Venture capital landscape

A closer look at key innovation hubs, Swiss Valley and Silicon Canals

![]()

header.search.error

A closer look at key innovation hubs, Swiss Valley and Silicon Canals

Introduction

Venture capital (VC) has emerged as a critical driving force in fostering innovation and economic growth worldwide. While the US has long been viewed as the epicenter of VC, Europe is rapidly developing its own ecosystems that are transforming approaches to financing, innovation, and entrepreneurship. With the rise of initiative-rich regions like ‘Swiss Valley’ and ‘Silicon Canals’, coupled with increasing investments and the strategic positioning of leading healthcare and life sciences companies, Europe is carving its niche in the broader VC landscape.

According to the latest Preqin data from October 2024, the total ‘dry powder’ ‒ or capital raised but not yet invested ‒ in venture funds has skyrocketed to approximately USD 555.6 billion, with Europe holding USD 47.2 billion of it (see Figure 1). The chart showcases the dry powder available across different regions:

As we explore these thriving hubs, we will examine how they have cultivated an attractive environment for startups and consider the role of major players in the healthcare sector, particularly in Switzerland, while also reflecting on the dynamics of these ecosystems.

Swiss Valley: a biotechnology powerhouse

Nestled between Zurich, Basel, and Lausanne, ‘Swiss Valley’ is a dynamic stretch that encompasses some of the most significant research and development institutions in Europe. At the heart of this innovation ecosystem is ETH Zurich, one of the most prestigious technical universities worldwide, well-known for its engineering and life sciences programs. The university fosters a robust entrepreneurial spirit, offering support to startups through dedicated incubators and mentoring programs.

Further downstream, Basel houses industry giants such as Novartis and Roche. These multinational pharmaceutical companies are not just significant players in the global market; they also play an integral role in the Swiss venture capital landscape by acquiring small, innovative biotech firms. These acquisitions allow major players to absorb advancements in technology and research, fueling their growth and extending their pipeline of innovative products.

The healthcare and life sciences sectors hold a unique position in Switzerland's innovation ecosystem. Key regional clusters include the BioValley in Basel, the Bio-Technopark Zurich and the Biopôle in Lausanne, each fostering biotech research in their own domain. With an increasing demand for innovative healthcare solutions, Switzerland has become a magnet for startups focused on life sciences, medical devices, and pharmaceuticals. According to the 2024 Swiss Venture Capital Report, Swiss biotech companies received VC investment to the tune of CHF 488 million in 2023 alone, a twenty percent year-on-year growth compared to 2022. Established firms, including Johnson & Johnson and Novo Nordisk, strategically acquire emerging companies to access groundbreaking research and expedite their product development cycles. Recent success stories, including NBE-Therapeutics (acquired for EUR 1.18 billion by Boehringer Ingelheim) or VectivBio (acquired for USD 1 billon by Ironwood Pharmaceuticals), are testimony to a robust exit environment.

Investments in Switzerland's startup scene have been bolstered by tax incentives and favorable regulations, encouraging private equity firms and institutional investors to funnel their ‘dry powder’ into promising ventures. Startups are increasingly focused on developing tools for personalized medicine, AI-driven diagnostics, and novel therapies, indicating a strategic shift towards cutting-edge solutions that respond to global healthcare challenges.

The rise of silicon canals in Amsterdam

Amsterdam is rapidly defining its identity as a leading European innovation hub. Dubbed ‘Silicon Canals’, this vibrant tech landscape is characterized by its diverse startup ecosystem powered by seasoned entrepreneurs and an influx of talent, supported by a collaborative environment that fosters networking and knowledge-sharing.

The University of Amsterdam and Amsterdam University of Applied Sciences are vital contributors to this ecosystem, producing a steady stream of talented graduates in technology and business. From fintech companies to green tech startups, the city's entrepreneurs are increasingly focused on addressing pressing global issues, such as sustainability and urbanization.

Key initiatives by the Dutch government, coupled with the efforts of private incubators and accelerators, have provided startups access to vital resources. Programs like StartupAmsterdam and various accelerators have contributed to the thriving environment, making it easier for entrepreneurs to collaborate with venture capitalists and industry veterans. Notably, the presence of numerous co-working spaces and incubators fosters a culture of innovation and collective growth.

The Amsterdam region is home to several VC firms that have been allocating increasingly larger portions of their dry powder to local startups. In 2023 alone, North American investments in European technology reached an all-time high, demonstrating the growing allure of European markets for global investors. This influx of capital and the availability of talent are critical components driving Amsterdam's emergence as a significant VC hub.

