We have seen little to no disruptions in service to our clients and have successfully managed very high volumes across our businesses, particularly in our trading operations. Prior investments in technology infrastructure are paying off.

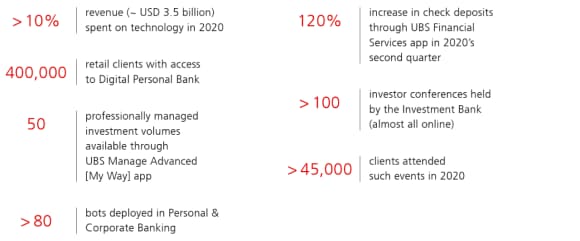

UBS’s strength and resilience allowed us to continue to responsibly deploy resources for the benefit of clients, employees and society throughout the pandemic. Our performance and resilience was also supported by our prior investments in technology that enabled us to maintain connectivity across our businesses, ensure continuity of service and access across our functions, and proactively support our clients. We also found new ways to digitally interact with clients by leveraging existing and newly integrated tools. Across the firm, we continue to provide clients with thought leadership and advice, along with investment solutions and global insights to help them navigate the significant market volatility and uncertain economic outlook.

We believe the future of finance belongs to firms that have scale where it matters and leverage that scale for the benefit of clients and shareholders. The move toward digital everything has increased the need to invest in technology and the pandemic has accelerated clients’ expectations and adoption rates of digital services, possibly by several years. One thing is clear: financial firms that have the scale also have the advantage in this area.

Digitalization provides new opportunities and significant efficiencies. As banks face heightened challenges from digitalization, intensified competition, low and persistently negative interest rates, as well as expectations of continuing easy monetary policy, there may be further industry consolidation.

Our growth objectives capitalize on our existing strengths, as we continue to build our presence in the world’s largest and fastest growing markets. We’re also well-positioned to benefit from secular trends, such as wealth creation and transfer, or the increased need for retirement funding, and the search for yield.

Technology capital

Technology capital

The global impact of COVID-19 has accelerated digital transformation and also influenced the way in which institutions interact with clients. Clients’ preference for omni-channel advice is stronger than ever: there has been growth in client engagement across all digital channels, as well as increases in the number of client-facing webinars and virtual client meetings. Clients care about the ease of access to information and client advisors, and the simplicity of doing business using technology.

We are coping with a level of uncertainty, a prolonged and very challenging economic environment and a digital transformation in the industry, all of which will trigger change that has been unmatched, at least for my generation.

Digital next

Digital next

Technology sits at the heart of delivering the client experience, enabling the bank of today and tomorrow. Explore our digital content hub to learn more about the work we do at ubs.com/digitalnext

Other interesting content

Other interesting content