Maintaining an emergency fund is an important part of planning for the unexpected, but holding too much could mean missing an opportunity to build toward your dreams. Find your sweet spot.

Inflation outpaces cash

Inflation outpaces cash

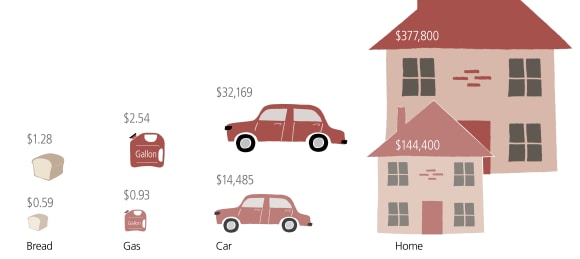

While cash is an important asset for short-term needs, historically cash has not kept pace with inflation. This means that your dollars won't purchase as much in the future as they will today. Over time, inflation could eat away at your money's buying power. Below are a few examples of how average costs rose from 1988 to 2018.

Year | Year | Bread | Bread | Gas | Gas | Car | Car | Home | Home |

|---|---|---|---|---|---|---|---|---|---|

Year | 1988 | Bread | $0.59 | Gas | $0.93 | Car | $14,485.00 | Home | $144,400.00 |

Year | 2018 | Bread | $1.28 | Gas | $2.54 | Car | $32,169.00 | Home | $377,800.00 |

Key Takeaways on Inflation:

- Inflation is an economic term that refers to the rising price of goods and services over time.

- It reduces the 'purchasing power' of your money—so as prices rise, your money doesn’t get you as much.

- Inflation increases your cost of living, meaning down the road you'll likely have to spend more to fill your gas tank or buy a gallon of milk.

- People have been experiencing inflation for a long time—ever hear your parents or grandparents reflect back on when they could get a candy bar for a few cents?

- Simply saving money won't help you keep up with inflation because it isn’t growing at a fast enough rate.

- One way to safeguard your savings against inflation would be to consider investing it.

Key Takeaways Overall:

- The answer to whether you should save or invest depends largely on your goals and your unique financial situation.

- Whether you're starting from scratch or have some money saved, the key is getting your money to work for you.

- Compound interest, or earning interest on interest, can help your money grow even faster.

- If you can start early, you've got some of the best investor allies on your side—compounding and time.

- When investing, it is a good idea to consider if you could benefit from professional advice.

"But cash is so safe"

Fear of losing money keeps investors on the sidelines. However, the reality is that putting too much of your money in cash guarantees that you'll have less spending power in the future due to inflation. Market fluctuations are inevitable, but in the long-term stocks and bonds have historically generated higher returns than cash. Making your money work harder for you brings you closer to reaching your goals.

A framework is key

A framework for managing your wealth based on your goals can help ensure that you have enough cash and other short-term investments to meet immediate needs and keep you from panicking during market downturns.

A Financial Advisor can help you think about what you want to accomplish with your wealth and design a plan that helps you clearly understand where your money is – and why.

- Entertainment and travel

- Taxes

- Purchasing a home

- Retirement

- Healthcare and long-term care expenses

- Second home

- Giving to family

- Philanthropy

- Wealth transfer over generations