A decade after the taper tantrum, is it the emerging market’s time to shine?

Emerging markets stand to benefit from both tactical and thematic tailwinds while remaining underrepresented in many investors’ portfolios.

![]()

header.search.error

Emerging markets stand to benefit from both tactical and thematic tailwinds while remaining underrepresented in many investors’ portfolios.

Key takeaways

Tactically, emerging markets also look attractive

Emerging markets maintain their growth advantage. While much of the developed world will probably experience a slowdown in growth – or even a recession – in the near term, forecasters expect growth in emerging markets to remain robust. In its most recent World Economic Outlook, the International Monetary Fund (IMF) predicted that emerging markets will see growth of 3.9% in 2023 – on par with the pace set in 2022 – while forecasting that growth in developed markets will slow by nearly 1%. India and China, two of the world’s largest economies, are expected to take the lead with forecasted annual growth this year of 5.9% and 5.2%, respectively.

Policy to remain supportive. While central banks in developed markets are battling sky-high inflation with growth-restricting interest rate hikes, policymakers in key emerging markets are already leaning toward rate cuts. For key emerging markets such as China, India, and Brazil, headline inflation remains close to target – and far from the decades-high prints seen in the likes of the US, UK, or Europe – allowing policymakers the room to cut rates without risking the adverse effects of high inflation.

USD strength, a thorn in the emerging market’s side, is set to abate. The post-pandemic strengthening of the US dollar has been another headwind for emerging markets. A stronger dollar has historically led to greater currency risk for emerging-market firms and governments that issue USD-denominated debt, as well as to headwinds for commodity exporters, since commodities are usually priced in US dollars. Yet peak USD strength may be behind us as the Federal Reserve pauses its once-aggressive policy rate hike cycle amidst a broader slowdown in the US economy.

Structurally, emerging markets have a large and growing footprint in GDP and asset classes

The past and future growth driver. According to the IMF, emerging markets now make up 60% of global GDP compared to the around 40% of developed markets, while having a similar footprint in their share of global growth. In other words, nearly two-thirds of every incremental unit of growth comes from emerging markets today. For long-term investors, it is important to note that the emerging-market growth edge will only widen in the coming years as economic juggernauts like China and India become larger and larger, with the latter also benefiting from a generational demographic dividend that could power its next chapter of growth. In fact, the World Bank predicts that by 2050, four-fifths of the largest economies will be emerging markets. Given the significant economic footprint of emerging markets, which is only set to grow in the coming years, we believe that many investors are underexposed to this asset class and could benefit from including emerging-market assets in their portfolios.

Far more structurally sound. A decade ago, emerging-market risk assets experienced a collective heart attack when then-Chair Ben Bernanke hinted at the prospect of higher interest rates from the US. The same can be said when Asian economies fell into recession in 1997 in the aftermath of Federal Reserve interest rate hikes. Since then, emerging-markets benefits have undergone a series of reforms and are now able to thrive in a challenging market environment. Apart from Turkey, key emerging markets such as Brazil, India, and South Africa operate with much milder current account deficits than a decade ago, which insulates these economies from sudden capital flows.

Emerging markets have also made significant strides in ESG

Perhaps some of the most significant opportunities for investors are in the ESG space for emerging markets, where the biggest improvements are being made.

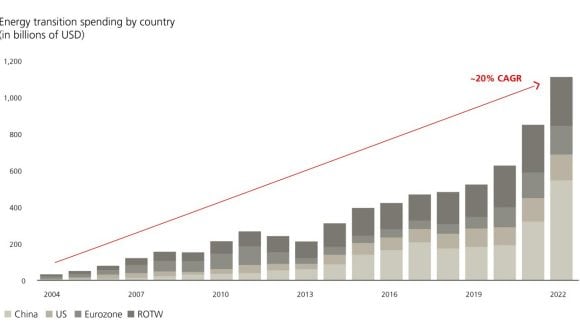

China leads the world in energy sustainability. Environmental concerns have been a mainstay for some time now at the National People’s Congress bi-decennial legislative session, and have only gone on to broaden in scope. Despite renewed green legislation from the US and eurozone, China still leads the world regarding sustainable financing and investment in the energy transition. Despite the country’s reliance on coal, China has usurped Europe to be the top wind power producer in 2020. China also leads both the US and Europe in terms of wind power generation, even pledging to accelerate spending. Bloomberg NEF predicts that by 2050 China could achieve a >90% zero-carbon energy consumption.

India is fast climbing in ease of business. Over the last decade, many emerging markets have made significant strides in corporate governance. Recently lowering corporate tax, reforming building permits, strengthening professional certification requirements, easing trade restrictions, and recently pushing for ESG-related metrics by the Securities and Exchange Board of India have all aided the business and investor environment. Perhaps the most impressive advance has been the World Bank’s “ease of doing business” ranking for India, which came in at 142 out of 190 countries in 2014, only to jump up to 63 in its latest iteration.

Challenges can also breed opportunities within emerging markets

Deglobalization. The US/China trade war that began in earnest in 2018, followed by the COVID-19 pandemic and related supply chain crunch, has led many policymakers and firms to rethink their manufacturing strategies. As a whole, a slowdown in global trade will disproportionately affect emerging markets with a larger share of GDP centered around manufacturing and exports. Nonetheless, some localized winners have emerged. For instance, Vietnam, which grew at a stunning 8% annual rate in 2022, was helped by US firms importing more from this smaller South-east Asian nation and less from China. Commodity exporters including Chile also materialized as beneficiaries of the supply chain crunch and quick economic rebound following the global slowdown in 2020.

Rising debt. Like their developed market peers, emerging markets also loaded up on debt amidst the COVID-19 pandemic as governments rushed to prevent their economies from free fall. Some market participants feared a return to the so-called “taper tantrum” once the Federal Reserve started raising rates in earnest. And yet, especially compared to the banking turmoil felt in the US and Europe, debt concerns in emerging markets remain relatively sanguine, thanks to the persistence of reforms implemented over the last two decades which have strengthened the emerging market’s external position and overall credit quality. Even still, given the overall volatility in the fixed-income space, many attractive entry points in local and hard currency debt have emerged, particularly for sovereigns such as Brazil.

Even adjusted for fundamentals, EM assets look attractive both from a fixed-income and equity perspective

What investors should know

As markets and economies settle into a new post-pandemic cycle, investors should consider emerging-market assets as a core holding in their portfolios, a typically underrepresented but structurally significant asset class. It is also important to note that emerging markets are not a monolith. In fact, the IMF notes that “the emerging-market universe is diverse and defies a uniform narrative”.1 Anticipated growth rates, debt levels, and other idiosyncrasies may be exacerbated during generally higher market volatility and investor scrutiny. Therefore, we believe that investors should consider highly experienced investment teams with a range of strategies that can distill distinct regional and thematic opportunities capable of driving or complementing existing portfolios.

We believe that the most attractive opportunities in emerging markets lie in fixed-income and China-centric strategies which can benefit from the growth in emerging-market trajectory and from attractive valuations, while thematic equities and index-based products stand to benefit from the wave of ESG investment and improvement.

Investing in emerging markets involves a greater degree of risk than investing in developed markets. Emerging-market risks are characterized by a certain degree of political instability, relatively unpredictable financial markets and economic growth patterns, a financial market that is still at the developmental stage, and a weak economy.