Hedge Funds As a Diversifier

Hedge funds have a key role to play in the diversification of portfolios, none more so than during challenging market environments. Here, our Hedge Fund Solutions team discuss where they see the best opportunities.

This webpage may contains product that does not match the risk profile for retail investor. To proceed, please confirm that you are a professional / institutional client and investor as defined under article 4 of Financial Consumer Protection Law and article 11 of SITE&SICE Act.

Key highlights

Key highlights

- Hedge funds are a useful tool as a portfolio diversifier. We believe selected strategies are likely to be well placed to perform in a volatile market with slowing growth challenging risk assets and inflationary pressures impacting bond markets.

- Different hedge fund strategies are effective at different points in the economic cycle. In our view, in the current market environment, strategies that can capitalize on higher rates, cross-asset volatility and dispersion while employing actively managed, tactical and low-beta approaches are most likely to benefit.

Turbulent months

Turbulent months

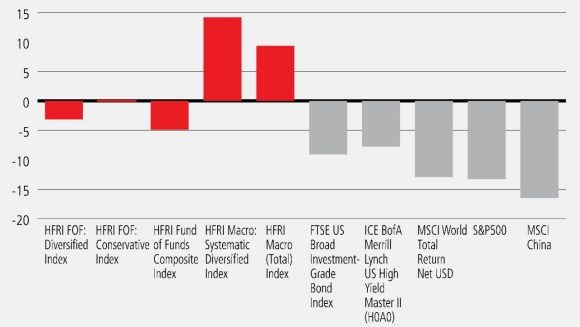

Much of the first half of 2022 has been characterized by events that have shaken global risk markets. During these turbulent months, hedge funds generally weathered this period better than equity or bond beta (Chart 1), a pertinent reminder that adding a diversified hedge fund allocation to traditional portfolios may serve as a good diversifier, particularly in difficult market environments.

We believe we are in a paradigm shift in investment markets: a new regime that has not been seen in financial markets for decades: that of real and persistent inflation. Investing in these conditions requires a different roadmap compared to the one used in previous years, what can best be described as a disinflationary ‘lower for longer’ environment of ample central bank liquidity.

Inflationary environments are much harder to navigate. When there is growth (or ‘reflation’), risk assets such as equities may still provide decent returns, but when growth slows or declines (‘stagflation’), it becomes trickier, since the traditional fixed income “safe haven” is no longer a reliable diversification tool, and equities also tend to come under pressure. This is an environment of tighter financial conditions, less liquidity, higher volatility and widening risk premia – all factors that can contribute to alpha opportunities for hedge funds.

While the market has now priced in high near-term inflation, there is an assumption that quantitative tightening and higher policy rates will reduce economic growth and hence, help to moderate price pressures. If inflation is stickier, and baseline inflation is higher than expected in 2023, we are likely to have some issues, including further capitulation of crowded secular growth trades and private positions, and even worse liquidity.

Which hedge fund strategies may be best placed to succeed?

Which hedge fund strategies may be best placed to succeed?

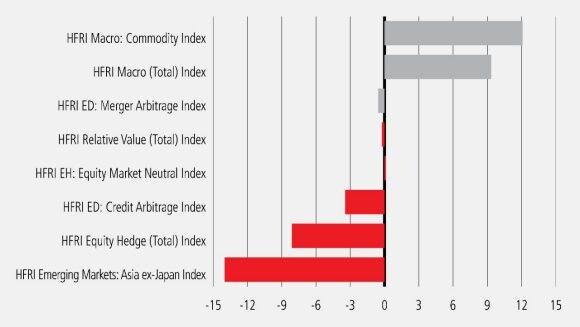

A look at year-to-date performance of different hedge fund strategy styles reinforces our view that certain approaches are better placed to take advantage of the current market volatility than others (Chart 2). With this in mind, the following are examples of where we have been focused and continue to tilt our allocations towards.

Chart 1: Performance of different hedge fund strategies versus equities and fixed income

Chart 2: The drivers of hedge fund performance (YTD)

Commodities

Commodities

We believe there is a multiyear supercycle ahead in commodity trading. Fundamental market drivers continue to be “in play” due to massive supply/demand imbalances, which have become further exacerbated by Russia’s invasion of Ukraine. Commodity markets are suffering from a decade of underinvestment in supply, and we’re now seeing critical shortages of inventory across the energy, metals and agriculture complexes.

Meanwhile, the growing impetus to invest along environmental, social and governance (ESG) lines and the push toward energy transition are also important drivers. With sustainable investment constraints restricting supply (by cutting off capital to fund fossil fuel production, for example) before we are ready with renewable sources, and the energy transition driving demand (it is, in particular, hugely metals intensive) this phenomenon is an inflation accelerant, and is likely to take a decade to play out.

However, this is not just a one-way trade. We are seeing huge volatility in these markets, many of which are extremely inefficient and have arguably fewer participants than 10 years ago, since many hedge funds exited the space. Those that remain have less competition, and more volatility to exploit. Producer hedging flows are also changing in their utility function as prices have increased to multiyear highs.

