Macro thoughts and portfolio themes

Macro thoughts and portfolio themes

Risk assets performed strongly in Q2, particularly equities, supported by better-than-expected economic performance, US debt ceiling relief and excitement over AI.

During the quarter, UBS Hedge Fund Solutions’ (“HFS”) broad based diversified and broad based neutral strategies typically generated modest gains as losses in discretionary macro and commodities partially offset profits in Relative Value and Equity Hedged, while Credit / Income strategies were relatively flat. Our low beta posture and overweight to Trading strategies were generally headwinds for performance in Q2. Discretionary macro strategies were largely challenged as many managers struggled to re-risk their portfolios amid sideways markets and heightened macroeconomic uncertainty. In addition, the most common macro trades, such as short Japanese rates and US steepeners, failed to materialize. Within commodities, rangebound oil prices and an unexpected spike in European natural gas prices at the end of the quarter negatively impacted returns. In Credit / Income, performance was mixed as losses from short positions within corporate credit offset gains in carry-oriented asset-backed strategies. However, Relative Value strategies performed as expected, led by gains from fixed income relative value. Equity Hedged also contributed positively, with returns supported by beta and short alpha.

With the soft June inflation print in the US, we expect policymakers to gradually shift their focus from inflation to growth. However, we believe that the "higher-for-longer” narrative will continue to dominate over the short term, supported by a resilient global economy and tight labor market. Besides manufacturing activity, economic data from the last few months have demonstrated a remarkable ability for Western economies to absorb the impact of higher interest rates. Elevated wage growth, though moderating, is indicative of more complex cyclical and structural imbalances. From a cyclical standpoint, buoyant demand for lower income jobs (e.g. construction and hospitality) contrasts with rising layoffs in those industries that hired excessively during the pandemic. At the same time, demographic trends are pushing the ratio between dependents and workers on a long-term inflationary trajectory. As such, we continue to believe that a certain degree of unemployment is required to settle inflation back to target, resulting in some form of recession next year. For the time being, central banks will likely hold off further action, recognizing the restrictive power of positive real rates, while inflation continues to moderate and many consumers enjoy higher real disposable income.

Portfolio positioning

Portfolio positioning

With a seemingly more benign macro backdrop in Q3, we look to add to EM-focused discretionary macro, fundamental long / short equity and structured credit, while maintaining a generally modest beta profile in our portfolios.

However, with inflation on a clear downward trajectory and weak demand from China, we plan to decrease our exposure to higher beta commodity strategies.

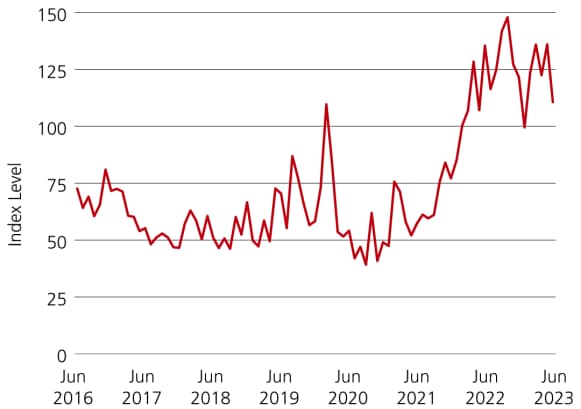

In the current regime, we expect rates volatility to trend lower, but anticipate it to remain well above QE levels. As such, we maintain healthy (but marginally smaller relative to last quarter) allocations to fixed income relative value strategies as they are expected to continue to benefit from this environment.

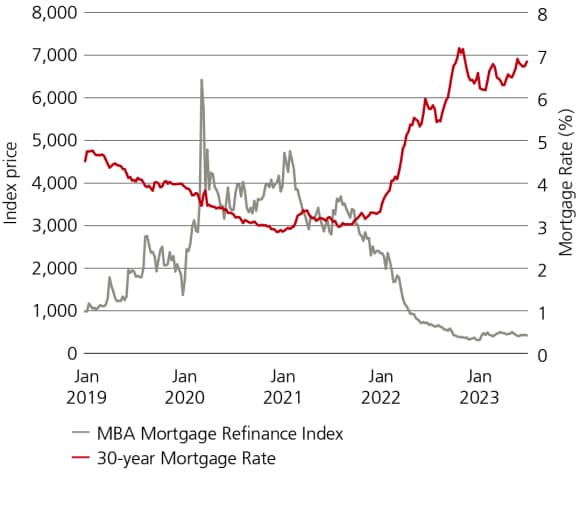

Finally, we continue to place emphasis on attractive, uncorrelated sources of carry from agency mortgages, diversified structured credit and short duration income.

