Macro Monthly

Thinking long-term about surging short-term rates

Over the last 18 months, investors learned about the power of fiscal stimulus to fill even unprecedented holes in demand. In our view, the lesson learned in 2022 will be about the ability of the private sector to drive above-trend growth.

Highlights

Highlights

- The rates market has priced in earlier and sooner central bank rate hikes, but remains pessimistic on how much central banks will ultimately be able to tighten this cycle.

- This implies pessimism on medium-term growth. We disagree with market pricing and view the backdrop for economic growth this cycle as structurally better than the last one.

- We believe that, into next year, the combination of surging incomes, strong household and corporate balance sheets and robust capital investment will translate into a smooth handoff from public to private sector led growth.

- This backdrop implies an underweight to government bonds and focus on the more cyclical areas of the global equity market, such as regions like Europe and Japan and sectors like energy and financials.

Short-term interest rate markets are sending a clear message: the beginning of global monetary policy tightening is at hand.

Expectations for central bank rates rise

Expectations for central bank rates rise

In some cases, this surge is contrary to central bank guidance. Investors are leaning into the idea that the stickiness of well above-target inflation will prompt monetary policymakers to act to prevent expectations from becoming unhinged to the upside.

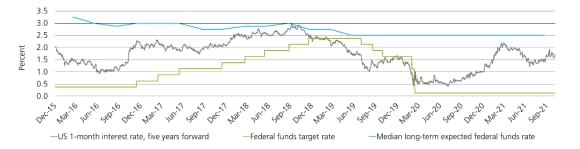

Despite the sharp rise in expectations for near-term tightening, the market-implied ‘terminal rate,’ or peak fed funds rate this cycle, is still 50 bps below the peak rate last cycle.

In our view, the more important question for asset allocation right now is not when central banks will tighten policy, but by how much.

Despite the sharp rise in expectations for near-term tightening, the market-implied ‘terminal rate,’ or peak fed funds rate this cycle, is still 50 bps below the peak rate last cycle.

Essentially, markets are arguing that with a few hikes, central banks will swiftly quell inflationary pressures and we will return to a world of slow growth and slow inflation. Indeed, long-term inflation-adjusted US yields are near record lows. This combination suggests investors are concerned about the magnitude and persistence of short-term inflationary pressures, but pessimistic about the medium-term growth outlook.

We retain a more positive outlook. In our view, investors are underestimating the sturdiness of economic fundamentals, which portend higher nominal GDP growth in this cycle. Household and corporate balance sheets began the expansion in a position of strength, fiscal drag is not poised to be as fierce of a headwind this cycle, and widespread shortages are boosting incentives for businesses to invest in capex. Indeed, the causes of elevated inflation today are the sources of robust growth in the tomorrows to come.

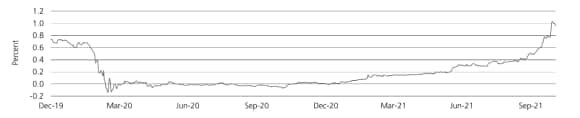

Exhibit 1: Surge in expected central bank policy tightening over next year

Exhibit 1: Surge in expected central bank policy tightening over next year

Average overnight rate expected in one year's time for US, UK, European Union, Canada, Sweden, Norway, New Zealand, Australia

In our view, global expansion is durable

In our view, global expansion is durable

Of course, either view – ours or the market’s – could ultimately prove correct. But based on what is being discounted, we believe that being an optimist about the durability of the global expansion is a more attractive risk-reward proposition.

We are monitoring a variety of macroeconomic issues to judge whether incoming information corroborates our thesis or supports the status quo. If we are right, investors should still benefit from being overweight equities vs. government bonds, but should outperform when tilted to more cyclical areas of the global equity market and commodities.

Margin pressure would be one key sign that end demand is weaker and companies are unable to pass along higher input costs.

Supply chains

Supply chains

The view seemingly embedded in fixed income markets is that supply chain snarls and the price pressures that accompany them will result in demand destroyed, rather than demand delayed.

Is demand real or a mirage?

Is demand real or a mirage?

There is also the risk that a certain degree of demand is a mirage – that due to the widespread knowledge of shortages, companies are over-ordering to secure what they can. Monitoring the new orders subindex of manufacturing PMIs should offer insight as to whether the strong demand backdrop persists, or hits an air pocket as supply chain stresses unwind.

Margin pressure is one sign to watch

Margin pressure is one sign to watch

Margin pressure would be one key sign that end demand is weaker and companies are unable to pass along higher input costs. The most recent earnings season shows us that this is not the case yet. The consequence is supply chain stresses are fortifying the case for business investment.

Companies can borrow at historically low rates to boost capacity and produce more volumes which can be sold at higher prices. Higher capital expenditures both directly increase profitability from an accounting standpoint and contribute to better growth and productivity that are also supportive for earnings on a macro level.

