US Politics and Policies

Sustainable investing perspectives on the US election

ElectionWatch 2024

![]()

header.search.error

US Politics and Policies

ElectionWatch 2024

Introduction

Markets see the 2024 US presidential election as pivotal to determining the path forward for sustainable investments. The US is the largest international funder of climate change mitigation and adaptation efforts. It is also home to a thriving market of renewable energy and electrification innovation, but the second largest emitter of carbon dioxide in the world as well.

Yet, contrary to emerging consensus, we believe that the party governing from the White House matters less to sustainable investing strategies and performance than overall macro conditions.

It is true that the two political parties sharply diverge in their positions on sustainability, reflecting two different potential paths for US policy. Recent history offers a useful guide: In 2016, President Trump withdrew from the Paris Agreement, and the Environmental Protection Agency rolled back over 100 policies within the first year of his administration. In 2022, under President Biden, Congress narrowly passed the Inflation Reduction Act (IRA), the largest climate-related investment legislation in US history allocating nearly USD 500bn in new spending and tax breaks for initiatives ranging from solar energy production to carbon capture by oil and gas companies, to electrification.

However, although regulatory and legislative actions matter, investor behavior and the performance of sustainable investments have surprised during both administrations.

In this special 2024 ElectionWatch edition of Sustainable Investing Perspectives, we dive into the history along with the policy expectations across energy, renewables, social issues, and SI investments, while discussing the implications for global investors. With eight weeks to go until the November 5 election, much could still change.

Investors should certainly be prepared for potential volatility in these thematic areas, but we recommend they continue to position for the longer-term opportunities tied to sustainability.

Labor Day weekend in the US marks the unofficial end to the summer. In an election year, this is also the time when the race enters the home stretch. Polls currently suggest that Vice President Harris is slightly better positioned in the race against former President Trump, but this election is still a toss-up with eight weeks remaining until the election on November 5. Of the four potential election outcomes, “Harris with split Congress” and a “Red sweep” are our two most likely scenarios with 40% and 35% probability, respectively (see our scenario analysis for up-to-date probabilities). We focus on these two scenarios when considering the impact of the election on sustainable investing.

In the sections following this summary, we discuss investor implications for each topic.

The Inflation Reduction Act (IRA) of 2022, passed along partisan lines, represents the single-largest US investment legislation in clean energy, electrification, and decarbonization. It is also one of the largest global government investment packages in these sectors. This election has been focusing on the preservation of the IRA and determining the Environmental Protection Agency’s (EPA) regulatory direction for environmental standards. As the largest funder of the World Bank, US participation in international agreements is also relevant to global efforts on climate and the environment.

The question of workforce management and DEI in corporate activity and investment decisions has emerged as a wedge issue in recent years. The Biden administration has embedded diversity-related requirements and incentives across federal activities and supported additional union activity. Policymaking differences in these areas will significantly impact corporate actions on these topics.

There is a robust debate and divergence between the two parties on the question of whether asset managers can consider sustainability-related factors in investment decisions. The debate is playing out at the federal level through agency rulemaking that could change how easily managers can bring to market SI strategies, as well as whether companies can or should disclose sustainability information to the market.

Three-quarters of voters in the representative sample believe there should be regulation of CO₂ as a pollutant.

The debate on climate-related policy has become a significant wedge issue in US politics over the past few years. Despite this, over 70% of registered voters have consistently expressed belief in climate change since 2016, according to Yale University surveys. Not only do Americans believe in climate change, but nearly three-quarters of voters also support regulating CO₂ as a pollutant.

The partisan divide is stark, with a 40- to 50-point difference on climate-related beliefs between registered voters who self-identify as conservative Republicans and liberal Democrats. This divergence is expected and reflected in campaign rhetoric on both sides. However, what stands out in the data is that over 65% of moderate Republicans and Independent voters do support CO₂ regulation. This data suggests that Vice President Harris is likely to keep her campaign speeches light on the topic of climate, as she has done thus far, assuming tacit support by a significant part of the committed electorate. We don’t believe that fewer mentions of climate mean that a Harris administration would not keep environmental sustainability on its governing agenda. The extent to which they’d be able to make additional meaningful change from the current baseline will depend on the Congress’ composition.

Interestingly, voter polling data indicates a “follow the leader” effect among conservative Republicans, as former President Trump has drawn a distinction on the topic. A record 60% of conservative Republicans supported CO₂ regulation in 2018, halfway through the Trump presidency and following US withdrawal from the Paris Agreement. Support has dropped to a decade low of 42%, with a major drop in 2020. The broader Republican party might see an advantage in preserving environmental, renewable energy and decarbonization-related policies, but the former president’s position will likely dictate policy adoption.

Despite headlines, we do not expect either of the two most likely scenarios to have a meaningful impact on fossil fuel related companies nor on the electrification and renewable-energy-related companies.

