- Switzerland is on track to meet its emission reduction targets, with a 24% decrease between 1990 and 2022, while its economy has more than doubled in size

- Remaining on track requires scaling renewables, increasing energy storage, and maturing negative emission technologies

- An estimated CHF 13bn per year is required to achieve net-zero, with most funding expected from private sources

- Financial sector will play an important role by guiding investments, innovating to de-risk new projects, and connecting investors with decarbonization opportunities

- Transition offers Switzerland opportunities to lead in new green markets like carbon capture or low carbon cement

Zurich / Geneva, December 10, 2024 – Switzerland is currently on track to achieve its net-zero goals, but to maintain this momentum, emerging challenges need to be addressed. This includes the provision of the necessary electricity capacity and the management of unavoidable emissions. In its white paper ‘Downhill climb’, discussed at the Building Bridges Conference 2024, UBS analyses the challenges and opportunities of Switzerland’s transition journey, putting regulatory conditions as well as locational factors in the context of the decarbonization pathways for six economic sectors.

Starting from a strong position

Switzerland starts from a strong position with the lowest carbon intensity of any OECD country, mostly zero carbon domestic electricity generation and with an effective carbon pricing mechanism. This is backed up by long-term oriented policies. From 1990 to 2022, overall emissions have fallen by 24%, while OECD emissions rose 1% over the same period.

Development of Swiss emissions

Development of Swiss emissions

Staying on track

To remain on track with decarbonization, more electrification is required, coupled with a rise in the generating capacity from 27 gigawatts (GW) today to over 60 GW by 2050. This comes at a time when 32% of current generating capacity is set to go offline, with the four remaining nuclear reactors scheduled for shutdown by 2034. Filling the gap requires a major build-out of renewables. This will bring increased challenges of seasonality in demand and supply. Maintaining grid stability will require innovations in demand management and a material increase in energy storage capabilities. Political and societal support must be secured, and competitive electricity prices maintained. Furthermore, attention must be paid to those sectors, which might not achieve full decarbonisation on time. In addition to their abatement efforts, carbon removal technologies need to be scaled, if net-zero is to be reached.

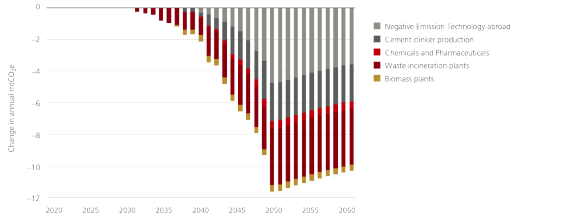

Michael Baldinger, UBS Chief Sustainability Officer, says: “Significant carbon capture and storage capacity, equivalent to around a quarter of current Swiss emissions, will be required for those sectors who cannot eliminate their emissions completely. This is a technological, logistical, and financial challenge, but one that offers Switzerland the opportunity to lead in new green markets.”

Targeted negative GHG emissions from carbon removals

Targeted negative GHG emissions from carbon removals

Focus on implementation and addressing increasing regulatory demands

The transition holds commercial opportunities for some sectors while others face more challenges and will require deeper reforms, sustained investment, and widespread collaboration to stay on track. Essential in this process is the implementation of the increasing regulatory demands which will define the legislative guardrails of Switzerland’s transition to a net-zero economy. In 2025, three major changes are incoming, such as the Electricity Law, the CO2 Act, and the Climate and Innovation Act. Furthermore, the Swiss government intends to broadly align with EU regulations in certain key areas, such as reporting, which will tenfold the scope from 300 to 3,500 Swiss companies.

Swiss financial sector well positioned to support

An estimated CHF 13bn per year until 2050, according to the Swiss Banking Association (SBA), will be required to achieve net-zero, which is equivalent to around 2% of annual Swiss GDP. The financial sector offers various capabilities to support the Swiss economy in its transition. This includes providing instruments for funding this capital-intensive undertaking such as bank loans, capital market financing through bond and equity investments, blended finance solutions or public-private partnerships to support the market entrance and scaling of new technologies. The Swiss economy can also be supported in their transition efforts through the financial sector’s capabilities in advisory, connecting investors and companies, engagement and active stewardship.

UBS AG

Contacts

Contacts

Krystal Miller (London)

krystal.miller@ubs.com

T: +44 20 7901 5537

Andreas Hensler (Zurich)

andreas.hensler@ubs.com

T: +41 44 236 3370

Switzerland:

+41-44-234 85 00

UK:

+44-207-567 47 14

Americas:

+1-212-882 58 58

APAC:

+852-297-1 82 00