Lawrence Klein appeared on scene just as statistical and mathematical methods were first being introduced in economics and he quickly became a leading figure in econometrics. Having witnessed the hardships of the Great Depression, he was eager to learn more about the essence of such crises. Over the course of his career, he created models that would accurately forecast economic trends, not only for the United States, but on a global scale. As the Cold War was still dominating international affairs, Klein talked to scientists in socialist countries to find out how important issues in the world economy could be addressed.

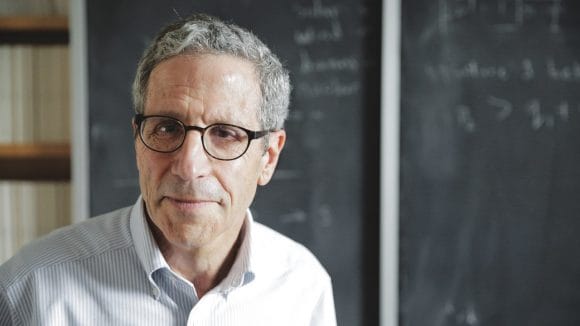

Lawrence R. Klein

Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, 1980

A desire to understand the world

A desire to understand the world

In the 1930s, Klein was one of many Americans who studied economics to understand why the Great Depression occurred. “I wanted to understand why the world was having such great problems,” he explained. “I was able to piece together the connection between mathematics and economics in a very simple way.”

How can we analyze movements in economies?

Has this question inspired you?

Get the latest Nobel perspectives delivered to you.

When he got his first degree from the University of California in 1942, Klein began to specialize in what was then the new science of econometrics. He wanted to practice economics in a way that would help solve real-world problems, so he started analyzing economic fluctuations to find out how the macroeconomy worked as a whole.

How can we answer what-if questions in economics?

Obviously, one can’t know everything about a complicated country with several million people making decisions all the time, so we have to make approximations.

That’s exactly what Klein tried to do with the models he built. “We have equation systems and we find prices and interest rates that satisfy those equations,” he said. “We take account of the restrictions that are imposed by the regulatory authorities and we try to project the growth path of the economy.”

With his models, Klein not only developed ways of representing an economy but he could also predict how it would be affected by future policy changes, for example in monetary and fiscal or international trade policy. “It’s inevitable that there will be some unexplained part and our objective has been to make this part as random as possible,” he said. “We can ask how would the economy look if it was hit by random events or bad judgments?”

Using econometrics forecasting models to challenge conventional beliefs

While the United States was still fighting in World War II, Klein was asked to model the economic situation of the country in the post-war period. People believed that the economy would sink into depression but Klein and his research team at the University of Chicago used their models to show that this wouldn’t happen as there was a demand for consumer goods that had been left unsatisfied because of the war and that the soldiers who were coming home would also increase demand.

“Our results showed that the economy would be quite strong,” Klein said. “There would be a good basis for realizing what we called the pent-up demand by consumers.” Klein’s predictions were correct and it wasn’t the only time he was able to prove the accuracy of econometric forecasting. Klein correctly predicted what the economic situation would be after the Korean and Vietnamese wars.

People feared that after the peace settlement, there would be a return to the recession we had in the 1930s, but we used our models to show that there wouldn’t be that kind of setback.

How can an economy maintain total demand?

How can an economy maintain total demand?

Klein never left his academic position, even despite a job offer from Jimmy Carter after winning the presidency in 1977, but he frequently commented on politics. When the shift from military to civilian production was still a hot debate topic, he publicly proclaimed that if the government followed proper economic policies, demand in the economy could be maintained.

Countries of the world, lay down your arms…

“Military goods are not designed to produce the future income stream,” he explained. Klein was sure that neither the NATO nor the Warsaw Pact countries would suffer from the shift to civilian production, and that unemployment would not increase if people allowed for a few years of conversion. He based his assumptions on his own international modeling.

From hand-based calculations to automation

When Klein began his work, data-intensive analyses were still done laboriously by hand until the mid-1950s when processes became automated using machines.

“Today, we make our calculations over and over again in the same day, in a few minutes, very fast,” he said. “Computers have enabled us to explore the possibilities of economic life in much greater detail and over a much wider spectrum.”

How computers changed economics forever

Using new technology, Klein built his Wharton Econometric Forecasting Model, which focused on the development of the American economy. It contained more than 1,000 equations to forecast economic fluctuations and business conditions and studied the effect of changes in taxation and public expenditure.

Understanding how economies affect each other

“I shifted my main interest from a purely national to an international focus,” he explained. “We used to think of America as a closed economy but it became much more open towards the end of the 1960s.” Klein understood that it wasn’t possible to really study the US economy without a very careful study of the world economy.

He became part of LINK, an international research project starting in the late 1960s. Under Klein’s leadership, the project was able to produce the world’s first global econometric model by coordinating research from different countries across the globe. Scientists hoped that coordination would enable them to analyze how changes in the economy of one country would affect other countries. Today, LINK is maintained at the United Nations and includes almost 80 countries.

A model of centrally planned economies

LINK was a good example of how Klein cared about the international academic dialogue. Though he was criticized for spending time and effort on the Socialist countries, he established contacts with econometricians in Poland, Czechoslovakia and China and began modeling centrally planned economies.

When China began its economic reform policies in the 1970s, Klein discussed how to help the economy grow with his Chinese colleagues. He also used his econometric models to analyze the economies of Mexico, Japan and Israel. His international focus meant that Klein traveled regularly, giving him the opportunity to see the world.

Why an economist can’t expect to be right all the time

While his econometric models had proven successful, Klein admitted that there was considerable room for improvement. As data processing became easier, he began working in high frequency forecasting but knew that econometricians would never achieve perfection.

With fast computers, we can make very quick projections and stay in touch with the evolving situation.

“There’s so much economic noise in the world that when dealing with human behavior, the economist cannot scientifically expect to be right more than two-thirds of the time,” he said. “We all operate in a system of probability and error.”

Can we forecast the future macroeconomy?

Has this question inspired you?

Get the latest Nobel perspectives delivered to you.

Klein was awarded the Nobel Prize in Economic Sciences in 1980 for his econometric models and their ability to predict global economic trends. The Nobel Committee emphasized how Klein had stimulated research on forecasting models unlike anybody else and hailed:

Few, if any, research workers in the empirical field of economic science have had so many successors and such a large impact as Lawrence Klein.

Why do countries have to find better ways to grow?

Hear Michael Spence's view on how countries can grow sustainably while having a long-lasting positive impact.

More Nobel Laureate stories

Has this question inspired you?

Get the latest Nobel Perspectives updates delivered to you.