Against this backdrop, active portfolio management is critical. This can take the form of directional long/short trading, relative value strategies such as calendar or locational spreads, volatility trading, or liquidity provision strategies. In particular, as the growth outlook has become more uncertain, we believe these hedge fund strategies are likely to continue to deliver in a stagflationary regime, and will be better placed to deliver strong risk-adjusted returns over time, compared to taking high beta commodities exposure via passive strategies or long-only instruments, for example.

Hedge funds focused on macro, fixed income relative value and commodity strategies have a wide opportunity set.

Global Macro

Global Macro

With this regime change, market characteristics are transitioning from mean reverting to trending, which is typically supportive for macro and CTA (commodity trading advisor) hedge fund returns. We are seeing a wide range of potential economic outcomes — i.e., increased uncertainty — as central banks try to balance their response to inflation with the risks to growth. With that comes elevated cross-asset volatility and changing interest rate differentials, creating excellent opportunities for macro hedge funds to potentially monetize.

Macro managers have already benefited from two key trends in 2022 so far — namely, the move higher in yields and a stronger US dollar — but have been tactically locking in gains and will likely be able to be opportunistic from here. While the entire global economy is wrestling with the inflation problem, there is still a large degree of cross-market divergence, with the Bank of Japan continuing its yield curve control (YCC) strategy, (still) negative policy rates in Europe alongside 8%-9% inflation in the region, and the US already on an aggressive hiking path. Two-way trading in emerging market local currency markets may also provide decent opportunities; for example, via commodity related currencies, or relative value government rates strategies as countries are at different stages of their monetary policy cycle.

Fixed Income Relative Value

Fixed Income Relative Value

Fixed income relative value strategies are also benefiting from the uncertainty around inflation and policy rates driving volatility higher — which creates wider dislocations to potentially monetize. The transition from quantitative easing to quantitative tightening means that central banks are no longer damping volatility with their bond purchases. This should increase opportunities in bread-and-butter trades such as cash vs. futures basis going forward.

That said, managers are still running with low balance sheet leverage (i.e., high cash levels) at the time of writing, so have dry powder to deploy as these spreads become more interesting. In addition, inflation relative value and short-term fixings trading have made a comeback, adding another string to managers’ bows.

Tactical, low net credit and equity strategies

Tactical, low net credit and equity strategies

The volatility we are seeing in the equity space, with back-to-back +/-3% days at the index level and the dominance of exchange-traded fund (ETF) volumes in secondary markets dragging constituent holdings along for the ride, may open up alpha opportunities for long/short hedge fund trades. But the approach needs to be hedged and tactical to monetize that alpha over time. These strategies should benefit as margin pressures, supply chain issues, and elevated funding costs start to erode earnings per share (EPS) and create further dispersion and stock selection opportunities.

In terms of sectors, we have a bias toward energy and materials (with trillions of dollars no longer investing in fossil fuels and directed toward renewables) and away from the technology, media and telecom (TMT) sector. Over the last few years there has been a deluge of company creation in the technology, biotech and consumer sectors and many of these new companies are not cash flow positive. We are now entering a period of tightening financial conditions with increasing cost of capital which historically has proven to be an optimal set up for shorting.

PDF

Mid-year outlook 2022

Mid-year outlook 2022

With inflation reaching multi-decade highs in many parts of the world, how can investors position their portfolios for this changing investment landscape?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

About the authors

Bruce Amlicke

Chief Investment Officer UBS Hedge Fund Solutions

Bruce Amlicke, Managing Director, is the Chief Investment Officer and Head of UBS Hedge Fund Solutions (HFS). Bruce is a member of the HFS Management and Senior Investment Forums and the UBS Asset Management Investments Management Committee. He is responsible for managing and overseeing investments of third-party active investment strategies across hedge funds, co-investments and private credit. In his CIO role, he leads the global investment team and oversees all aspects of portfolio management, asset allocation and manager selection.

Claire Tucker

Head of Trading and Fixed Income Relative Value Investments, UBS Hedge Fund Solutions

Claire Tucker, Executive Director, is Head of Trading and Fixed Income Relative Value Strategies, UBS Hedge Fund Solutions (HFS). Claire is a member of the HFS Senior Investment Forum and is primarily responsible for manager research and performing investment due diligence on prospective and existing hedge fund investments. She also contributes to asset allocation and portfolio management decisions.

Bruce Amlicke

瑞銀對沖基金解決方案首席投資總監

Bruce Amlicke,董事總經理,瑞銀對沖基金解決方案(HFS)部首席投資總監兼主管。Bruce是HFS管理層及高級投資論壇以及瑞銀資產管理投資管理委員會成員。他負責管理及監督各項對沖基金、共同投資及私募信貸的第三方主動投資策略所作的投資。在首席投資總監的職務中,他領導環球投資團隊,並監督投資組合管理、資產配置及經理挑選的各個層面。

Claire Tucker

瑞銀對沖基金解決方案交易及固定收益相對價值投資部主管

Claire Tucker,執行董事,瑞銀對沖基金解決方案(HFS)交易及固定收益相對價值策略部主管。Claire是HFS高級投資論壇的成員,主要負責管理研究,以及就潛在及現有的對沖基金投資進行投資盡職審查。她亦有參與資產配置及投資組合管理的決策。

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.