Escape velocity?

In physics, “escape velocity” is the minimum speed an object needs to break free from the gravitational pull of a massive body without further propulsion.

As we enter 2026, investors are asking whether the powerful combination of AI innovation, fiscal spending, and easing monetary policy can help the world economy break free from the gravitational pull of traditional “end-of-cycle” dynamics and accelerate into a new era of growth.

AI is at the heart of the debate. The current boom has the potential to deliver the necessary productivity improvements to overcome historical constraints and help economies achieve their own type of escape velocity. Whether this potential is realized will depend on investors’ willingness to keep funding AI, tech leaders’ ability to monetize innovation, and the world’s capacity to supply the energy needed to power it all.

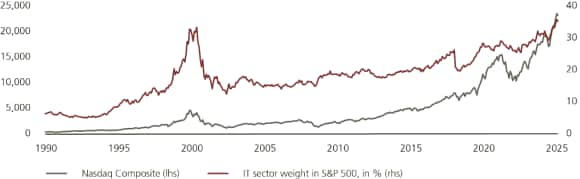

Can AI power the market even higher?

Nasdaq Composite Index (lhs) and weight of information technology sector in S&P 500, in % (rhs)

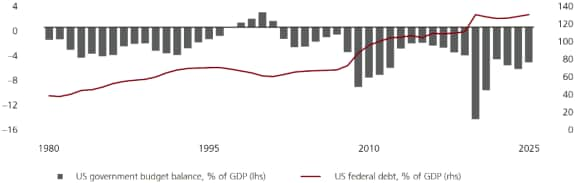

Debt is another critical factor in major developed markets. Fiscal spending is supporting growth, but in many countries—especially those with aging populations—government outlays are already at “escape velocity,” set to rise as a share of GDP unless decisive action is taken.

Deglobalization also looms large. The interplay of trade policy, domestic politics, and geopolitics continues to exert a powerful force. The gravity of history—clashes between rising and established powers, cycles of integration and fragmentation, and the thawing of frozen conflicts—may fuel further volatility in 2026. Whether new policy approaches can help us “escape” these age-old dynamics will be another defining question for investors.

How will governments manage rising debt?

US budget balance (lhs) and federal debt (rhs) as a % of GDP

Despite the uncertainty surrounding these questions, we believe durable principles for investing in today’s world are coming into focus. In previous editions of the Year Ahead, we discussed the “5Ds” of digitalization, decarbonization, debt, demographics, and deglobalization. But these are no longer distant trends. They are actively shaping the investment landscape and remain central to our thinking as we look at the year ahead. As I wrote in “The New Rules of Investing” and my “big problems, big money” thesis: Understanding where capital is being deployed at scale is critical for investors.

Accordingly, our focus is on sectors and ideas aligned with these forces. AI, power and resources, longevity, and commodities stand out as beneficiaries of both structural change and policy support. Rising debt points to a future of “financial repression”—a regulatory and policy regime that channels savings and central bank funds into government bonds, suppressing yields. Meanwhile, the intersection of trade policy, domestic politics, and geopolitics strengthens the case for portfolio hedging and multi-asset diversification.

Ultimately, while the future remains unpredictable, we are confident that pairing our disciplined analytical framework and our timeless asset allocation principles will help investors navigate 2026 and beyond.

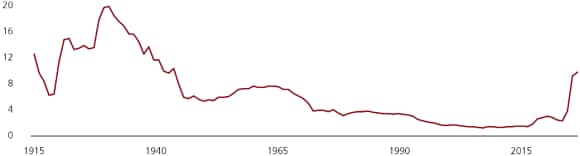

How will politics shape markets in 2026?

US effective tariff rate since 1915, in %

Our views

AI and technology have been key drivers of global equity markets. Strong capex and adoption should fuel further gains in 2026, though investors should be mindful of bubble risks.

Opportunities span AI’s enabling, intelligence, and application layers, as well as power and resources and longevity. We recommend allocating up to 30% of equity portfolios to these structural growth ideas.

