AI and datacenters: A new source of electricity demand

AI and datacenters are driving a surge in US electricity demand, creating new investment opportunities in the energy sector.

![]()

header.search.error

AI and datacenters are driving a surge in US electricity demand, creating new investment opportunities in the energy sector.

Key points

After years of subdued growth in electricity demand in the US, where power demand significantly decoupled from economic development,1,2 the consumption of electricity by data centers and artificial intelligence (AI) electricity use are set to revive electricity demand growth.

The rise of datacenter energy use

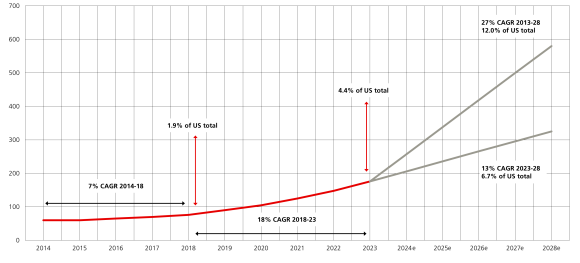

According to a recent study by the US Department of Energy (DOE) and Lawrence Berkely National Lab,3,4 US datacenter energy use was roughly stable between 2014 and 2016. However, it started to pick up between 2018 and 2023 due to strong growth in server installations and increased usage of graphic processing units (GPUs). US datacenter demand grew from consuming 76TWh5 or 1.9% of US total annual electricity consumption in 2018 to 176TWh or 4.4% of US electricity demand in 2023.

DOE scenarios, capturing a range of future equipment shipments, operational practices and energy cooling technologies, project a high and low estimate of 325TWh and 580TWh for 2028 power demand in datacenters, equivalent to 6.7%–12% of total projected US electricity consumption in 2028. This corresponds to a compound growth rate of 13%–27% per annum.

Total US datacenter electricity consumption 2014-2028e, TWh

AI enthusiasm and capital expenditure

The surge in AI development has led to an acceleration in datacenter capital expenditures since the introduction of ChatGPT in late 2022.6 Recent announcements7,8 by large-tech companies (hyperscalers) to ramp up spending on datacenter construction, along with AI initiatives deployed by the Trump administration9, indicate strong future spending.

The historical fleet of datacenters consists mainly of smaller ones, with electricity demand in the order of 5–10 MegaWatts (MWs).10 However, the increasingly common large datacenters that are currently being built will have power demands of 100MW or more – the annual electricity consumption equivalent to powering 10,000 households.

Technological developments and energy efficiency

AI learning (or “training”) requires a lot of computation power, especially with specialized hardware like GPUs, and therefore it uses more electricity than AI use (or “inference”). Training an AI model often results in a one-time spike in energy consumption. As AI models become more widespread and advanced, the number of inference queries will increase, leading to higher ongoing energy consumption.

Ongoing technological development and innovation, efficiency gains in both hardware (chips, power management, datacenter architecture, cooling systems etc.) and software (model training and inference) will continue to lower electricity consumption per unit of AI output. Still, despite better technology and the advent of more energy-efficient AI models characterized by lower training cost and strong performance, such as recently launched Chinese-developed open source large-language-model (LLM) DeepSeek11, datacenter buildout and energy consumption growth are not likely to abate anytime soon.

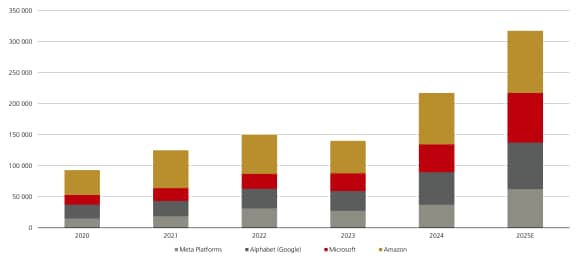

Spending on AI is likely to continue to grow, as illustrated by the capital expenditure budget announcements of the US hyperscalers: management guidance indicates that combined spending by Meta Platforms, Microsoft, Amazon and Alphabet (Google) will rise from under USD 140 billion in 2023 to over USD 300 billion in 2025.12

Big Tech CAPEX (USD millions)

While improvements in energy efficiency during AI training might reduce the power needed for model development, the increasing adoption of AI is likely to counteract this: more computing power will be required to run a growing number of models on a wider variety of inference tasks, which may or may not be energy efficient or energy intensive.13

Investment opportunities in datacenters and AI

As the number and size of datacenters continue to grow, their electricity consumption is expected to rise significantly, Datacenter operators are increasingly seeking clean and reliable electricity sources. In 2024, several interesting deals were signed between hyperscalers and providers of 24/7 low-carbon energy, particularly nuclear energy. 14,15,16

From an investor perspective, there are many angles to approach benefiting from the proliferation of datacenters and AI. In the early innings, these are mostly concentrated in hardware: think of GPU chip manufacturers, cooling technology companies, power management and equipment providers in the datacenter itself, but also think of companies involved in powering datacenters, such as electricity generation, storage and transmission companies. The spending arms race on data centers will not be just a US phenomenon – there is global appetite for increased AI development and usage.

CFA, Senior portfolio manager, Thematic Equities

Dirk Hoozemans (MA, CFA, ESG CFA), Director, is Lead Portfolio Manager of the Energy Evolution strategy. In 2022, he joined Credit Suisse Asset Management, now part of UBS Group, from Triodos Investment Management, where he was fund manager of a global small- and mid-cap-focused thematic impact strategy and responsible for outlining a new impact-driven investment process, including ESG integration and active ownership policies. Prior to that, Dirk held various portfolio management positions at Robeco Asset Management, including portfolio manager of a global energy strategy. Dirk holds a master’s degree in Econometrics from Tilburg University, The Netherlands, is a CFA charterholder, and has obtained the CFA Institute Certificate in ESG Investing.