Highlights

Highlights

- US exceptionalism should continue into 2025, with Trump’s ‘America First’ policies likely to support US equities via deregulation and tax cuts while disproportionately weakening ex-US equities via tariff uncertainty.

- But relative valuations already reflect much of this divergence, so it is worth keeping an open mind on what could challenge the prevailing consensus of US outperformance.

- US equities could underperform if the US’s growth advantage narrows, Trump becomes more hesitant on tariffs due to inflation concerns, or the AI theme loses luster.

- While we are overweight US equities and the USD into 2025, we will be keeping a close eye on these dynamics and be ready to adjust if catalysts for a reversal in US exceptionalism emerge.

2024 has been yet another year of US exceptionalism – US economic growth repeatedly surprised to the upside and beat out other advanced economies, US stocks have soundly outperformed ex-US equities, and the US dollar is up. But this price action just continued a trend that has extended for nearly 15 years.

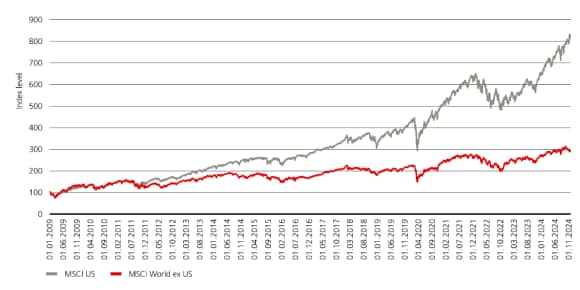

Since the stock market bottomed post-GFC in March 2009, MSCI USA has outperformed MSCI ex USA by 4.5% annually in USD terms. This US outperformance reflects several favorable drivers including faster nominal GDP and earnings growth, larger margin expansion and a rise in valuations. A comparatively favorable business environment, fiscal stimulus and critically, dominance in megacap tech underpin these trends.

Exhibit 1: Total Returns MSCI USA vs MSCI World ex USA

With this historical track record, it is hard to bet against the US. And incoming President Trump’s ‘America First’ policies should support US equities via tax cuts and deregulation, while disproportionately undermining ex-US companies vulnerable to tariff uncertainty.

The US economy continues to hum along, with positive real wage growth and solid productivity, while Europe and China suffer from weak consumer confidence and a stall in global manufacturing. Moreover, there is little to suggest the artificial intelligence (AI) theme is set to stumble, which disproportionately accrues to US tech companies and should improve productivity for US companies across a variety of industries. We have been overweight US equities through the bulk of 2024 and plan to carry this position into 2025.

There is only one problem: valuations. The S&P 500 12M forward P/E is above the 90th percentile going into 2025, and the US’ valuation challenge is no longer just about megacap tech – US stocks excluding the ‘Magnificent Seven’ have also reached the 90th percentile. Valuation is a not a timing tool and has low explanatory power for performance under a year. But over longer time frames it matters and mean reversion, in response to a worthy set of catalysts, can begin at any time.

Given extreme relative valuations and a strong consensus for US outperformance next year, it is worth exploring ways in which markets could surprise so that we are ready to adjust when the facts change.

Exhibit 2: Equity market valuations

12-month forward P/E ratio in the last 25 years

What could disrupt US exceptionalism?

What could disrupt US exceptionalism?

(i) Narrowing growth differentials

US growth has repeatedly surprised to the upside thanks to fiscal policy and resilient household spending. But fiscal support will fade next year (potential incremental tax cuts won’t take effect until 2026), and slower immigration may weigh on aggregate incomes and spending. In contrast to the US, European growth has already been weak; allowing for more aggressive European Central Bank cuts, which should help housing and give European consumers the needed confidence to start spending their savings. From a market expectations standpoint, US growth has gone through a sequence of upgrades this year and has a higher bar to keep beating, while the rest of the world faces a low bar for improvement.

A convergence in growth between the US and rest of the world would be given a boost if major economies, namely Germany and China, adopt more expansionary fiscal policy. In the case of Germany, the snap Federal election on February 23rd has the capacity to bring about fresh thinking on fiscal policy. For China, we think fiscal expansion has capacity to increase. It is possible Chinese policy makers have left themselves room to act in the scenario of a growth dampening trade-war.

It is worth remembering that in Trump’s first year as President in 2017, emerging markets soundly beat US stocks and the USD depreciated – surprising most investors. This can be largely attributed to China’s stimulus driving global manufacturing, making the US less exceptional. Of course, the US-China trade war began the year after, reversing this theme.

Note, we still think outright growth in the US will outperform, and the risks are skewed to the downside for the rest of the world versus the US, but given starting points and expectations, there is a risk growth converges more quickly than we expect.

(ii) Trump 2.0 is not Trump 1.0

In President-elect Trump’s first term he had a clear mandate to boost nominal GDP growth. Inflation was of little concern, deficits and debt to GDP were much lower and 10-year yields were at 2%. In contrast to 2016, one of the reasons, if not the key reason, Trump was elected this year was unhappiness with inflation.

Trump’s mandate is different this time – while tariffs and tax cuts are campaign pledges that will likely be delivered, voters would presumably be unhappy with policies that drive the prices of goods up too much or make housing even less affordable via higher mortgage rates. These political realities may act as constraints on Trump’s tariff and fiscal plans. Despite the threats, he may end up delivering much less on the tariff front which should ease risk premia on non-US equities and currencies. He may also need to dial back corporate tax and stimulus plans to ensure US yields and mortgage rates do not rise too sharply.

