Global Insights

An emerging market perspective on the US elections

ElectionWatch 2024

![]()

header.search.error

Global Insights

ElectionWatch 2024

The US is the world’s largest economy. It spends more on the military than any other country. The US dollar makes up nearly 60% of foreign-currency reserves globally. And the country boasts the world’s largest and deepest capital markets. Investors worldwide justifiably pay more attention to the US presidential election than any other leadership contest elsewhere.

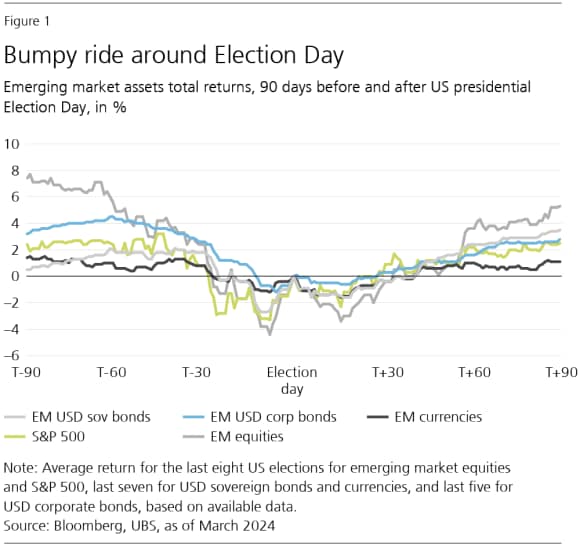

What can we learn from the impact of past US elections on emerging markets? We know that assets from the emerging world often experience strong, if short-lived, price moves around Election Day (Fig. 1). The nature of the electoral outcome also seems to matter: Emerging market assets have performed better during periods of a unified US government, as well as during periods with a Democratic president in the White House (Fig. 2). But these findings need to be taken with a grain of salt, as they rely only on eight presidential election cycles, providing a limited amount of data from which to draw definitive conclusions.

To complement a historical analysis, it is worth analyzing three key channels through which the election can influence emerging markets:

A described in our scenario analysis, considering the policies both candidates have stated so far, a Republican victory appears to be more conducive to an environment of faster US economic growth, higher inflation, higher long-term interest rates, and—at least at first—a stronger US dollar. In the realm of trade and geopolitics, a Republican administration would increase uncertainty around US external policy. Former president Trump has repeatedly expressed his preference to actively use tariffs as a trade policy tool and seems likely to take a more unilateral and isolationist approach to address cross-border issues.

Stronger US growth is undoubtedly good for emerging markets. But higher interest rates and a stronger US dollar represent a tightening of financial conditions for the emerging world, and global investors are rarely willing to increase their allocations to emerging markets when trade and geopolitical noise increases. A Republican victory would therefore likely introduce more headwinds than tailwinds for emerging market assets.

Channel | Channel | Blue sweep | Blue sweep | Harris with split Congress | Harris with split Congress | Red sweep | Red sweep | Trump with split Congress | Trump with split Congress |

|---|---|---|---|---|---|---|---|---|---|

Channel | US macro environment | Blue sweep |

| Harris with split Congress |

| Red sweep |

| Trump with split Congress |

|

Channel | Trade | Blue sweep |

| Harris with split Congress |

| Red sweep |

| Trump with split Congress |

|

Channel | Geopolitics | Blue sweep |

| Harris with split Congress |

| Red sweep |

| Trump with split Congress |

|

Although the outcome of the contest matters, long-term portfolio construction is best treated as an apolitical exercise. Academic research has shown that an investor’s personal political biases—and the electoral performance of their preferred candidate or party—directly affect their level of optimism or pessimism about the economy and markets. Emerging market assets should play a central role in such portfolios, as they promote geographic diversification and contribute to higher returns than a portfolio without them.

It is also important to remember that emerging markets are a heterogeneous set of economies, and any blanket statements could gloss over their idiosyncratic drivers. For that reason, in the following sections we dive deeper into the election’s implications for countries in Latin America, Asia, and Central and Eastern Europe, the Middle East, and Africa (CEEMEA).

