Day to day

Saving money day to day: the best tips

How to save money on a regular basis so you can fulfill big and small wishes.

![]()

header.search.error

Day to day

How to save money on a regular basis so you can fulfill big and small wishes.

Saving money on a regular basis can be a challenge. We show you how to spend less in everyday life and systematically save money. This will put you in a good financial position today and tomorrow.

There are various adjustments you can make in everyday life so a certain amount comes together quickly each month, which you can consistently set aside.

Your fixed costs are a good place to start. You don’t have any influence over your rent, but there is often potential to save money on subscriptions and insurance.

Check your daily utilities consumption:

A major item in every budget is shopping, from regular household purchases to more expensive items. How to save when shopping:

Save money when paying? It’s easier than you think.

Now you know how to save money in everyday life, your expenses will reduce. This means you’ll have more money left over, which you can set aside every month. This is your savings amount.

Tip: Set up standing orders so that the amounts saved are transferred to a separate account immediately after the salary is credited. If your situation changes, simply adjust the standing order again.

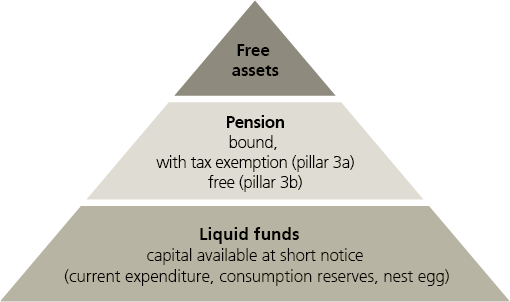

But how and where is it best to save? Ideally, you approach this question in three steps.

1. Ensure liquidity: for peace of mind

First, you need to have enough money that you can access at any time. This means the balance in your account that you can access whenever you need to. You use this money to finance your living expenses and unforeseen expenses.

Goal: to build a reserve. You should have at least three months of expenses set aside.

2. Save for retirement: for a good life in old age

Do you have enough cash on hand? Next, dedicate yourself to saving for your retirement. This is the way to ensure a good standard of living in old age and remain independent in the long term. By saving privately for retirement you’ll also save on taxes.

Goal: to pay the annual maximum amount (CHF 7,258 for employees with a pension fund; as of 2026) into pillar 3a. This is how you lay the foundation for long-term financial security.

3. Save any spare cash: for long-term financial independence

Any money left over can be saved and invested. For more significant goals and dreams as well as a higher standard of living in old age.

Goal: a specific amount or simply as much as possible. Build wealth step by step. This way you will also achieve your long-term goals and take your future into your own hands.

With the savings pyramid in mind, you now set specific short-, medium-, and long-term goals.

Short-term goals: one to five years

These are wishes and needs that you want to fulfill in the near future such as a new laptop, a high-end bike, a vacation or a training course. Since you will need to access the money again soon, it is best to put it in a traditional savings account.

Medium-term goals: five to ten years

Typical medium-term goals include a new car, more extensive education or training or starting a family. Depending on how long you can leave the money untouched, different solutions are recommended, such as a fund account.

Long-term goals: ten years and more

There are also wishes and dreams that lie one or more decades ahead, such as buying property, children’s education, retirement planning or passing on wealth. If you want to save successfully in the long term, you should consider investing the money.

Either way, the most important thing about saving is simply to get started. The sooner you begin, the more time you have to build wealth strategically, which is the foundation for a successful future.

Don’t hesitate to seek support to set and tackle your savings goals. Our experts will be happy to advise you.