Central banks are trying to curb inflation without slowing the economy too much. Markets are starting to anticipate a relatively painless recession that will help push inflation down, eventually reversing the current monetary policy trend.

Macro thoughts and portfolio themes

Macro thoughts and portfolio themes

The macro narrative is largely centered around central banks trying to curb inflation without slowing down the economy too much.

Nevertheless, risk of global recession is rising and markets are starting to anticipate a relatively painless recession, yet effective in pushing inflation down to acceptable levels, eventually reversing the current trend in monetary policy. This explains why the interest rate curve is currently so inverted.

In reality, we are seeing signs of inflation potentially rolling over in the near term. Commodity prices, particularly industrial metals, are falling sharply on fears of a global recession, Chinese woes around the property sector, and COVID-19 lockdowns are also playing their part.

We also expect the housing market to cool down, especially in the US where mortgage rates have doubled in a short period of time. On the other hand, food and natural gas prices are still predominantly supply driven and linked to the war in Ukraine, making central banks’ job particularly arduous, especially in Europe.

We continue to believe a number of structural inflationary forces are in play, with medium to long term impact, such as reshoring of supply chains, labor shortages and energy transition. This is before savers change their investment behaviors chasing hard assets at times of extremely low real yields.

Risk assets will likely be rangebound. For equity investors, there may be room for disappointment, especially for those hoping for the Goldilocks regime of the last 10-15 years to resume at some point. Without the proverbial Fed put, the current credit cycle could potentially be more extended while volatility in risk premia is likely to remain elevated.

Portfolio positioning

Portfolio positioning

With higher volatility and dispersion, we are not deviating much from our defensive posture and will continue to favor market neutrality and maintain low beta in our portfolios.

We continue to focus on the core strategies that we think have higher odds of success in the current environment:

- In Commodities we still expect marginal but positive contribution from beta over time and the green energy transition theme also adds to our bullish view.

- Discretionary global macro strategies have historically performed well in a recession or risk-off climate. We expect the higher interest rate and cross-asset volatility environment to provide ample trading opportunities for those managers with tactical acumen.

- Within Relative Value, we continue to have high conviction in fixed income relative value strategies given the structurally improved opportunity set.

- We continue to be focused on trading-oriented corporate long / short strategies as corporate credit markets are expected to continue exhibiting increased volatility and dispersion in Q3.

Overall Equity Hedged exposure will likely be reduced, especially from fundamental and event-driven strategies, in favor of market neutral, quantitative equity strategies, particularly statistical arbitrage, that should benefit from higher volatility and higher dispersion.

Equity Hedged

Sub-strategy | Sub-strategy | Q3 2022 | Q3 2022 |

|---|---|---|---|

Sub-strategy | Fundamental | Q3 2022 | 14 - |

Sub-strategy | Equity Event | Q3 2022 | 6 - |

Sub-strategy | Opportunistic Trading | Q3 2022 | 12 |

Sub-strategy | Equity Hedged Total | Q3 2022 | 32 - |

Credit/Income

Sub-strategy | Sub-strategy | Q3 2022 | Q3 2022 |

|---|---|---|---|

Sub-strategy | Distressed | Q3 2022 | 1 |

Sub-strategy | Corporate Long/Short | Q3 2022 | 9 + |

Sub-strategy | Reinsurance / ILS | Q3 2022 | 1 |

Sub-strategy | Asset Backed Securities | Q3 2022 | 3 - |

Sub-strategy | Other Income | Q3 2022 | 1 |

Sub-strategy | Credit/Income total | Q3 2022 | 15 |

Relative Value

Sub-strategy | Sub-strategy | Q3 2022 | Q3 2022 |

|---|---|---|---|

Sub-strategy | Quantitative Equity | Q3 2022 | 7 + |

Sub-strategy | Merger Arbitrage | Q3 2022 | 1 |

Sub-strategy | Capital Structure/Volatility Arb | Q3 2022 | 4 |

Sub-strategy | Fixed Income Relative Value | Q3 2022 | 11 + |

Sub-strategy | Agency MBS | Q3 2022 | 3 |

Sub-strategy | Relative Value total | Q3 2022 | 26 |

Trading

Sub-strategy | Sub-strategy | Q3 2022 | Q3 2022 |

|---|---|---|---|

Sub-strategy | Systematic | Q3 2022 | 3 |

Sub-strategy | Discretionary | Q3 2022 | 13 |

Sub-strategy | Commodities | Q3 2022 | 10 |

Sub-strategy | Trading total | Q3 2022 | 25 + |

Equity Hedged -

Equity Hedged -

After a period of repositioning into more balanced, factor neutral Equity Hedged strategies, we are planning to marginally reduce overall exposure to fundamental and equity event strategies. We continue to be cautious and build balanced portfolios around lower net managers that can adapt quickly to sharp moves in the market, as well as reduce residual sector, factor and geographic over-weights.

Asset Backed Securities -

Asset Backed Securities -

In line with our view on the credit cycle, we continue to harvest profits in asset backed and structured credit strategies that we opportunistically increased in the second quarter of 2020.

