Net zero pathway: decarbonizing highly pollutive industries

Rising inflation has driven a sharp shift in investor preferences. Tangible cashflows are taking priority over future growth prospects – traditional value appears to be back in fashion.

Key highlights:

Key highlights:

- The efforts of climate solution providers, such as renewable energy companies, are critical to meet climate targets.

- To achieve net zero, highly pollutive legacy sectors must decarbonize, or transition.

- An investment approach in this area is inherently value investing, partially driven by years of sell-off due to climate concerns

Is there an intersect between climate and value investing?

Is there an intersect between climate and value investing?

The answer lies somewhere between yes and it depends. It depends because even if investors broadly agree on how to define value, there are multiple approaches to climate investing, each with their own merits. In systematic investing, tilts allow for the popular low-carbon approach to be combined with value if one is willing to overweight the financial sector. In active investing, low carbon alone is no longer seen as enough to define a meaningful climate strategy. Instead, many active investors focus on climate leaders and pure play solution providers. These companies are often referred to as ‘green darlings’ and while being popular investments, they rarely represent value.

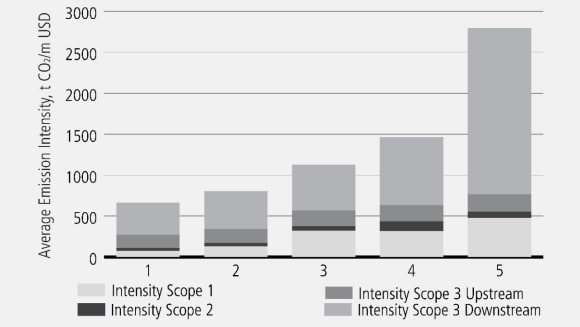

Chart 1 shows the positive relationship between value and emission intensity. In aggregate, higher value exposure comes at the cost of higher emission intensity. This is hardly surprising, the most pollutive sectors are all deep value, partially driven by years of sell-off due to climate concerns.

Chart 1: Emission intensity vs Fundamental value

The rise of climate transition investing

The rise of climate transition investing

The efforts of climate solution providers, such as renewable energy companies, are critical to meet climate targets. But they are only one piece of the puzzle. To achieve net zero, highly pollutive legacy sectors must decarbonize, or transition. Today, transition investing is by no means mainstream, but it is quickly gaining momentum. Here the focus is on the rate of change in emissions rather than the current level. Given that transitions are only relevant for companies with material emissions, transition investing is by construct inherently value investing.

Another related approach is to look for ’hidden assets’ in legacy businesses. Many companies have significant businesses in areas critical to combating climate change but are not widely perceived as climate solution providers. These businesses with ‘hidden solutions’ can often be purchased at far lower implied prices than what one sees for the pure play solution and low carbon businesses that are the core of many sustainable investment strategies. These companies are often growing their climate solutions business and using their legacy business cash flows as a cash cow to fund this transition journey.

Hybrid companies: is it a paper company or a renewable power producer?

Hybrid companies: is it a paper company or a renewable power producer?

Many pulp and paper companies produce biomass power with the residue and/or by-products from their pulp operations. Some of these companies have even added wind and solar power generation to take advantage of the stable, dispatchable nature of biomass power to create an integrated renewable power offering. These companies are generally more focused on their new energy operations than on the legacy pulp business which is low/no growth. Investing in these companies provides exposure to sustainable assets at a steep discount.

Furthermore, this type of investment is likely to offer a better financial return than buying an established renewables company. Hybrid companies are likely to:

- grow its renewables business to the point where it is perceived as a mainly “renewables” company at which may potentially lead to a higher valuation

- spin out its legacy paper business resulting in a higher valuation

- do some sort of creative M&A to arbitrage the valuation differential.

In all these cases, the investor may be in for superior financial return. We see similar ’hidden asset’ opportunities in other sectors.

Engagement is key to a meaningful transition strategy

Engagement is key to a meaningful transition strategy

Transitions can be divided into two categories:

- Decarbonization of existing business model

- Shift in business mix, from pollutive legacy to sustainable.

In both cases, effective investor engagement can drive an acceleration of companies’ climate efforts. For pollutive businesses, when we believe there is a potential net zero end-state, we consider the company a transition target. But engagement should focus on driving tangible actions now. Real business decisions could include allocating resources to abatement technologies and sustainable businesses.

When we think climate investing, let us stop neglecting the pollutive legacy industries that are key to reaching our shared climate goals. We believe effective engagement can turn transition investing into a deep green climate impact strategy.

Looking beyond the already green

Looking beyond the already green

Transition investing is by construct inherently value investing. In addition, sustainable investors looking beyond the already green can gain exposure to hidden climate solution assets at a discount. As these businesses evolve, we believe they will be recategorized as green and earn higher valuations.

A credible transitions strategy must include effective engagement. That is what makes it not only a value strategy, but an investment approach tackling climate change in a meaningful way. We expect the net zero race to accelerate and become the key performance differentiator in emission-intense sectors. Engagement accelerating decarbonization is doing good for the climate but is also likely to drive investment returns. A winning double bottom line approach.

PDF

Mid-year outlook 2022

Mid-year outlook 2022

With inflation reaching multi-decade highs in many parts of the world, how can investors position their portfolios for this changing investment landscape?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

About the authors

Adam Gustafsson

Investment Data Scientist

Adam is a member of UBS-AM's data science team, specializing in data-driven fundamental and sustainable investment research. Publisher of "The Value of a Green Transition" whitepaper in 2021, leading to the new Climate Action strategy as deputy PM. Fellow at UBS's Sustainability and Impact Institute, providing thought leadership on sustainability. Adam joined UBS in 2020, previously working at Credit Suisse in equity research (HOLT) and as a quantitative analyst in London and New York, developing pricing and risk models.

Ellis Eckland

Portfolio Manager Climate Action

Ellis Eckland, lead portfolio manager for UBS Climate Action and UBS Future Energy Leaders strategies. Also a Senior Investment Analyst on UBS AM's Global Equity team, focusing on renewable energy, materials, and conventional energy sectors. Ellis joined UBS AM in 2010. Former Chairman and CIO of Eckland Capital Management. Previous roles at Frontpoint Partners and Putnam Investments as energy and materials analyst. Former US Naval Intelligence Officer awarded Joint Service Commendation Medal.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.