In summary, in Latin America, Mexico appears particularly susceptible to shifts in policy and rhetoric. That said, as the US seeks to reduce its reliance on mainland China, the US-Mexico economic relationship looks likely to only grow in importance over time. The combination of an uncertain US presidential race and the likely approval of several angst-inducing constitutional reforms domestically will likely keep volatility in Mexican assets high through November. We do expect a more favorable risk-reward to emerge by the end of the year. Brazil will have the challenging yet potentially rewarding job of maintaining a neutral position in the face of US-China tensions. In the case of a Trump victory, Argentine President Javier Milei’s close relationship with the former president may yield benefits, while Venezuela may find a tougher road ahead given Trump’s decidedly hawkish record on the use of sanctions.

Asia Pacific is a region where the election more clearly brings both disruption and opportunity. US-China relations look likely to remain on a structurally challenged path. Further US technology restrictions against mainland Chinese companies are likely irrespective of who sits in the Oval Office, supporting our view of the need to diversify global tech exposure into Korea and Taiwan—home to world-class memory suppliers and chip foundries. India will likely continue to observe rising foreign interest as supply chains are redrawn.

Finally, in CEEMEA, a pickup in US fossil fuel production and exports in the case of a Republican victory may weigh on international prices and increase competition for exporters in the Gulf region. A Trump presidency would also likely lead to sharply reduced financial and military support for Ukraine and a weakened NATO, which would increase the geopolitical risk premium on European assets.

Significant market implications emerge from the stark contrast between the presidential candidates’ policies. While we believe portfolio construction should be an apolitical process no matter how distracting the lead-up to Election Day may be, here are our policy, economic, and market expectations for the most likely outcomes.

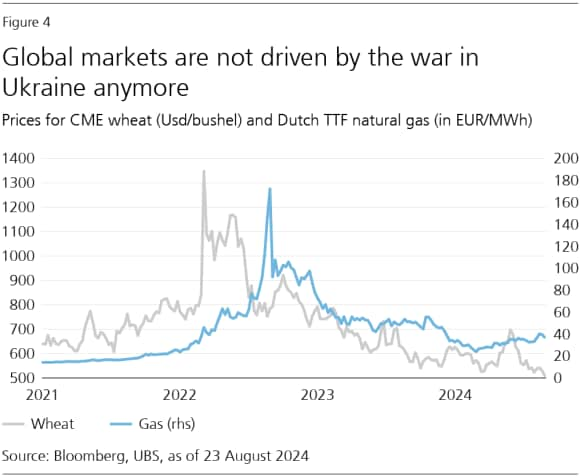

The name at the top of the Democratic ticket may have changed and the respective running mates may have been picked. But in terms of relevance for most countries in Central and Eastern Europe, the Middle East, and Africa (CEEMEA), the key differences between a Democratic- and a Republican-leaning outcome from the US elections remain similar: They concern energy policy, US involvement in geopolitical hotspots, and the use of tariffs on select industries or economies. US support for Ukraine to resist Russia’s invasion is seen by many as crucial, and the conflict in the Middle East remains on the brink of further escalation—US foreign policy priorities can have a big impact in both theaters. And CEEMEA is exposed given direct security risks and possible refugee flows for many countries in the region, while food and energy prices represent indirect transmission channels. In the event of new US tariffs targeting steel, aluminum, and other metal imports, Russia, Türkiye, and various Gulf Cooperation Council (GCC) nations would directly feel the effects, while higher tariffs on mainland China, a key trading partner for most CEEMEA countries, could indirectly weigh on their economies. Lastly, the Gulf region is closely tied to future trends in hydrocarbon. A pickup in US fossil fuel production could weigh on international prices and increase the competition for exporters in the GCC.

A Harris administration would likely continue to promote and potentially speed up the shift to renewable energy in the US. According to a recent poll, Democrats trust Harris even more than Joe Biden when it comes to tackling climate change. Conversely, a Trump presidency would probably seek to reduce energy-related spending within the Inflation Reduction Act (IRA) and eliminate obstacles to fossil fuel development, though this would require Republican control of Congress. Even with such control, resistance might come from moderate party members or those whose states benefit from the IRA.

