Please read the important information of the fund before proceeding

Please read the important information of the fund before proceeding

UBS (Lux) Equity SICAV – All China (USD)

1. The Fund, UBS (Lux) Equity SICAV – All China (USD) (" UBS All China Equity Fund"), invests mainly in shares and other equity interests of companies domiciled in the People’s Republic of China (“PRC”) as well as in other companies that have close economic links with the PRC. These investments contain securities listed within the PRC (onshore) or outside of the PRC (offshore).

Bringing you the best of China equity markets

Bringing you the best of China equity markets

China's onshore stock markets have opened up and now the distinction between offshore and onshore markets is increasingly irrelevant. Our goal is to fully capture the best opportunities in onshore and offshore markets, that will be benefited from China's long-term growth.

Fund features

Fund features

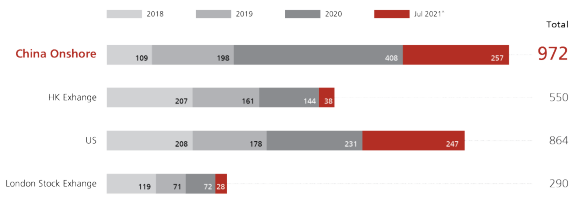

1. China is now the most active Initial Public Offering (IPO) market

An “All China equity” approach allows investors to tap into the best opportunities that the China onshore and offshore markets can offer.

Number of IPOs

Number of IPOs

2. Captures high-growth sectors, no matter where they are listed

In our research, onshore markets have more companies in fast-growing healthcare and consumer sectors, while offshore markets have a big selection of innovative tech and services companies.

3. Managed by award-winning China equity team

Bin Shi, Head of China Equities

- Best Fund Manager, Equity China 2018, 2019, 20201

- AAA – Citywire rating2

More funds

More funds