Q3 equity market outlook

Five charts on the key equity market drivers

![]()

header.search.error

Five charts on the key equity market drivers

Key highlights

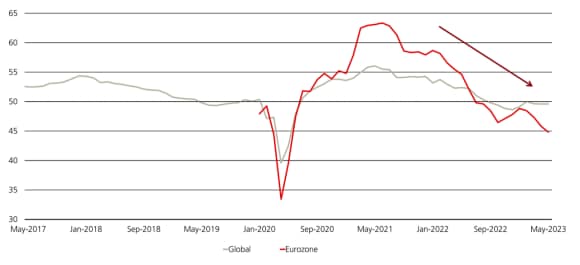

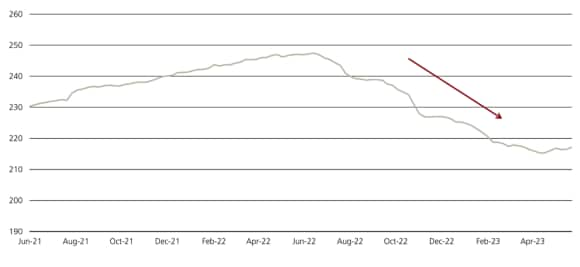

Central banks’ efforts to contain inflation are backward-looking and are reigniting fears of a recession

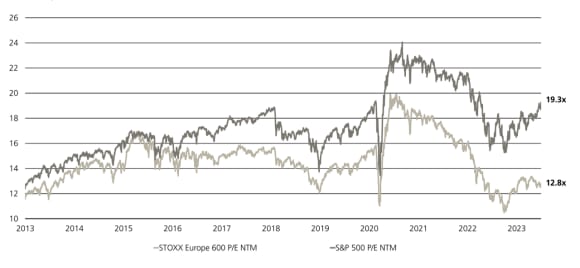

Equity valuations move higher despite weaking leading indicators

Analysts continue to cut earnings for US stocks

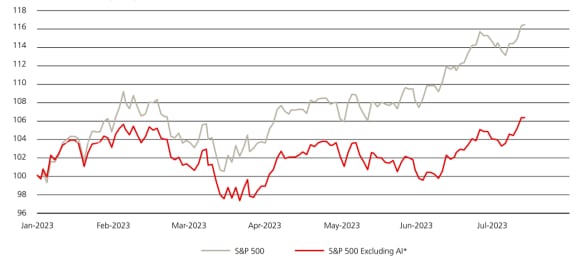

AI stocks drive equity markets higher

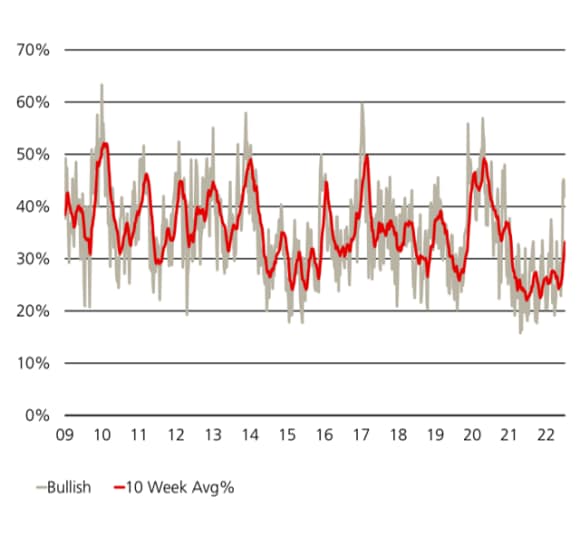

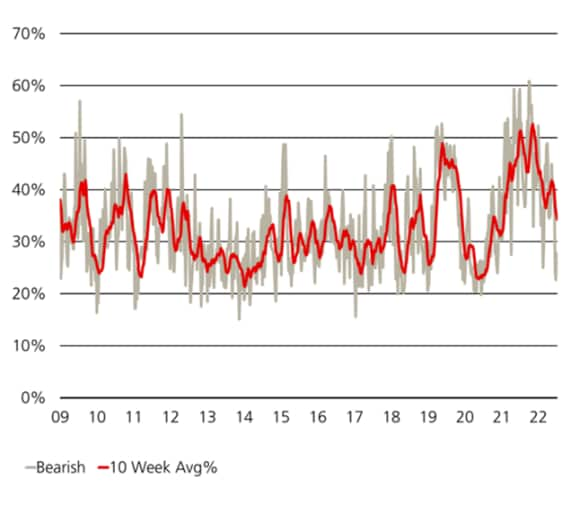

Investors have become more bullish