The future business backdrop for the US fossil fuel industry hinges on the election results. A Trump win would likely reduce regulatory risks and boost drilling activities, leading to increased US oil production and LNG exports. This would intensify competition with Middle Eastern exporters and potentially drive down energy prices structurally. Additionally, a second Trump term could modify US sanction policies against key energy producers, causing temporary market volatility, though without structurally altering prices, in our view.

The Middle East, meanwhile, is strategically positioned to lead the energy transition by producing renewable energy at competitive rates and replacing domestic hydrocarbon demand with wind and solar power. For instance, Saudi Arabia aims to cut domestic oil consumption by 1 million barrels per day by 2030 and achieve net-zero emissions by 2060 through solar and wind energy. This shift would increase the availability of fossil fuels for export and help to support the kingdom’s fiscal health. Saudi Arabia’s NEOM hydrogen project, set to be the world’s largest green hydrogen producer by 2026, could position the country as a major green energy supplier. Other countries in the region are implementing similar initiatives. Qatar, for example, is constructing the world’s largest blue ammonia plant, expected to be completed by 2026.

From a macroeconomic perspective, a Harris victory would likely create a favorable scenario for the Middle East. As US inflation declines, rate cuts and lower bond yields should follow. Lower interest rates can contribute to a weaker US dollar and ease financial conditions, enhancing growth prospects for the Middle East and other emerging markets.

In contrast, a Trump victory, particularly with a Republican sweep, could be more disruptive. Adjustments in policy rate cut expectations and the potential for persistently higher inflation—and thus higher equilibrium interest rates—could increase interest rate volatility, tighten financial conditions, and raise funding costs. In this scenario, the Middle East would likely be more resilient than many other emerging markets owing to its stronger credit metrics. Higher US deficits and funding costs could raise concerns about the long-term sustainability of US debt, potentially weakening the US dollar and leading the region to accelerate efforts to diversify its economy and expand export industries beyond hydrocarbons. A Republican sweep, however, would likely be slightly negative for the region.

After months of delay, the US Congress passed a foreign aid bill in April which included close to USD 61bn funding for Ukraine. This has helped ease some of the ammunition and equipment scarcity that hobbled Ukrainian defensive efforts. Despite persisting manpower and weaponry shortages, Ukraine was able to regain the partial initiative with its incursion into Kursk Oblast earlier this month. Still, it remains under pressure along most of the frontline, and no clear path for negotiations has appeared. Against this backdrop, continued material and diplomatic support from the US appears crucial, as Europe and other nations would likely struggle to compensate for a reduction of US engagement.

The Biden administration has focused on rebuilding US relations with its allies—including NATO—and the country’s support to Ukraine has been ample. Kamala Harris represented the US at June’s Summit for Peace in Ukraine, pledging US support until a “just and lasting peace” is found. Under Harris, the US would likely continue to support Ukraine financially, militarily, and diplomatically. That said, given the budgetary constraints and resistances of parts of the US society, even under Harris the support for Ukraine may become less generous.