According to Dealroom, Amsterdam now counts 12 companies valued over USD 1 billion, since the early Booking.com success story: almost one per year on average, but almost two every year since 2019. Recent Dutch unicorn success stories include Adyen, Elastic, Takeaway.com, Mollie and WeTransfer.

Sweden's growing innovation landscape

Sweden has established itself as another key player in the VC arena, with a burgeoning ecosystem of startups and incubators. The country boasts a rich tradition of innovation, spurred by its strong education system and extensive research institutions such as the Karolinska Institute and KTH Royal Institute of Technology. The Wharton School of Business called Sweden a “unicorn factory” in a 2015 study and one year later TechCrunch dubbed Sweden the “tech superstar from the north.”

Swedish VC has increasingly flowed into promising startups, particularly those focused on technology, sustainability, and healthcare. Initiatives like STING (Stockholm Innovation & Growth) and Startup Sweden serve as incubators, providing support, mentorship, and funding for nascent companies. These programs play a crucial role in connecting entrepreneurs with venture capitalists and experienced industry mentors, laying the foundation for sustainable growth.

In 2018, Sweden saw two of its major tech success stories come to full fruition with Spotify’s USD 27 billion IPO and iZettle’s acquisition for USD 2.2 billion by PayPal. As for many other European innovation clusters, major exit outcomes like this can help to attract more capital into the region and inspire the next generation of founders.

The Swedish startup ethos is significantly influenced by a strong commitment to sustainability, which leads to a diverse array of innovative projects aimed at addressing climate change and fostering sustainable development. With an increasing emphasis on environmental, social, and governance (ESG) criteria, venture capitalists are incentivized to prioritize investments in companies that align with sustainable practices. This trend reflects a broader evolution in the VC landscape, where climate tech is not just a niche but a critical focus area for many investors.

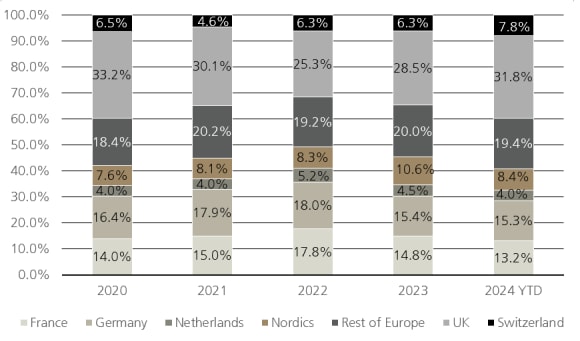

To enhance our understanding of the VC dynamics within Europe, we can analyze the number of deals and aggregate deal values across major European countries for early and late-stage VC investments (see Figures 2 and 3). The charts display the breakdown by country and vintage year for both the number of deals and aggregate deal values.

Analyzing the data offers valuable insights into the VC landscape in Europe:

The competitive landscape of European VC

As of October 2024, European VC funds boast a total dry powder of approximately USD 47.2 billion (see Figure 1). These capital reserves are pivotal for the growth of startups, especially when market conditions tighten or economic uncertainties loom.

A significant observation in the current funding environment is the disparity in investment levels between regions. North America leads with a staggering USD 250.2 billion, while Asia follows closely with USD 235.5 billion. Comparatively, Europe, with USD 47.2 billion, may seem smaller but represents a burgeoning opportunity particularly with the backing of government initiatives and a commitment from institutional investors to diversify their portfolios.

Over the past few years, European VC has seen considerable growth, particularly in sectors such as technology, healthcare, and fintech. This growth has been supported by both local and foreign investments, suggesting that European VC firms are likely to prioritize high-potential startups, creating a positive feedback loop of funding innovation.

Leading VC firms across Europe have significantly influenced the direction of investments. Firms such as Balderton Capital, Index Ventures, and Northzone have established themselves as pivotal players, focusing on a wide array of technology-driven startups across various sectors.

Additionally, family offices and sovereign wealth funds have begun to actively participate in the European VCscene, offering a new pool of capital to startups. This diversification of investor profiles contributes to a vibrant environment where innovation can thrive.

Despite the promising growth, European VC faces several challenges. As more funds enter the market, competition for the best investment opportunities intensifies. Startups often encounter difficulties in securing financing, particularly when competing against well-established firms with longer track records and better access to capital.

Moreover, ongoing geopolitical tensions and economic uncertainties can affect investor sentiment, potentially leading to fluctuations in funding availability. Startups may need to pivot quickly or exhibit greater adaptability to maintain investor confidence.

Nevertheless, there are ample opportunities for growth within Europe. Markets in Central and Eastern Europe are beginning to reveal their potential as emerging startup ecosystems, offering a unique blend of innovation and lower competition. VC firms that strategically tap into these emerging markets could uncover new avenues for investment and growth.