Quantitative Equity +

Quantitative Equity +

Our outlook on quantitative equity has improved this quarter as we continue to be highly selective as manager quality is generally more relevant than strategy backdrop. Our focus is predominantly on statistical arbitrage strategies, which tend to benefit from higher volatility and cross-sectional dispersion, and are less correlated with discretionary Equity Hedged strategies. Also, the liquidity provision characteristics of the strategies can provide tailwinds.

Trading +

Trading +

Our high conviction in commodities and discretionary sub-strategies remain intact. Our outlook for systematic sub-strategies has improved slightly this quarter as we believe overall premises for trending markets have improved while carry in fixed income and commodities is again becoming additive to the strategy performance.

Strategies

Strategies

Trading

Our high conviction in commodities and discretionary global macro strategies remain intact.

Commodities prices have come down from their highs in Q2, but supply remains extremely tight, particularly in oil and refined products, so we still expect marginal but positive contribution from beta over time. The green energy transition theme also adds to our bullish view as long and short opportunities should arise over time across multiple markets such as energy, metals and carbon. We are focused on commodities managers who can trade both directionally and relative value, seeking alpha and tactical beta, with a disciplined risk framework.

Discretionary global macro strategies have historically performed well in a recession or risk-off climate. We expect the higher interest rate and cross-asset volatility environment to provide ample trading opportunities for those managers with tactical acumen. Outside of rates, volatility in FX has finally returned, potentially providing alpha opportunities, especially in emerging markets, as interest rate differentials widen from varying speeds of interest rates hikes and growth outlooks. We continue to favor discretionary managers who can trade tactically and nimbly across a wide range of markets and asset classes, as well as construct convex portfolios and sustain a robust risk management discipline.

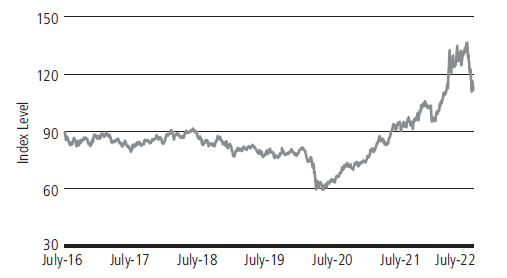

Bloomberg Commodities Index

Bloomberg Commodities Index

Relative Value (RV)

We continue to have high conviction in fixed income relative value strategies and our view of quantitative equity has improved this quarter.

FIRV strategies benefit from the structurally improved opportunity set resulting from increased rates volatility, higher yields, higher inflation and monetary policy normalization globally, as well as the breadth of sub-strategies at play.

In quantitative equity, we continue to be highly selective as manager quality is generally more relevant than strategy backdrop.

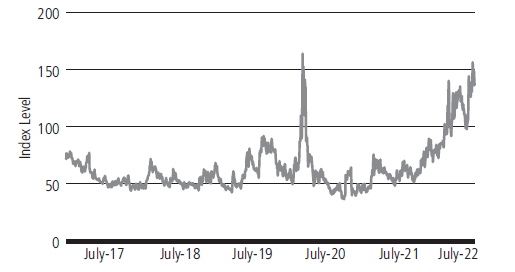

MOVE Index

MOVE Index

Equity Hedged (EH)

Given the elevated market and factor volatility dominating micro considerations, our overall allocation will be slightly reduced, especially from fundamental and event-driven strategies.

We continue to build balanced portfolios around lower net managers that can adapt quickly to sharp moves in the market, as well as to reduce residual sector, factor and geographic over-weights. We continue to identify exciting alpha themes in areas that are generally less crowded and broadly beta neutral, such as energy long / short.

Energy markets are at the crossroads of secular transition trends, both from the supply and demand side, creating price inefficiencies that our specialist Equity Hedged managers are well positioned to take advantage of. Given the secular energy transition dynamics combined with energy security needs, we believe alpha opportunities should be exceptional; we endeavor to allocate to managers that invest across the entire spectrum of energy markets while keeping a low net exposure.

In Asia, we have a more cautious outlook and are currently downgrading our outlook on China-focused long / short due to the challenges of Common Prosperity and the zero COVID-19 policy, and now heightened geopolitical tensions associated with a transitioning world order.

Equity Net Exposure

Equity Net Exposure

Credit / Income

We continue to focus on trading oriented corporate long / short strategies, but our outlook on dislocated China property credit has deteriorated.

Corporate credit markets are expected to continue exhibiting increased volatility and dispersion in Q3, as corporate fundamentals appear to be showing early signs of deterioration and markets price in a potential economic contraction.

Our outlook on dislocated China property credit has deteriorated given the significant decline in new home sales and liquidity issues surrounding the market segment, and we will likely be reducing exposure.

We are monitoring market dynamics extremely closely, particularly in Europe, and expect to be providers of capital should value opportunities arise.

Investment grade and high yield cash spreads

Investment grade and high yield cash spreads