Labor market

Labor market

Wage growth and labor force participation are two key variables to watch to gauge the urgency for rate increases as well as the ultimate destination for short rates.

Lower participation coupled with the hottest increase in US labor compensation in 20 years would suggest the US economy is closer to maximum employment than the Federal Reserve currently thinks, and that an earlier, and perhaps aggressive, removal of accommodation is warranted.

Exhibit 2: Investors pricing a peak policy rate below last cycle’s

Exhibit 2: Investors pricing a peak policy rate below last cycle’s

In our view, the current degree of strength in wage growth represents “surge pricing” for labor, which is supply constrained primarily due to the pandemic and will likely moderate over time. Evidence in support of this view includes the slower recovery in participation for women and abnormally low re-entry rates among retired Americans compared to the aftermath of previous recessions. A recovery in labor force participation would imply that the US economy’s potential growth is not deteriorating and that there is not any downward pressure on the ultimate terminal policy rate this cycle.

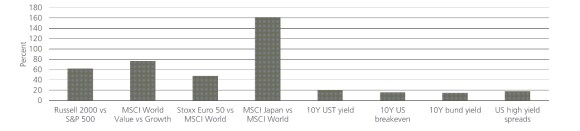

Exhibit 3: Attractive risk-reward in procyclical equity trades

Exhibit 3: Attractive risk-reward in procyclical equity trades

Retracement of peak risk-on move since Nov. 6, 2020.

China

China

The prospects for the world’s second largest economy are something of a wild card for the global economic outlook. Investors have been conditioned to expect that Beijing will be reactive in maintaining a high floor for economic activity.

In our view, [China’s] credit impulse is likely to bottom in Q4.

However, a focus on the quality rather than the quantity of growth may portend a more prolonged adjustment phase of decelerating activity. In addition, policymakers have been more willing to introduce mobility restrictions to control outbreaks of the pandemic, a short-term negative for activity.

Throughout 2021, China has maintained a substantial current account surplus as credit growth decelerated, capitalizing on the global growth rebound. In our view, the credit impulse is likely to bottom in Q4.

That, plus continued resilience in external demand, should be sufficient to stabilize Chinese activity. Trend growth in China is indeed slowing. But in 2022, we have a high degree of conviction that this will be more than offset by the how robust activity is in developed markets.

COVID-19

COVID-19

We believe there is ample evidence that vaccinations are allowing for progress towards pre-pandemic levels of mobility over time, and that successive waves of infections are having smaller impacts on economic activity. Continued public health improvements and innovative adaptations by businesses and consumers should allow this to continue, in our view. If our assumptions are wrong, and the pandemic is a material, persistent drag on activity, we believe that this would support market pricing that central banks have limited scope to raise rates and face an unfavorable growth/inflation mix.

We see strong evidence that growth and inflation will run hotter this cycle than is currently being priced.

Implications for asset allocation

If the market’s view of low-for-the-long-term is correct, it would be indicative of a world in which aggregate demand growth cools meaningfully. This backdrop could still be positive for risk assets as long as growth does not slow too much, since lower interest rates help sustain high valuations. Growth stocks and regions like US equities may likely be the biggest beneficiaries, as could traditional 60/40 portfolio structures.

However, we see strong evidence that growth and inflation will run hotter this cycle than is currently being priced, particularly for longer-term real rates. We believe that this more robust expansion should support the outperformance of cyclical-oriented sectors, such as Financials and Energy, and regions like Europe and Japan.

Over the last 18 months, investors learned about the power of fiscal stimulus to fill even unprecedented holes in demand. In our view, the lesson learned in 2022 will be an appreciation of the ability of the private sector to drive above-trend growth. The initial conditions for household and corporate balance sheets are extremely favorable, and income growth is providing a runway for continued increases in consumption while supply constraints incentivize investments in productive capacity.

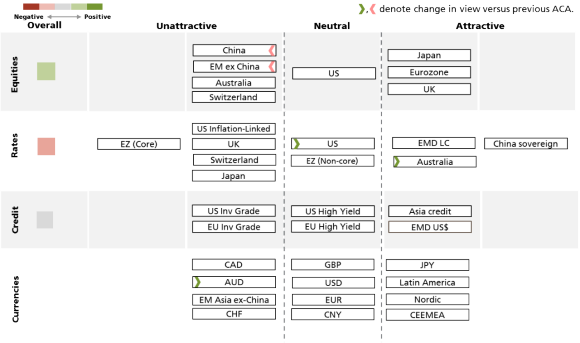

Asset class attractiveness (ACA)

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 3 November 2021.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Light green / Light green | UBS Asset Management’s viewpoint |

|

Asset Class | China Sovereign | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 165 billion (as of 30 September 2021). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

For more information, contact your UBS Asset Management representative or your financial advisor.