Furthermore, partnerships with academic institutions and industry leaders can facilitate collaborations that foster startup growth. By bridging the gap between research and commercialization, stakeholders can expedite the development of innovative solutions that meet market demands.

The healthcare and life sciences sectors continue to be focal points for VC investments. The COVID-19 pandemic underscored the need for rapid innovation in healthcare, and this demand is unlikely to dissipate. Startups that focus on telehealth, biotechnology, AI in healthcare, and digital health solutions are poised for significant growth, and venture capitalists are taking note.

Switzerland's strong legacy in life sciences, coupled with the EU's increasing emphasis on healthcare innovation, ensures that opportunities abound for investors willing to support promising healthcare ventures that demonstrate innovative approaches to disease management and patient care. The emphasis on preventative care, personalized medicine, and the integration of technology in health management presents a multitude of avenues for investment and growth in this sector.

Emerging trends in European venture capital

Health tech and biotech sectors within European VC continue to experience robust growth. The COVID-19 pandemic accelerated digital adoption in healthcare, giving rise to numerous startups specializing in telemedicine, health data analytics, and remote patient monitoring. Investments in these areas are expected to increase as healthcare systems and patients recognize the long-term benefits of innovation and technology in improving health outcomes.

Biotech is thriving, particularly in ‘Swiss Valley’, where collaboration between universities, research institutions, and industry leaders facilitates the rapid translation of laboratory findings into marketable solutions. Startups developing new therapies, vaccines, and CRISPR-based technologies are attracting significant attention from investors looking to fund the next breakthrough in medical science, reinforcing Switzerland's position at the forefront of biopharmaceutical innovation.

In a recent discussion with Peter Pilavachi, a GP of the PA MedTech VC fund1 Peter described some of the advantages Switzerland enjoys and the challenges faced by European companies in this sector:

“Switzerland’s success is built on its world-class education system and its ability to coordinate essential resources ‒ start-up infrastructure, financing, and, crucially, a business-friendly fiscal and regulatory environment. Switzerland excels in the pharmaceutical sector, whereas the US maintains a clear edge in MedTech, led by major strategics such as Johnson & Johnson, Medtronic, and Boston Scientific.

Most of Europe lags behind the US in key areas of this technology race and obtaining regulatory approval in the EU is slower, with many European MedTech companies prioritizing FDA approval over CE mark certification. The FDA’s approach is business-friendly and in general the US is more entrepreneurial, with better access to financing and has a more favorable tax environment. Entrepreneurs, being highly mobile, often relocate to jurisdictions with better incentives, contributing to brain drain in some European countries.“

With Europe grappling with climate change, there has been a massive push toward sustainability and climate tech investments. The European Union has set ambitious targets for reducing greenhouse gas emissions, which has incentivized startup creation in areas such as renewable energy, waste management, and carbon capture technologies. Venture capitalists are increasingly focusing on companies that not only generate strong financial returns but also contribute positively to addressing climate issues.

Startups like Oatly in Sweden, which focuses on sustainable food alternatives, have gained traction and demonstrated the potential for VC investments to drive meaningful change. As consumers demand more sustainable products, VC firms are integrating ESG criteria into their investment strategies, fostering a new wave of innovation that tackles climate challenges while delivering financial returns.

Final thoughts

As Europe cultivates its VC landscape, regions such as ‘Swiss Valley’, ‘Silicon Canals’, and Sweden's burgeoning ecosystem represent the convergence of academia, industry, and entrepreneurship. While competition and market saturation pose challenges, the vast potential for innovation and growth in healthcare, technology, and sustainability presents untapped opportunities for investors.

The dynamic interplay between established pharmaceutical giants absorbing smaller innovators and burgeoning startups creating disruptive technologies paints an exciting picture of the future of VC in Europe. As institutional investors, private equity specialists, and finance professionals continue to explore Europe, they will find lively hubs rich with potential and a community eager to drive the continent's next wave of innovation.

The right investments can position Europe as an important player in advancing innovation and sustainable growth. The time is ripe for investment in a future defined by creativity, collaboration, and transformative breakthroughs.

The journey ahead will require stakeholders to secure a balance between nurturing nascent startups and maintaining an agile, competitive posture. By acknowledging the inherent challenges and embracing the multitude of opportunities outlined, investors and entrepreneurs alike can harness the collective power of these innovation hubs to foster a new era of venture capital that promises profound societal impact and sustained economic advancement.

As Europe pushes forward, its commitment to innovation, sustainability, and collaboration will be crucial in shaping the trajectory of its VC landscape, ensuring that it remains a fertile ground for up venture firms.