Real Estate: Aiming for Broad Diversification

How might global real estate fare in the face of rising inflation? UBS Asset Management’s Real Estate team give their outlook for real estate in the US and Europe.

This webpage may contains product that does not match the risk profile for retail investor. To proceed, please confirm that you are a professional / institutional client and investor as defined under article 4 of Financial Consumer Protection Law and article 11 of SITE&SICE Act.

Key considerations

A rising risk of stagflation?

A rising risk of stagflation?

Real estate offers generally stable income returns and provides low risk in portfolios due to low volatility and low correlations of returns with traditional asset classes. However, the challenging times we’re living in pose threats to all asset classes and require some words of caution. Taking a look at the past, and periods of higher inflation have been followed by typically higher real estate returns.

This was supported by an analysis we did in 2020 which compared nominal real estate returns and inflation across 26 countries globally. Our model showed that real estate offered a 78% inflation protection1 and up to 80% when further conditions such as real interest rates and variable property risk premium were applied.

However, we are now seeing rising risk of stagflation (which occurs when inflation is above-average and GDP growth is below-average), due to rising interest rates from central banks as they attempt to curb inflation. These are our views for the US and Europe:

US real estate

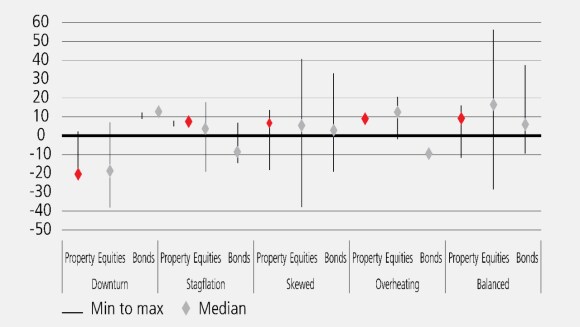

Limited evidence from the US, dating back to the latest period of stagflation in the 1970s, shows that real estate outperformed equities and bonds, though performed below expectations compared to times of better economic growth (Chart 1). Since 1978, annual real – after inflation – total returns were of 6-7% during times of balanced economy, with a median of 6.9%. However, during periods of stagflation, real estate returned 5.5% in real terms while equities returned 2.5% and government bonds -7.3%.

In our view, the biggest threats to real estate markets are periods of recession combined with inflation at average or below average levels. To mitigate such risks, we believe broad diversification across countries is the most prudent strategy.

However, the US real estate market is in better condition than during the global financial crisis (2007+), with loan-to-value ratios being less stretched and spreads between real estate yields and bond yields less compressed.

Chart 1: US total returns by asset class during different economic environments (% YoY, 4Q78 – 1Q22)

European real estate

In Europe, the relationship between high inflation and strong real estate returns has historically been tenuous at best. In some instances, inflation has been propelled by strong demand which has been positive for rental growth.

However, when high inflation is a symptom of late cycle economic growth, additional risks are attached. Currently, inflation is cost-push rather than demand-driven, leading to a downgrade of economic growth forecasts. For example, the Bank of England expects the UK economy to stagnate in 2023/24. Also, interest rates are rising, with considerable hikes which have narrowed the spreads between real estate and fixed income. For real estate, this may translate into some upward pressure on yields, as the sector should price-in the new interest rate environment, and a downgrade in rental growth expectations as the economy weakens.

However, some segments of the European market still offer robust rental growth prospects and are showing a positive outlook in this challenging macroeconomic environment. This is especially the case for logistics assets located in strategic distribution hubs, where demand potential still significantly exceeds construction activity. Another sector continuing to benefit from structural trends is the European rental housing sector. In fact, the steady growth in household numbers and the rising attractiveness of the rental segment from a flexibility and affordability point of view continue to fuel a sizeable pent-up demand for the sector in most urban areas of the continent.

PDF

Mid-year outlook 2022

Mid-year outlook 2022

With inflation reaching multi-decade highs in many parts of the world, how can investors position their portfolios for this changing investment landscape?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

About the authors

Fergus Hicks

Real Estate Strategist

Fergus Hicks, Director, joined UBS Asset Management in May 2016 and is a Real Estate Strategist in the Research and Strategy team of Real Estate and Private Markets (REPM). Fergus supports real estate investment mandates by providing quantitative and qualitative cross-regional analysis of property investment markets and is responsible for maintaining an in-depth knowledge of investment market conditions globally. Fergus is responsible for producing global real estate market performance forecasts which are used to assess relative performance and guide allocation decisions for specific strategies and mandates.

Kurt Edwards

Head of Real Estate Research & Strategy US

Kurt Edwards, Executive Director, leads the Real Estate Research and Strategy team for Real Estate US, a business which forms part of Real Estate and Private Markets within UBS Asset Management. His team specializes in investment analytics and creating market insights using proprietary and alternative data. Kurt is a member of the Investment and Management Committees.

Brice Hoffer

Head of Real Estate Research DACH

Brice Hoffer, Director, was appointed Head of Real Estate Research and Strategy for the DACH region at UBS Asset Management, Real Estate and Private Markets (REPM). Part of Brice’s role includes analyzing property market fundamentals and assessing risks and returns for Swiss real estate, as well as for European residential and industrial assets. Brice also contributes to the development of existing fund strategies, advises on acquisitions for new investments, supports marketing and capital raiding efforts and is involved in the elaboration of new real estate products. In addition, he is responsible for the analytics and benchmarking activities of the UBS Swiss direct real estate funds and is Deputy Valuation Officer in the DACH region. Brice is a member of the Executive Committee of the Urban Land Institute (ULI) Switzerland and part of the Residential Product Council of ULI Europe. He is also a member of the Organization Committee of the Swiss Real Estate Research Congress.

Zachary Gauge

Head of Research & Strategy Europe ex DACH Director

Zachary Gauge was appointed Head of Research & Strategy Europe ex DACH of the Real Estate & Private Markets (REPM) business for UBS Asset Management (UBS-AM) in June 2021.

Zachary Gauge joined UBS-AM’s Real Estate Research & Strategy team in December 2014. Zachary's main role is to help the European real estate teams identify risks and opportunities traditional real estate sectors as well as the alternative markets, using a top-down macro-economic approach.

Zachary also delivers regular research-based views on the market to the internal fund management teams and external clients in both written and verbal form, and in addition, contributes to the bi-annual European commercial property forecasts, the development of fund strategies, new products and supports ongoing marketing and capital raising efforts. Zachary is a voting member of the European investment committee.

Prior to joining UBS Zachary worked at CBRE (2012–2014) on the EMEA research team with a focus on office occupational analysis and at Property Market Analysis (2010–2012) where he was responsible for analyzing regional UK office and industrial markets.

Zachary holds the Investment Management Certificate (IMC).

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.