CIO model portfolio and sub-strategy outlook

Strategy | Strategy | Sub-strategy | Sub-strategy |

|

| Q3 2023 | Q3 2023 |

|---|---|---|---|---|---|---|---|

Strategy |

| Sub-strategy |

|

|

| Q3 2023 | Forward looking target weight % |

Strategy | Equity Hedged | Sub-strategy | Fundamental |

| + | Q3 2023 | 14 |

Strategy |

| Sub-strategy | Opportunistic Trading |

|

| Q3 2023 | 11 |

Strategy |

| Sub-strategy | Equity Event |

|

| Q3 2023 | 3 |

Strategy |

| Sub-strategy | Equity Hedged Total |

|

| Q3 2023 | 28 |

Strategy | Relative Value | Sub-strategy | Quantitative Equity |

|

| Q3 2023 | 3 |

Strategy |

| Sub-strategy | Merger Arbitrage |

|

| Q3 2023 | 1 |

Strategy |

| Sub-strategy | Cap Structure/Vol Arb |

|

| Q3 2023 | 7 |

Strategy |

| Sub-strategy | Fixed Income Relative Value |

| - | Q3 2023 | 13 |

Strategy |

| Sub-strategy | Agency MBS |

|

| Q3 2023 | 6 |

Strategy |

| Sub-strategy | Relative Value Total |

|

| Q3 2023 | 30 |

Strategy | Credit/Income | Sub-strategy | Distressed |

|

| Q3 2023 | 1 |

Strategy |

| Sub-strategy | Corporate Long/Short |

|

| Q3 2023 | 10 |

Strategy |

| Sub-strategy | Reinsurance / ILS |

|

| Q3 2023 | 0 |

Strategy |

| Sub-strategy | Asset-Backed |

|

| Q3 2023 | 5 |

Strategy |

| Sub-strategy | Other Income |

| + | Q3 2023 | 4 |

Strategy |

| Sub-strategy | Credit/Income Total |

|

| Q3 2023 | 20 |

Strategy | Trading | Sub-strategy | Systematic |

|

| Q3 2023 | 3 |

Strategy |

| Sub-strategy | Discretionary |

| - | Q3 2023 | 12 |

Strategy |

| Sub-strategy | Commodities |

| - | Q3 2023 | 6 |

Strategy |

| Sub-strategy | Trading Total |

|

| Q3 2023 | 21 |

Strategy | Niche & other | Sub-strategy | Niche |

|

| Q3 2023 |

|

Strategy |

| Sub-strategy | Liquidating/Side Pockets |

|

| Q3 2023 |

|

Strategy |

| Sub-strategy | Niche & other Total |

|

| Q3 2023 | 1 |

Strategy |

| Sub-strategy |

|

|

| Q3 2023 | 100 |

Fundamental

- US equity markets have been dominated by macroeconomic sentiment and narrow market leadership, but we anticipate these trends will reverse which should bode well for fundamental stock picking.

Fixed income relative value

- After strong performance from fixed income relative value over the past few years, we will trim our allocation to reflect a more moderate volatility regime and increased tail risk (stemming from position crowding).

Other income

- With rates now higher and access to capital becoming tighter, we believe lending strategies that are short duration could potentially offer attractive risk-adjusted yields with minimal beta.

Discretionary trading

- With a more benign macro backdrop, we continue to add to EM-focused discretionary trading managers, while decreasing exposure to DM-focused strategies.

Commodities

- In commodities, we will reduce exposure to more correlated oil-driven and metals strategies, but plan to maintain our allocation to more idiosyncratic opportunities in gas / power.

