Emotions are not a good guide

Emotions are not a good guide

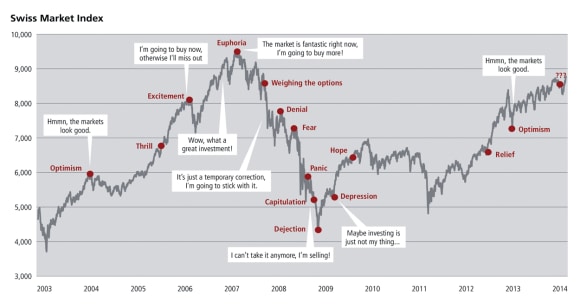

Investing is a very personal matter. And it's often tied to emotions. When markets are on the up, investing is fun. But when things don't go as you’d hoped, looking at your investment portfolio can be painful. Unfortunately, emotional moments like these often lead to poor investment decisions.

Stay on course, despite the emotional roller coaster

Stay on course, despite the emotional roller coaster

Rely on the knowledge of specialists when you invest. We’ll analyze the relevant financial markets for you, help you to select the right strategy, and implement your investment solution in a disciplined way.

Analysis

Investment decisions are best made based on a systematic and sober analysis of the investment markets. What are the fundamental drivers? What are the market opportunities and risks? These questions need to be answered objectively.

Strategy

Your portfolio should follow the agreed investment strategy, which is individual to you and tailored to your needs. It takes into account your circumstances, your financial goals, and the level of risk you can take.

Discipline

Once the strategy for your portfolio has been decided, it must be followed consistently. This involves monitoring investment priorities using up-to-date market analyses. If the market situation changes, the strategy should be reviewed. Maintaining discipline is the key to investing successfully.

Our investment solutions

Our investment solutions

We will help you to achieve your investment goals. You decide how much support you want to receive.

UBS Manage™

UBS Manage™

You want your investment strategy to be implemented quickly and directly. You can adjust your investment management mandate to your own investment preferences and needs at any time in line with the UBS House View.

UBS Advice™

UBS Advice™

You want to take your investment decisions yourself. You also want your portfolio to be monitored regularly. You decide how often you want to be informed about investment opportunities and risks in your portfolio, and have suggestions on improvements.

More on this topic

Take decisions based on sound knowledge. This is where to find more information as well as advice, tips, and a financial personality test for investors.