjoy many perks under the WAC program, including:

Unlike some competitors, UBS does not compete for your affluent clients, but rather aligns with you to provide support—and transparency is the foundation of our partnership.

Advisors who migrate or refer clients to the WAC maintain visibility into their accounts, down to line items that inform them as to their ongoing compensation. Utilizing our intuitive Migration Tool, you are able to see your transitioned clients’ Assets Under Management (AUM), as well as their T12 revenue and most recent statement. This visibility offers you the opportunity to convert them back to your practice when appropriate.

Your biggest commodity is time. We partner with you to deliver individualized advice to your affluent client base, so you are free to focus on your HNW and UHNW clients—all while receiving ongoing compensation from accounts you refer or migrate to the WAC.

Migrating your smaller households to the WAC means you gain time back in your day to focus on deepening key relationships with existing HNW/UHNW clients, as well as developing and nurturing new ones.

UBS’ Wealth Advice Center delivers personalized attention to your affluent clients, creating time for you to nurture HNW/UHNW clients—all while providing ongoing compensation for your migrated accounts.

In addition to personal advice from our advisor team, your affluent clients benefit from digital advice through instant guidance and analytics to help them refine their investment strategies.

Clients have access to UBS Advice Advantage, and receive a proposed portfolio based on our view of the markets. If they like what they see, clients can choose to invest in the UBS Advice Portfolio Program in one click.

Meanwhile, our innovative software allows you to continually track the progress of these clients, with the option to migrate them back to your practice when you wish.

Our WAC Relationship Manager comes into the office every week and we talk over who we are migrating and how best to approach them. He really feels like part of the team. This is absolutely the way to go and we hope you don’t change it.

Thinking ahead? By working with us before you transition your business, you can receive ongoing production credit and not have to abandon smaller relationships at your former firm. In addition to directly transitioning clients to the WAC, you have the flexibility to transfer accounts to your book of business at your new UBS branch office and then migrate them to the WAC. From there, you will be assigned a relationship manager, designed to be your key point of contact for all things related to the WAC.

The key to our success at the Wealth Advice Center is that our compensation is tied to your compensation. Our foremost goal is to deepen our advisors’ migrated relationships. Because when we do well, you do well—it’s that simple.

To learn more about how the UBS Wealth Advice Center can help you grow your HNW/UHNW business and position for the upcoming $84 trillion wealth transfer, submit your contact information to be connected with a Field Leader now.