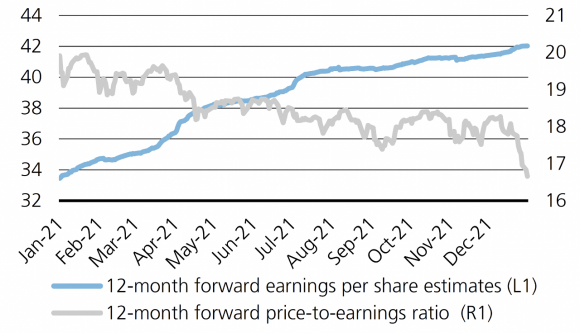

Coming into 2022, we expected that equities would be faced with a tug-of-war between the headwind of multiple compression and the tailwind of strong earnings growth. In January, the derating of stocks has been front-loaded to a large degree as yields, in particular real rates, surged. Yet there is little cause to think the positive profits or economic growth story has deteriorated. In our view, what has transpired so far in 2022 is not a reason to cut risk or transition away from our preferred procyclical relative value equity positions.

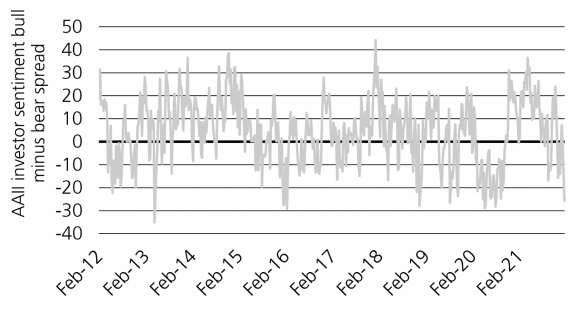

The price action has been resoundingly negative in 2022. The underlying backdrop is not. Measures of factory activity have surprised to the upside even amid the rapid spread of the Omicron variant. There is meaningful evidence that China is easing monetary and fiscal policy to stabilize economic activity. Valuations in Europe and Japan are now cheaper than they were before the pandemic. And indicators of investor gloom – like surveys of sentiment and equity put/call ratios – have reached levels at which they provide a powerful contrarian signal and suggest a recovery is in the offing. Global risk assets have become less expensive in January – not worse.

This is not a growth scare

This is not a growth scare

This is a valuation-centric sell-off, not a signal that investors are pricing in a prolonged slide in global growth. 10-year US inflation adjusted yields have risen more than 50 basis points since the start of the year. A move that big, that fast typically causes discomfort for risk assets.

On a regional basis, the S&P 500 and Nasdaq 100 indexes have suffered worse declines than European, UK, and Japanese stocks. We have preferred ex-US developed market equities in part because they are less expensive than US stocks and less susceptible to multiple compression.

Energy, one of our favored equity sectors, has once again proven its worth as a useful hedge from a portfolio construction standpoint during concurrent declines in stocks and bonds. Importantly, the sector is still very attractive on an outright basis. Geopolitical uncertainty surrounding a potential Russian invasion of Ukraine has buoyed the energy complex. However, we believe that the underlying fundamental arguments of tight supply and rising demand are more than sufficient to support resilience in oil and gains in energy equities in the coming months.

It is still early in the US reporting season. But so far, results have been solid. Earnings/sales surprises, as well as rates of growth and corporate guidance are all running far stronger than their long-term averages. As expected, these are not as hot as they have been over the past year. Revisions to calendar year 2022 earnings have also not come under any pressure at the global level.

Exhibit 1: Global equities are suffering from a valuation shock, not a growth scare

Exhibit 2: Investor sentiment has deteriorated, which often bodes well for forward returns