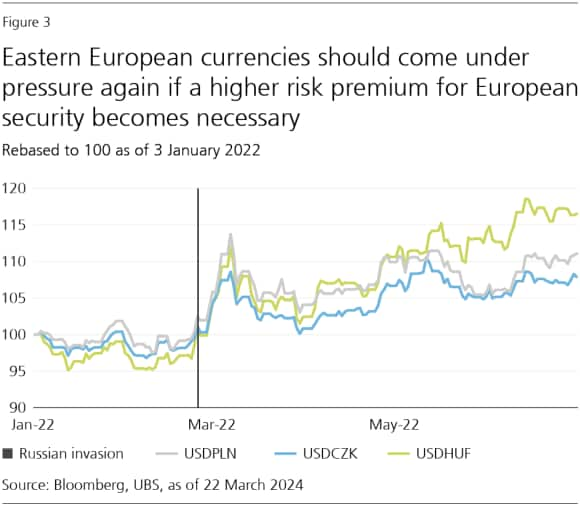

Trump, meanwhile, has indicated a different approach to the war in Ukraine. He would likely aim to reduce US financial and arms support to Ukraine, and increase pressure on Kyiv to negotiate a truce. His running mate, JD Vance, also made it clear in the past that he sees US tax dollars better spent at home. Trump has also challenged NATO allies’ spending commitments in the past, going as far as signaling that the level of spending may impact the US decision to come to the aid of allies. A weakened defense alliance and Ukraine losing the war would raise the geopolitical risk premiums on European assets. In our view, European valuations are barely pricing in the risks stemming from the war or the tensions between European NATO members and Russia.

Eastern European currencies came under significant pressure at the start of Russia’s invasion of Ukraine. Risk premiums may rise again in reaction to a second Trump presidency, as the market may reassess the potential of the war approaching the doorsteps of Eastern Europe’s NATO members. We believe this makes a long position in USDPLN a valid option to hedge against the risk of flagging support to Ukraine and a weakened NATO. Select structured investments to limit downside risks from a long USDPLN position are worth considering, however, as we expect the USD to give back some strength over the medium to longer term based on US growth and yields moderating. A Harris presidency may lead the market to position more rapidly for such a dynamic. While not at pre-pandemic lows, three-month implied volatilities in USDPLN are roughly at early-2022 levels.

Geographic proximity, cultural affinity, and deep economic ties all explain why the US has played a major role in modern Latin American history, to the extent that the region is dubbed “America’s backyard” in some international circles. Residents of the region will be following the US election with great interest.

As we argue in the sections above, a Republican victory would introduce several headwinds for the region. Higher interest rates and a stronger US dollar represent a tightening of financial conditions, and global investors are rarely willing to allocate capital to Latin America when trade and geopolitical noise increases. The impact would be even more noticeable in the event of a unified US government outcome.

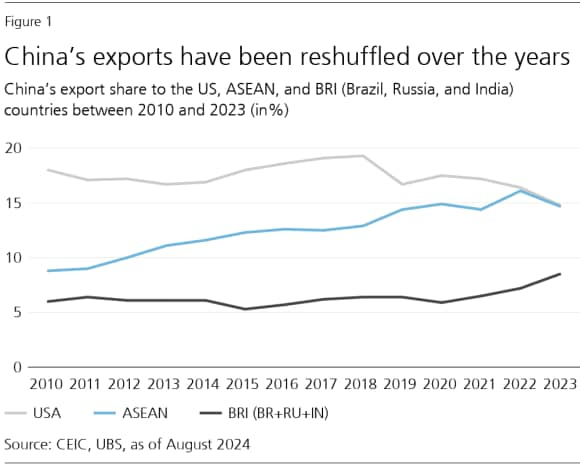

That said, various countries will experience the elections quite differently, taking into account the nature of the economic linkages (Fig. 1), as well as the stark gap between Trump and Harris in their approach to trade and geopolitics.

The US and Mexico are highly interdependent in many aspects including trade, investment, migration, and public security.

Mexico is particularly sensitive to US economic growth dynamics—it is commonly said that when the US sneezes, Mexico catches pneumonia. After all, the US is Mexico’s largest trading partner (Fig. 2) and largest source of foreign direct investment. Moreover, remittances represent a very sizable source of foreign income for Mexico, and nearly 95% of these originate from the US. We think a Republican victory, particularly in the case of a Red sweep, would likely lift activity and inflationary dynamics in Mexico.

That said, a Trump victory would likely trigger uncertainty for Mexico, with the potential implementation of new tariffs on selected imports and possibly universal tariffs likely weakening the Mexican peso to offset the impact. However, Trump is more likely to pursue aggressive enforcement of the USMCA rather than exiting it. In contrast, a Harris administration would likely result in a more predictable and stable trade relationship, with existing tariffs remaining in place and an emphasis on strategic alliances with countries like Mexico. While challenges around labor and environmental issues would remain, the overall stance is expected to be more collaborative.