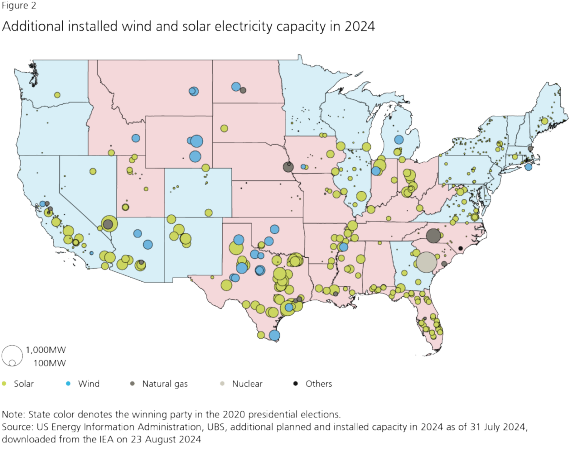

We do not expect the clean energy related incentives in the Inflation Reduction Act to be dismantled as a base case, given that investment in the first two years of the legislation has benefited majority Republican and Democratic districts alike (Figure 2). IRA credits at risk in our “Red sweep” scenario will most likely be those related to offshore wind and clean hydrogen energy production credits. We expect the aggregate impact to be minimal in real terms in these cases, as only a negligible part of US clean energy production is driven by each subsector. Electric vehicle (EV) credits face greater risk in our “Red sweep” scenario due to former President Trump’s critical stance on EVs and the current challenges facing the industry, such as supply chain issues and market competition, which weaken their political appeal.

In our “Harris with split Congress” scenario, we similarly do not expect any additional policy support from the federal government in sectors related to clean tech, although action might continue at the margin with policies such as mandating electrification of federal fleets and decarbonization objectives in federal procurement. We also do not expect a Harris Administration to be more restrictive to the oil and gas sector than the current administration. We expect traditional energy companies to continue some of the policies announced already on methane reduction or carbon-capture-related innovation.

While from a fundamental perspective we see limited impact on renewables and fossil fuels in either election scenario, we expect some headline-related volatility as we get closer to November. Sectors related to themes like the Energy transition and Energy efficiency have experienced significant pullback since the 2021 peak, prior to the war in Ukraine and interest rate hiking cycle. Valuations stand today at a full standard deviation lower than the past five years, implying potential for long-term-oriented investors to reposition in the sector.

While the debate on sustainability unfolds at the federal level, much of the legislative activity has been at the state level in the past two years. As the conversation reached a fever pitch last year, most state legislatures adopted either pro- or anti-ESG legislation. According to Institutional Investor, this year there were 161 anti-ESG bills put forward as of June 2024 at the state level. Of those, only six passed.

The evolution of state-level activity matters to the ability and willingness of investors to adopt SI strategies. We anticipate the debate to intensify again if Harris is elected. We have seen two types of anti-ESG legislation put forward: 1) prohibitions for states to do business with specific entities that boycott industries like fossil fuels or guns, and 2) prohibition of state pension funds from considering sustainability-related factors in investments. The latter category most directly limits the growth potential of sustainable investing strategies and brings additional risks for asset managers focusing on these strategies. It is important to note that even these regulations have so far emphasized the importance of “pecuniary” factors, i.e., consideration of ESG or sustainability if considered financially material.

Conversely, multiple states have adopted pro-ESG stances in a backlash to the backlash, explicitly permitting or even encouraging the integration of sustainability-related factors in investment decisions. This divergence creates a patchwork of regulations that can be challenging for investors to navigate. The “anti-” and “pro-” ESG debate is actively fought at the state level, with a flurry of activity and copycat legislation.

Despite the headlines, the impact of anti-ESG regulations is less significant than it might appear. Over 70% of total assets from state pension plans are concentrated in 15 states, and most of these states have neutral to positive regulations regarding sustainability (Figure 4). Furthermore, more than 90% of US assets under management (AUM) belong to private investors and institutions, corporate retirement plans or federal retirement plans, which cannot be legislated at the state level. The combined value of state-level public pension plans was about USD 6tr in 2023, only about 10% of the USD 60.4tr in AUM.

Although the actual impact ought to be limited, we have seen a shift in terms of messaging from some US-based large asset managers over the last year. In other words, despite what should be a limited impact, we have seen the beginning of a “greenhushing” movement: the opposite of “greenwashing,” this is where managers (and corporates) understate the importance of sustainability in order to not enter controversies on the topic. It’s possible that this trend continues in the coming years, regardless of the outcome at the national election.

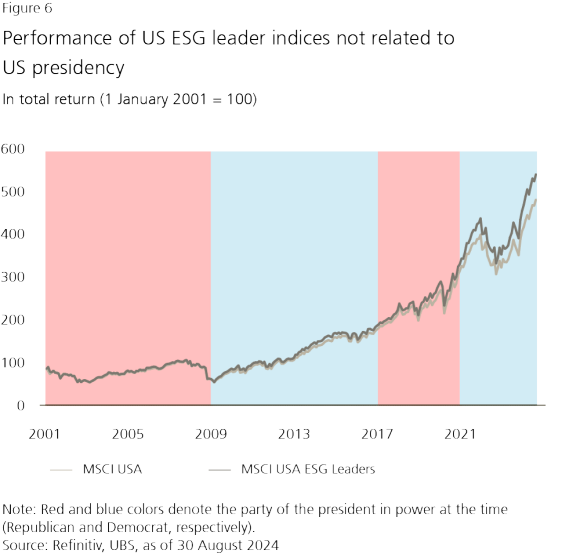

Performance of sustainable investing strategies historically has not hinged on the US presidency. Just like in other investment areas, we urge investors to stay invested and focused on their strategic investment views.

