Planning with Carried Interest

Strategic opportunities for wealth transfer and estate planning

![]()

header.search.error

Strategic opportunities for wealth transfer and estate planning

Managers of private equity funds, venture capital firms or hedge funds who own an interest in their fund’s future performance—known as carried interest—have a unique wealth transfer opportunity. But the structural and tax issues can be complex.

With the right advice—and careful planning—you can use carried interest to help transfer your wealth in a tax efficient way.

Carried interest: the fundamentals

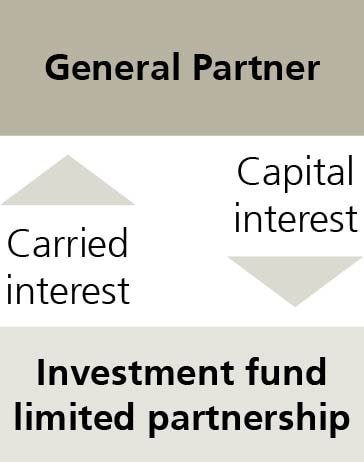

Carried interest is the economic interest a manager of an investment fund has in the fund. Most commonly, it is a 20% allocation of the fund’s profits to a manager or General Partner (GP) of the fund. Normally, this is in addition to the 2% management fee. Together, this is commonly referred to as the ‘two and twenty’ fee structure.

A GP will normally have two types of fund ownership: (1) a capital investment in the fund and (2) the carried interest, or a percentage share of the profits.

Strategic gifting using the vertical slice

Because there is uncertainty about a fund’s success or future performance, the initial fair market value of the carried interest will be low (or even very low) compared to its future potential value. For this reason, a popular strategy is to transfer part of the fund manager’s interest to family members, before a sizable increase in value.

Estate planning strategies using the vertical slice

There are a number of effective ways to transfer carried interest using the ‘vertical slice’ strategy for the benefit of the next generations. These can include the following:

Tread carefully, avoiding pitfalls

Because of the complexity of using carried interest in tax and estate planning, it is important to work closely with your team of advisors and estate planners to help navigate the complexities of the rules and tax laws surrounding carried interest. A few issues to bear in mind include:

To learn more about carried interest and how it may be part of your overall gifting and estate planning, download our publication Planning with carried interest or speak to a UBS Financial Advisor.