China’s growing influence in global trade is a bipartisan concern in Washington. Mexico finds itself in a difficult position, as its role as a reliable ally for nearshoring is sometimes questioned due to concerns that China might be using Mexico to bypass US tariffs. Recently, Mexico has demonstrated a strong alignment with US concerns by imposing significant tariffs on Chinese imports. However, as the 2026 USMCA review approaches, this narrative may become a central theme.

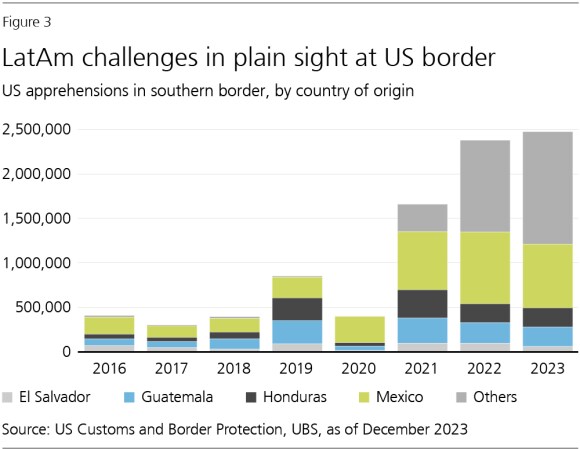

Immigration also remains a pivotal issue, with record apprehensions at the US southwest border (Fig. 3). A Republican victory could lead to stricter immigration policies, including the construction of physical barriers and more aggressive deportation measures; this has the potential of reducing remittance flows to Mexico, which are crucial to the country’s economy as they account for 4% of GDP. While a Democratic administration would also tighten immigration policies, the approach would likely be less aggressive.

The US elections will have profound implications for Mexico. While there are potential challenges ahead, a generally cooperative stance between both countries is anticipated. As the US seeks to reduce its reliance on China for sectors deemed crucial to national security, Mexico’s role in US industrial policy will grow in significance, making the US-Mexico trade relationship more important than ever.

The combination of an intensifying US presidential race and uncertainty surrounding the approval of Mexico’s proposed constitutional reforms will likely keep volatility in Mexican assets high through November. A more favorable risk-reward scenario may emerge by the end of the year.

The US remains Brazil’s second-largest trading partner, behind only China. In fact, the US was the destination of 11% of Brazilian exports and the origin of 18% of Brazilian imports in 2022. But from a US perspective, Brazil is on the receiving end of just 1% of American exports, and the origin of less than 3% of its imports. Brazilian exports to the US are mostly concentrated in commodities and related processed goods including oil, iron, steel, coffee, juices, fruits, sugar, and pulp, and paper. In the case of a Republican victory, some impact on trade matters should be expected; a universal US import tariff of 10% could lead to a marginal reduction in trade between both countries.

In the geopolitical arena, Brazil holds the challenging yet potentially rewarding job of maintaining a neutral position in the face of US-China tensions. China is the main destination for American soybeans, for instance. China could embargo American soybeans (as it did in the past) in retaliation for a US increase in Chinese tariffs, which could end up strengthening the Brazil-China relationship.

In terms of asset class implications, a Democratic victory would likely give more room for the Brazilian real to appreciate due to lower US rates and a weak USD environment. We see opposite pressures under Trump, at least initially: Higher US interest rates and trade uncertainty would make it more difficult for the BRL to appreciate.

A comparable picture emerges for Brazilian equities. A Democratic victory would lead to lower domestic interest rates in Brazil, which would positively impact local stocks as investors focus on positive domestic fundamentals. In the case of a Republican victory, the local stock market could experience headwinds on the back of higher terminal rates in Brazil. We think the expected positive drivers for US stocks in this scenario, such as deregulation and a friendlier US business environment, would fail to carry over to Brazil.

Argentina is likely to maintain constructive relationships with either US president, yet President Javier Milei’s close relationship with Trump may yield some added benefits if he wins, possibly in the form of increased financing support.

Venezuela may find a tougher road ahead, particularly following the lack of transparency and questionable results in the latest presidential election. However, Trump offers a decidedly more hawkish track record in the sanctions realm.