We expect global economic growth to stay resilient, and accelerate through the year. In the US, we favor technology, utilities, and health care. In Europe, we like industrials, technology, and utilities. In Asia, we favor China (in particular tech), Japan, Hong Kong, Singapore, and India. Globally, we also like banks.

China’s tech sector stands out as a top global opportunity. Strong liquidity, earnings, and retail flows should sustain momentum for Chinese, Asian, and emerging market equities.

Commodities look attractive for 2026. Supply constraints and rising demand support energy, metals, and agriculture; precious metals remain effective diversifiers.

Income-seeking investors should diversify by blending quality bonds and higher-yielding strategies with in-come-generating equities and structured investments, especially in low-yield regions.

Currency strategy matters. We favor the euro and Australian dollar over the US dollar, as US rate cuts may weigh on the greenback. Financial repression could lead to greater currency volatility in future.

Key risks include AI setbacks, inflation, trade tensions, and debt concerns. Holding adequate liquidity, capital preservation structures to lock in gains, quality bonds, and gold can help hedge market risks.

Alternatives such as hedge funds and private markets can further diversify returns, though investors should be aware of inherent risks such as illiquidity and lower transparency.

By building a clear plan, deploying cash, constructing a strong core across equities, fixed income, and alterna-tives, as well as selectively hedging risks and seizing tactical opportunities, investors can position them-selves to thrive in 2026 and beyond.

2025 in review

Economy

In our Year Ahead 2025 publication, we anticipated a moderate slowdown in economic growth for 2025. Developed economies broadly have met our forecasts (we now expect 1.6% growth for 2025), while emerging and developing economies have modestly outperformed, on course to deliver 4.4% growth for 2025 versus our initial 4.0% expectation. Inflation has also trended lower across regions, in line with our initial projections.

Rates

We said rates would come down in 2025, and they have—albeit somewhat more gradually than expected. The Fed has delivered 50bps of cuts so far this year (versus our initial expectation of 100bps), with scope for a further 50bps by end of the first quarter of 2026. US 10-year Treasury yields have fallen from 4.6% (end 2024) to 4.1%, in line with our forecast (4.0%), although European yields have risen amid fiscal and political uncertainty.

AI

We identified AI as the decade’s defining investment idea, recommending exposure to listed megacaps. The US IT sector has since risen by 27% year-to-date, with capital expenditure forecasts exceeded by a factor of three over two years. We now expect global AI capex to rise 88% year over year to USD 423bn in 2025.

Equities

We had forecast the S&P 500 would rise from 5,917 at the time of last year’s Year Ahead publication to 6,600 by end-2025. Its gains have broadly met our expectations. European, emerging, and Asian markets have outperformed the US, exceeding our projections, with MSCI Europe, China, and EM indices posting year-to-date returns of 15%, 36%, and 31%, respectively.

US dollar

We recommended selling further US dollar strength. The dollar initially strengthened into late December 2024 and January 2025, with EURUSD reaching a low of 1.02, and the dollar subsequently saw its weakest first half since 1973, depreciating even further than our expectations. At the time of writing, EURUSD stands at 1.16 versus our initial end-2025 forecast of 1.12.

Gold

Gold traded at USD 2,675/oz at the time of our Year Ahead publication last year. We expected gold to build on its gains, forecasting USD 2,900/oz by end-2025. The metal has performed even more strongly than projections, reaching an all-time high of USD 4,336/oz.

Investing in 2026

Building a robust portfolio

By building a clear plan, putting cash to work, building a strong portfolio core across equities, fixed income, and alternatives, and selectively hedging against risks and seizing market opportunities, we believe investors can position themselves to thrive in 2026 and beyond.

Download the PDF

Our Year Ahead 2026 outlook, “Escape velocity?”, is designed to help you spot the signals that matter, cut through the noise, and act with confidence.

Disclaimers

Disclaimers

Year Ahead 2026 – UBS House View

Chief Investment Office GWM | Investment Research

This report has been prepared by UBS AG, UBS AG London Branch, UBS Switzerland AG, UBS Financial Services Inc. (UBS FS), UBS AG Singapore Branch, UBS AG Hong Kong Branch, and UBS SuMi TRUST Wealth Management Co., Ltd.