Views from Collis Boyce, Portfolio Manager at HBK Capital Management; Lauren Cummings, Managing Director at Hellman & Friedman, Tad Freese, Managing Partner at Latham & Watkins. Moderated by Gregor Feige, Co-Head of Americas Equity Capital Markets (ECM) and Head of Global Technology, Media and Telecommunications (TMT) ECM at UBS.

The last few years have seen a dip in IPO activity, with companies choosing to remain private for longer as they ride out the market uncertainty. What is causing these shifting tides in the tech sector and when will IPO markets normalize?

UBS hosted a panel of industry experts at the Private Software and Internet Conference to discuss the IPO market and how private companies and investors can navigate these complexities.

The IPO market: an evolving landscape

The IPO market: an evolving landscape

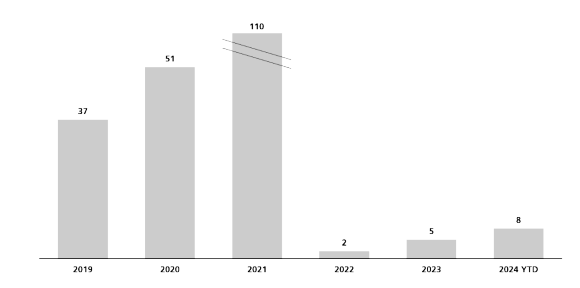

The panelists reflected on the slowdown in the IPO market citing significantly lower deal flow since the peak of 110 TMT IPOs completed in 2021. Although volume has increased in comparison to 2022-23, there has been just eight TMT IPOs so far this year.

Collis Boyce, Portfolio Manager at HBK Capital Management, explained the impact on IPOs from the changing market dynamics over the last few years. “This has caused a disconnect between the value that investors are willing to pay and the value that companies are willing to transact at, with companies choosing to wait for a higher multiple.” But the IPO pipeline isn’t going away, he continued “at some point companies will need more capital and there will be a more thoughtful conversation to be had on the right price.”

Given this backdrop, private companies are increasingly considering a dual or tri-track approach. By simultaneously keeping several options open — to stay private for longer through M&A or raising private capital; selling themselves; or going public via an IPO — they have more latitude to choose when, and if, to go public.

US TMT IPO’s From 2019 - 2024

Preparing for IPO success

Preparing for IPO success

A successful IPO takes careful planning, patience and sage advice.

Given the current market challenges, to help drum up interest with investors the panelists outlined a recent trend of ‘testing the waters’ more frequently than before – an approach where companies meet with investors pre-IPO. “We’ve seen this pre-IPO engagement become more commonplace, it is helpful to get investor feedback before companies open themselves up to capital markets,” noted Tad Freese, Managing Partner at Latham & Watkins. Events such as the UBS Private Software and Internet Conference, provide a space for investors and Bankers to interact with company management to understand their business vision and growth projections, often several years prior to a potential IPO.

Alongside these events, Gregor Feige, Co-Head of Americas ECM and Head of Global TMT ECM at UBS, observed that companies are adopting more creative ways to engage with investors. From arranging factory tours to podcast interviews with company management or hosting analyst days alongside their annual customer conferences, there are myriad of new tactics to consider.

Going public takes several years of preparation. Business readiness, having the right team and a fully formed finance organization are some of the key building blocks that need to be in place.

The profitability versus growth tradeoff

The profitability versus growth tradeoff

When companies are considering an IPO there are many competing factors driving investor demand, from potential market cap, to revenue growth and profitability. But which metric matters most and where does the line of demarcation lie to move ahead with an IPO?

As for the optimal company size, Collis Boyce contended that it’s not always necessary to have more than USD 400-500 million in revenue to go public. If you are a USD 150-200 million revenue company, with unit economics that work and with a clear path to profitability there will still be demand, particularly with small and mid-cap hedge funds, he added.

With rising interest rates and slower economic growth, Gregor Fiege noted that there is a more balanced approach to growth and profitability for companies looking to IPO. It is no longer growth at all-costs, the focus has shifted towards strong growth balanced with profitability or proportional cash burn.

Lauren Cummings agreed that “investors will still want to see growth in the next few years but with a reasonable sight to profitability”. It is essential that companies have the metrics, data and rationale for how they are going to become profitable overtime, she explained.

Pre-IPO strategies

Pre-IPO strategies

With companies increasingly engaging in pre-IPO crossover rounds, which transition primary and secondary offerings to institutional investors, the panelists believe this will help build the discipline of being a public company and relieve some of the pressure of going public when the time comes. Depending on your goal, Tad Freese suggests a pre-IPO offering six to twelve months prior to the IPO is the sweet spot to achieve this outcome and cautions that these crossover rounds often come at a deeper discount than the IPO price which companies will need to take into consideration.

Large secondary offerings pre-IPO can also serve as an alternative growth strategy, noted Lauren Cummings. “Scaled secondary private sales can be done in lieu of an IPO, allowing the business to stay private for longer and extend duration of the investment.”

What lies ahead for the IPO market?

What lies ahead for the IPO market?

Looking ahead, the panelists agreed the deal queue, along with pent-up demand from investors, is building and it’s a case of when, not if, the IPO window will reopen.

Gregor Feige has observed an increase in pitch and deal activity in the first half of this year, adding that UBS has significantly expanded their senior Banking coverage team across TMT as the pipeline is expected to pick-up pace in 2025.

As for what makes an IPO most successful, Lauren Cummings had a simple word of advice to close out the discussion: “a really good business that has momentum.”

It’s crucial that we remain agile and in-tune with both companies and investors as markets continue to

open-up.