Finally, under a Republican victory, left-leaning leaders in the region, including those in Brazil, Chile, and Colombia, may get a colder reception in Washington compared to the last four years.

As the US election approaches, Asian economies and risk assets are set to embrace the potential impact from different potential outcomes. Here we take a closer look at implications of a potential second Trump administration on Asia from a renewed tariff shock.

Among the key agenda points from a potential second Trump presidency are the universal 10% tariffs for any country exporting to the US and a 60% tariff for China’s US exports. Even if China’s export share to the US has been in decline (Fig. 1), as the country has been exporting more to other emerging markets, the US still accounts for about 15% of China’s total exports. A 60% tariff rate on China, if fully enacted, could potentially force an exit from most Chinese exports, hurting overall Chinese growth significantly.

For other Asian markets, open economies that are highly exposed to both mainland China and the US include South Korea, Taiwan, and Thailand. Over the longer term, those with the potential to fill the gap in the dislocated supply chain due to tariffs could attract incrementally higher foreign direct investment. India, Indonesia, Malaysia, and Vietnam are among the potential beneficiaries.

On the other side of the coin, we also look at company revenue exposure to the US for equity markets in the region. North Asia (Taiwan and South Korea) appears to have the highest revenue exposure to the US market (averaging 18%), whereas direct revenue exposure of listed Chinese companies to the US is small at low-single-digit percentage points of MSCI China’s total sales as of 2023. This suggests that the earnings risk from new tariffs is secondary and more likely to stem from the impact on economic growth. In addition, among the eight largest equity markets in EMs, the only one with a steadily increasing sales exposure to the US is South Korea.

Looking back at the periods when trade tensions escalated during the Trump administration, we identified three main episodes, which led to different degrees of market reaction (Fig. 2). Mainland China suffered the largest correction—over 15% on average—with the first tariff shock sending Chinese equities down by more than 26%, followed by South Korea, Hong Kong and Taiwan. North Asia as well as select ASEAN markets suffered asymmetrically more due to their close linkage to China, currency vulnerability, or revenue exposure to the US as described above.

That said, we believe Trump’s potential new tariff regime will instead be targeted or at least imposed via a step-up approach. We estimate this would still knock off roughly 0.7 percentage points of Chinese growth per year over the next two to three years, with the immediate fallout also hurting smaller trading-oriented economies in both North and Southeast Asia.

Under a potential second Trump presidency, comprehensive tax cuts could result in higher fiscal deficits, which in turn could push US government bond yields higher and strengthen the US dollar. Stricter rules on immigration could also lead to renewed inflationary pressure. These factors could deter the Federal Reserve’s easing pace, in turn constraining Asian central banks’ monetary easing and possibly weigh on financial stability for open Asian economies.

If the former president returned to office in January 2025, he looks likely to pursue a policy of transactional isolationism where US participation in multilateralism is contingent on the receipt of concessions from other nations. While the new global order around de-risking and supply chain re-shuffling should continue long term, the pace might be disrupted. Countries such as India could continue to observe rising foreign interest as supply chains and foreign investment routes are redrawn, but in choppier fashion.

Within Asian equities, we favor AI beneficiaries, select banks, consumer proxies, and high dividend yielders in ASEAN benefitting from tailwinds like approaching Fed cuts, AI spending, and improving regional macro conditions. We also recommend managing election risks with balanced exposure to defensive, high-yielding state-owned-enterprise sectors and growth names in mainland China. For Asian bonds, we advocate a barbell strategy with a combination of short duration and high-quality, long-dated bonds. Last but not least, we recommend holding a long USDCNY or CHFCNY position as a hedge against escalating US-China trade tensions.

Historical evidence indicates that political biases can be detrimental to investors, particularly over the long term. Such biases may encourage risk-averse behavior precisely when asset prices are undervalued and market opportunities are favorable. Moreover, fundamental drivers often serve as more reliable indicators of investment performance than political events or geopolitical risks. Therefore, long-term investment decisions should be approached as an apolitical exercise, in our view.