Strategies

Strategies

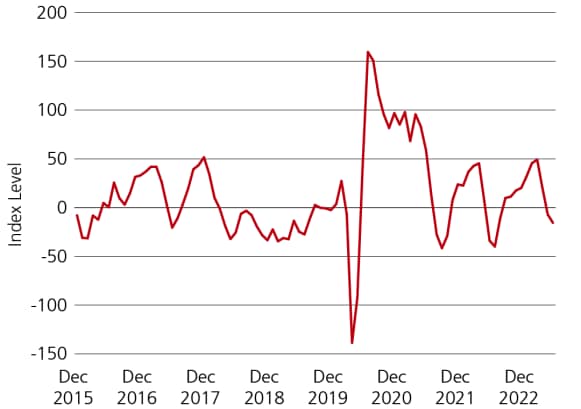

Trading

Within discretionary macro, we continue to create balance geographically by adding to EM-focused managers. HFS prefers managers that have a relative value skew as we are conscious of adding EM beta at this juncture. In our view, the near-term outlook for DM-focused managers could remain somewhat challenged in the absence of clear trends in the macro data. However, managers that can trade more nimbly and tactically, and / or deploy more of a relative value style could be well-positioned to capture short-term reversals. In commodities, with inflation clearly on a downward trajectory and weak demand from China, we find the top-down rationale for an overweight allocation less compelling. While we plan to maintain our allocation to more idiosyncratic opportunities in gas / power, we will reduce exposure to more correlated oil-driven and metals strategies.

Citi Economic Surprise G10 Index

Relative Value

In Relative Value, we are taking some profits from fixed income relative value to reflect a more moderate volatility regime and increased tail risk (stemming from position crowding). HFS plans to increase our allocation to capital structure / volatility arbitrage strategies. We believe the opportunity set for the strategy should benefit as issuers approach a wall of debt maturing in 2025 and 2026. However, we anticipate this may bring more opportunities in Q4 of this year than in Q3.

MOVE Index

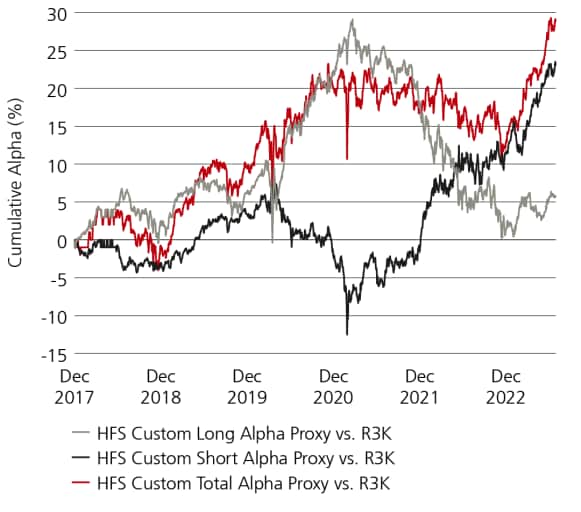

Equity Hedged

After several quarters of reductions, we are beginning to reallocate to more fundamentally oriented strategies in Equity Hedged, using our allocation to opportunistic trading managers as a source of funding. US equity markets have been dominated by macroeconomic sentiment and narrow market leadership, but we anticipate these trends will reverse which should bode well for fundamental stock picking. We strive to limit beta exposure as markets seem richly priced relative to interest rate levels.

In China, we plan to maintain our relatively low exposure to long / short equity managers. Compared to last quarter, our near-term outlook is less constructive given the weak economic rebound thus far, limited evidence of forceful action to stimulate the economy, and heavy outflows from the region. We believe alpha opportunities remain intact in the long term; however, further progress on fiscal support and policy change are probably needed to boost investor confidence. In Japan, equity event remains a high conviction strategy as corporate change gains momentum. A weaker yen and increased investor interest should also provide tailwinds.

HFS Custom Proxies for Industry Alpha (vs. Russell 3000)

Credit / Income

As cash is expected to remain our biggest competitor, we continue to place emphasis on a variety of high carry strategies, particularly agency MBS, diversified structured credit and short duration income, that still benefit from solid fundamentals. With respect to agency MBS, we think the strategy should benefit from more stable rates volatility, a lack of new supply and normalizing technicals as regional banks’ balance sheet overhang gets absorbed. Elsewhere in credit, our allocations to corporate long / short strategies remain focused on defensively positioned, trading-oriented managers that may take advantage of dislocations or event-driven opportunities. Though the opportunity set was more muted in late Q2 as market volatility abated, the space remains attractive given expectations for increasing technical and fundamentally driven volatility, as well as a growing frequency in corporate events (stress / distress, new issue, refi’s, M&A). Finally, we remain patient in more liquid, long-biased credit as spreads tightened somewhat over the quarter.

Prepayment speeds and mortgage rates