(iii) Sector concentration

US exceptionalism has been driven in large part by dominance in the technology sector. The Magnificent Seven now represent nearly one-third of US market cap, a striking degree of concentration. The current level of valuations reflects high earnings and sales expectations, which increase the bar for surprises. In recent quarters, the magnitude of tech sector earnings surprises has started to decline from very elevated levels. Valuations could be challenged if this trend extends.

Over the last two years, large tech companies have dramatically stepped up capital expenditure to develop AI infrastructure. But there is a lot of uncertainty on when and by how much these companies will be able to monetize on this capex in earnest. Investors may start losing patience if there is delayed adoption of AI capabilities.

Moreover, current AI champions benefit from low competition which underpins elevated profit margins. But this environment is unlikely to last forever, especially if the government presses forward with antitrust actions. While we think the US government is focused on the US winning the AI race and won’t do too much to undermine its tech champions, the sheer concentration of these companies makes any risk to their outlook worth monitoring.

Asset allocation

Asset allocation

In our view, the anticipation of Trump’s pro-growth policies can continue to support US equities into 2025. Moreover, tariff uncertainty is likely to limit the ability for ex-US equities to outperform. We remain overweight US large cap market weight, equal weight and small cap indexes versus Europe. We are also long the USD versus EUR and CNH.

That said, we are conscious that US exceptionalism can get too stretched, leaving markets vulnerable to even minor changes in the narrative. As discussed above, we are monitoring relative growth differentials, Trump’s actual fiscal and tariff policies, and any questioning of the AI narrative.

On growth specifically, there is potential for US economic data to moderate organically into 2025. Many Fed rate cuts having been priced out, and we have begun adding duration in portfolios as the risk-reward has improved. Gold also is an effective portfolio diversifier to fiscal largesse, geopolitical risk or issues with Fed credibility.

Asset class views

Asset class views

Asset Class | Asset Class | Overall / relative signal | Overall / relative signal | UBS Asset Management's viewpoint | UBS Asset Management's viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Constructive macro and earnings backdrop means more upside despite elevated valuations. Positive seasonality combined with positioning that is not yet stretched, is supportive of a year-end rally. |

Asset Class | US | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Relatively strong earnings profile and less manufacturing sensitive than global equities. |

Asset Class | Europe | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Disappointing economic and earnings data. Ongoing challenges in manufacturing is a weight. |

Asset Class | Japan | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Ongoing corporate reform, solid earnings countered by renewed JPY strength. |

Asset Class | Emerging Markets | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | While constructive earnings and China’s policy pivot will provide support, tariffs risks and USD strength undermine the case for EM. |

Asset Class | Global Government Bonds | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Valuations have improved, increasing the attractiveness of duration. Our positioning is modest as we wait for further policy details out of the US or higher yields to take a larger positions. |

Asset Class | US Treasuries | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Attractive valuations already discounting some fiscal risk in our eyes; expect inflation to moderate further. |

Asset Class | Bunds | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Persistently weak growth and slowing inflation suggest market could revise lower estimate of neutral rate. |

Asset Class | Gilts | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Large budget deficit with more near-term fiscal spending offsets cheap valuations. |

Asset Class | JGBs | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Wages & underlying inflation accelerating while market is pricing in too accommodative central bank policy. |

Asset Class | Swiss | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Valuations are historically-expensive; substantial further easing priced into the SNB. |

Asset Class | Global credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | The risk-reward outlook for credit is not particularly attractive, especially in the US, where spreads are at the tightest levels since immediately before the GFC. EUR and Asia HY still offer the best carry opportunities. |

Asset Class | Investment Grade Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Investors keep looking for income opportunities in credit. Expect returns to be driven by carry. |

Asset Class | High Yield Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | US HY spreads dropped to their lowest level since 2007. Relatively good credit quality vs. history and the generally supportive macro backdrop justify tight spreads, but compensation for downside risks is very modest. HY bonds in Europe and Asia offer more attractive valuations and risk-adjusted carry. |

Asset Class | EMD Hard Currency | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Many distressed EM issuers managed a restructuring and important reforms in 2024 clearing the way for lower default risk ahead. Spreads are somewhat less tight than across DM but rising US yields and / or a strong USD are risks. |

Asset Class | FX | Overall / relative signal | - | UBS Asset Management's viewpoint | - |

Asset Class | USD | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | US exceptionalism and increased tariff risks should support the USD vs. both low and high-yielders. |

Asset Class | EUR | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Relative growth and rate differentials point to a weaker EUR, and weakness may accelerate from tariffs. |

Asset Class | JPY | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | We expect the Bank of Japan to hike rates more aggressively than markets are pricing in. |

Asset Class | CHF | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Increased dovishness from the SNB and an expensive valuation should weigh on CHF vs. USD and JPY. |

Asset Class | EM FX | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Overweight BRL and ZAR on carry, underweight CNH and AXJ on tariff risk.. |

Asset Class | Commodities | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Gold remains an interesting diversifier with structural support. Oil is in a tug-of-war between rising supply and geopolitical risk. |