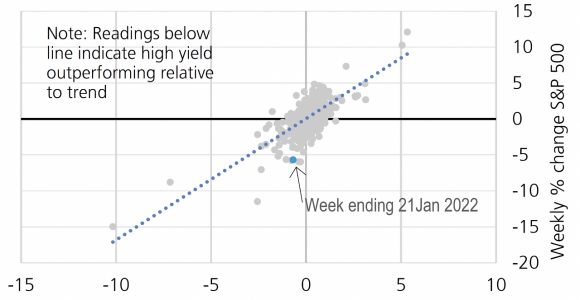

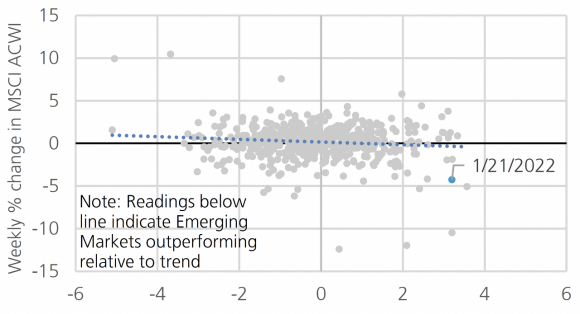

In the near term, data is poised to weaken due to the Omicron variant, particularly in the services sector. Markets have known this since late November, and largely elected to look through the upcoming soft patch. The judgement, which we share, is that this slowdown would not be severe or long-lasting enough to undermine what is poised to be another strong year of the expansion. The performance of credit and emerging market equities so far this month implies that investors’ faith in the growth outlook has not been materially shaken. Of course, we are cognizant that a further 10% decline in global equities would, by itself, be sufficient to raise alarm about the durability of the expansion.

Fed aggressively priced for 2022

Fed aggressively priced for 2022

The rise in US real rates linked to Fed balance sheet normalization and expected higher policy rates is the driving force behind the drawdown in risk assets, in our view.

Because inflation is stubbornly high, we believe that the Fed will not be quick to pivot despite falling stock prices. This is particularly true given the sell-off has been most painful for highly speculative areas of the market compared to firms most tied to the economic outlook. Our key takeaway from Fed Chair Jerome Powell’s press conference is that the central bank has no more tolerance for any additional upside inflation surprises. As such, the market's sensitivity to inflation (CPI, PCE) and inflation-adjacent data (surveys of expectations, wage growth, purchasing managers’ prices paid) should be elevated in the weeks to come. This is likely to put a high floor under market volatility, in our view. These inflation data will be significant in determining whether the Federal Reserve elects to signal a much larger withdrawal of monetary stimulus this year. As it stands, there are sizeable two-sided risks to market pricing for 4 to 5 hikes of 25 basis points from the Federal Reserve in 2022. Monetary policymakers want tighter financial conditions as a way of slowing demand growth, and in turn, inflation. Rising rates, widening credit spreads, and the drawdown in stocks have already combined to tighten US financial conditions by an amount consistent with more than two 25-basis point interest rate hikes.

Conclusion

Conclusion

The early year equity turmoil is not prompting us to reduce risk or change preferred styles at this juncture. On the contrary, we have judiciously looked to add risk in some portfolios during this equity downdraft.

We remain highly confident in our view of above-trend growth for 2022. We also acknowledge a great deal of humility is required when assessing the inflation outlook, which has consistently surprised to the upside. If sustained, elevated price pressures are likely to elicit more aggressive monetary tightening and the continued derating of equities.

It is important to emphasize that the primary risk to stocks at the headline level remains multiple compression, not earnings growth turning to contraction. We are staying positioned accordingly, favoring regions and sectors that will benefit from above-trend activity even as monetary and fiscal stimulus wanes.

Exhibit 3: Credit holding up well despite stress in US equities

Weekly % change in US High Yield Total Return Index

Exhibit 4: Emerging markets holding up well despite stress in global equities

Weekly % change in MSCI Emerging Markets vs MSCI ACWI

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

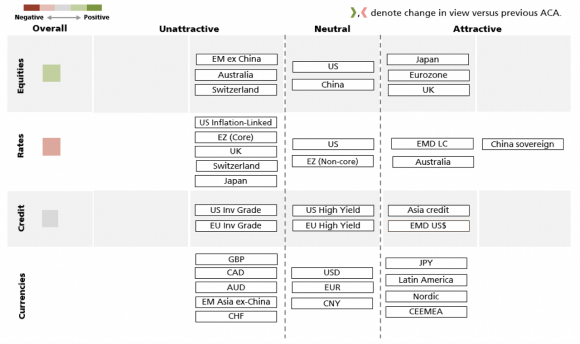

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 26 January 2022.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities (ex-China) | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Grey | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt | Overall signal | Light green Light green | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 165 billion (as of 30 September 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.