Designing for fair competition: how auctions promote efficiency and neutrality

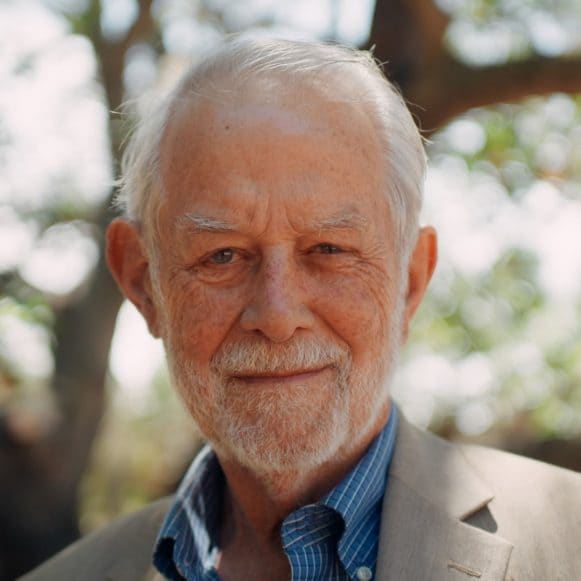

Auctions are a common way to allocate resources and determine prices. Nobel economist Robert Wilson studies how auctions promote fair competition, efficiency, and neutrality, and why they're an important tool for businesses and governments.