In sustainable investing, the macroeconomic environment remains a key performance driver, with thematic strategies particularly sensitive to interest rates and other developments. For example, despite limited policy support for renewables and cleantech during the Trump administration, the S&P Global Clean Energy index rallied more than 300% towards the end of Trump’s term, largely due to emergency interest rate cuts at the start of the COVID-19 pandemic. As ten-year yields increased in 2021 and 2022, pressure mounted on the index, which is heavily weighted towards growth stocks with a longer-term orientation, and continued as the rate-hiking cycle began in early 2022.

We observe a similar trend in ESG leaders’ strategies, where sector exposures typically do not deviate significantly from traditional strategies. As such, performance has been in line with the traditional benchmark under multiple administrations. ESG leaders’ strategies may display a small underweight of the energy sector, which we believe is positioned to benefit from a Trump presidency. This is offset by the small overweight of the financials sector, which also benefits in our “Red sweep” scenario.

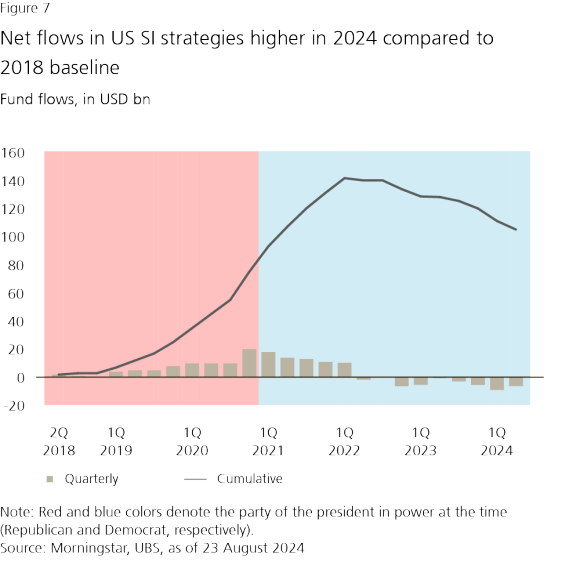

US SI strategies have seen outflows since 2022, however, overall net flows are still cumulatively up by USD 105bn since early 2018. Total US sustainable investing fund assets stood at USD 336bn at the end of Q2 this year, meaning cumulative outflows of USD 36bn since 2022 represent an outflow of approximately 10%.

Investments in renewable energy capacity have also been steadily increasing during the Biden administration, as they did when Trump was in office. In 2023, these reached USD 93bn, up from 47bn in 2016 (BNEF, 2024). This has financed a spike in new capacity, with wind generation up 87% in this period, and utility-scale solar up 356% (EIA, 2024). The annual growth rates were similar for both administrations, with a slight uptick during Trump’s four years in office versus Biden’s first three.

In discussing investor and corporate activity on sustainability topics, we would be remiss if we did not mention the adoption of diversity goals among listed US companies over time. US corporate diversity has also improved consistently during both the Trump and Biden administrations. The share of female directors across S&P 500 companies reached 32% in 2023 (up from 23% in 2018, in the middle of Trump’s term), and racial and ethnic makeup reached 25% (versus 20% in 2018), according to a recent report by The Conference Board.

On the development cooperation side, USAID’s budgetary resources (as stated in their annual financial reports) rose from USD 27bn in 2016 to nearly USD 52bn in 2023, reflecting the growth in funding needs and opportunities across emerging and frontier markets.

These examples illustrate a fundamental trend that has an economic and geopolitical foundation and is likely to be independent of election outcomes, as long as investors continue to see the potential for long-term financial returns and opportunities across sustainability and sustainable investments (regardless of whether they are explicitly referred to as “ESG” or not).

In addition to secular trends, it might be worth considering how the more polarized parts of the public respond. Under our “Red wave” scenario, we think it is possible that more private endowment and private foundation assets with a focus on environmental or social issues flow into SI strategies, at least near term, even in the case of reduced activity from state pension funds.

One way to illustrate this is to parallel investors’ potential reaction to some of the evolution in the philanthropy space, where private individuals and families have been largely driving capital flows. According to Giving USA, charitable giving has increased by nearly 30% since 2019, with corporate giving showing the highest growth rates, and individual donors contributing the largest total share. Anecdotally, according to various media reports, donations to Planned Parenthood and similar charitable organizations significantly increased in the early days of the Trump administration, and more recently after the overturn of Roe v. Wade.

Assumptions on both secular and emotional responses carry a degree of risk. Shorter-term market conditions—such as interest rates and inflation—will continue to impact sustainable investments just as they do conventional capital allocations regardless of fundamental trends. In addition, very drastic policy changes—such as complete repeal of IRA or removal of tax benefits for charitable contributions—might pose challenges to continued growth in sustainable investment and philanthropy flows.