However, campaign rhetoric and policy platforms frequently target specific sectors and regions, potentially affecting certain assets in the short to medium term. It is crucial for investors, especially those with concentrated exposure to individual countries or sectors, to understand portfolio risks and strategies to mitigate them.

Examining the key political scenarios outlined at the beginning of this report, we observe that a Harris presidency would likely result in policy continuity in areas such as trade tariffs, U.S. engagement in geopolitical events like the Russia-Ukraine and Israel-Hamas conflicts, and a commitment to combating climate change. Consequently, a Harris victory could limit potential market volatility, which would generally support risk assets and likely trigger a relief rally in emerging market assets. Conversely, a Trump victory would probably be more disruptive.

The table below summarizes potential strategies for investors to position themselves for either a Harris victory or a second Trump term.

That said, we remind readers that this election campaign has already experienced numerous unexpected developments and may still hold surprises in the remaining two months until election day. Given the close race and the new administration taking office only in January 2025, we recommend that investors align their portfolios with the market-moving macroeconomic dynamics of moderating growth and central bank rate-cutting cycles as a priority.

In emerging markets, we recommend investors to position as follows:

Scenario | Scenario | Position | Position | Rationale | Rationale | Levels / implementation | Levels / implementation |

|---|---|---|---|---|---|---|---|

Scenario | All | Position | Short USDMXN, short EURMXN / structured position | Rationale | The upcoming approval of constitutional reforms in Mexico will likely keep volatility in the Mexican peso high in the coming month. Heated rhetoric around trade and immigration policy as the US presidential election draws near could also pose challenges for the peso. While there are potential challenges ahead, we think the fundamentals of the Mexican economy remain strong and we expect a generally cooperative US-Mexico stance to eventually emerge. A favorable risk-reward for the Mexican peso may emerge by the end of the year. | Levels / implementation | In the current environment, we think the risk reward for a short USDMXN or a short EURMXN position are not yet attractive enough. However, all else equal, we think entry levels around USDMXN 20 would be an attractive entry point. We recommend selling the upside risk in USDMXN from 21, with a tenor of six months, bridging the period of heightened political uncertainty. |

Scenario | Trump | Position | Long USDPLN / structured position | Rationale | We believe a long USD short PLN position is a suitable hedge against the risk of lessened support for Ukraine and a weakened NATO in the event Trump becomes president again. Moreover, such a position could also benefit from growing uncertainty about future European support to Ukraine. | Levels / implementation | Current USDPLN levels around 3.82 are a suitable entry point, in our view. We favor structured investments to limit the downside of such a position. Implied volatilities in USDPLN are still rather low. |

Scenario | Trump | Position | Long USDCNY, long CHFCNY | Rationale | We think a short CNY, long USD or CHF position is a suitable hedge against US-China trade tensions under a potential second Trump presidency. The CNY came under significant selling pressure during the escalation in trade tensions between June 2018 and November 2019. | Levels / implementation | Current USDCNY levels of 7.14 and CHFCNY levels of 8.26 are suitable entry points, in our view. |

Scenario | Harris | Position | Buy South African assets | Rationale | Harris winning the presidency should represent policy continuity, and focus markets back on economic fundamentals, including moderating US growth exceptionalism and a Fed rate-cutting cycle, broadly weighing on the US dollar. Downside risks to US-China trade relations should also be more muted. The domestic setup for South African equities has improved with the emergence of a reform-minded government, better energy availability, and the South African Reserve Bank likely initiating a rate-cutting cycle in the near term. Positioning by international investors is also rather low, and positive domestic dynamics could combine with a boost from the external side via the market’s sensitivity to China. Similarly, the South African rand could extend its recent gains in such an environment against the backdrop of still undemanding valuations. | Levels / implementation | We believe South African equities are more likely to outperform the broader emerging market complex with a Harris victory, and we recommend to fund allocations to South Africa out of emerging market exposure. On the currency side, we note that the South African rand strengthened rapidly in recent weeks, more than reversing the early August losses. Accordingly, downside participation in USDZAR with structured investments is more attractive to us at this point than outright short exposure. |