Market report

Swiss economy performs solidly in a turbulent global environment

After moderate growth in 2023, the Swiss economy recorded slightly above-average growth in the second quarter of 2024.

![]()

header.search.error

Market report

After moderate growth in 2023, the Swiss economy recorded slightly above-average growth in the second quarter of 2024.

Figure 1: Risk premium back to long-term average

Yield on 10-year Swiss Confederation bond, net initial yield on prime real estate and resulting risk premium (%)

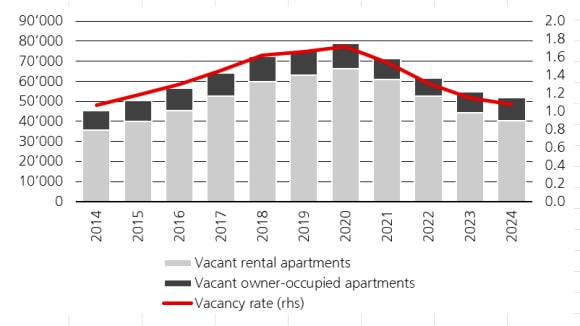

Figure 2: Vacancy rate continues to fall

Vacant apartments (total (left axis); in % of stock (right axis))

The macroeconomic environment of recent years has been characterized by great unrest. The pandemic and the resulting economic slump were followed by inflation, interest rate hikes, and the associated fears of recession as well as geopolitical upheaval. The resulting uncertainty is also reflected in the mood of Swiss economic players. With Germany as one of Switzerland’s most important trading partner, the weakness of German industry is affecting the manufacturing sector also here. This is clearly illustrated by the PMI Purchasing Managers Index, which has been continuously below the growth threshold of 50 points for industry since January 2023. With a range of values between 43 and 57 points since January 2023, the Purchasing Managers Index in the service sector paints a somewhat less gloomy picture than the industry index, though its high volatility reflects the increased uncertainty.

After moderate growth of 0.7% in 2023 and following growth of 0.5% in the first quarter of 2024, the Swiss economy was able to record slightly above-average growth of 0.7% in the second quarter despite the lack of tailwind from abroad, boosted by strong expansion in the chemical and pharmaceutical industry. Growth on the labor market is however not in line with the growth numbers in the economy. Following the significant employment growth of 77,200 full-time equivalents (FTEs) in 2023, employment growth in the first half of 2024 was relatively moderate at 26,900 FTEs. Similarly, the unemployment rate has risen in the year to date from 2.2% in January to 2.5% in September. Overall growth of 1.4% is therefore expected for 2024, which represents a significant improvement compared to last year, but is still below the trend growth rate of 1.6%.

Low inflation allows the Swiss National Bank to lower interest rates

In contrast to other European countries and the USA, inflation in Switzerland has remained within the target range of the Swiss National Bank (SNB) of 0 to 2% for more than a year now. Also in the third quarter, inflationary pressure in Switzerland fell again compared to the previous quarter. Imported goods in particular have had a deflationary effect since November 2023. However, the year-on-year rate of change for domestic goods also no longer exceeded the 2% mark in 2024. Accordingly, the prime rate was lowered again in September by 25 basis points to 1%. With the strengthening of the Swiss franc and the easing of energy prices, the SNB’s conditional inflation forecast was also revised downwards significantly in September. This means that two further interest rate cuts of 25 basis points each are currently expected in December 2024 and March 2025.

Risk premiums back at the long-term average

Swiss real estate investments had lost some of their attractiveness in the past two years, but investor sentiment improved considerably again in 2024, thanks in part to the normalization of the risk premium. At around 175 basis points, the risk premium for direct real estate investments is back just above the level of the long-term average (Fig. 1). In addition to the significant decline in yields on Swiss Confederation bonds, the corrections in real estate yields over the past 24 months have had a positive effect. Compared to the low point in the first half of 2022, prime yields in the residential segment have risen by a total of 65 basis points and prime yields in the retail segment by 53 basis points. The comparatively low corrections in the retail segment can be explained by the lower compression of yields in this segment during the pandemic due to the boom in online retail. Residential properties, on the other hand, experienced strong yield compression during this period, which resulted in a somewhat stronger correction after the interest rate turnaround. In the case of office properties, the change in conditions on the capital markets is being compounded by structural shifts that are putting additional pressure on the segment. As a result, office real estate worldwide has suffered the sharpest corrections in the past two years. With an increase in yields of 70 basis points, offices in Switzerland also experienced the most significant correction, although this remains moderate in an international comparison.

Recently, yields have stabilized again across all segments and have even started to come down slightly in the third quarter of 2024.

Demand for rental apartments in Switzerland remains high

The fundamentals of the Swiss housing market remain very positive. Following the record figure in 2023, net immigration is down year on year at just over 58,000 between January and September 2024, but it remains at a high level. As a result, demand for rental apartments continues to rise sharply, while the increase in supply, with 38,000 residential units approved for construction in the past 12 months, is only slowly recovering from the very low level. This means that the vacancy rate has fallen further from 1.15% in the previous year to 1.08% at present. The decline was once again driven by rental apartments, where the vacancy rate fell by 8.6%, while 9.5% more owner-occupied units were recorded (Fig. 2).

As a result, the ongoing shortage is driving rents up further: according to Wüest Partner, asking rents rose by 6.4% across Switzerland in 2Q24. Growth remained strong in the third quarter as well at 3.8% year on year, despite the already strong increase of 3.9% in the same quarter of the previous year.

Last year, two increases in the mortgage reference interest rate of 25 basis points each in June and December 2023 also led to an increase in existing rents on the rental apartment market. As the reference interest rate is based on the volume-weighted average interest rate of the outstanding mortgage receivables of Swiss banks, no further increase in the reference interest rate is expected due to the recent fall in mortgage interest rates. However, due to the high proportion of fixed-rate mortgages, the interest rate level for part of the total mortgage portfolio continues to rise (depending on the term and time of refinancing) despite the rate cuts. This means that changes, such as the current fall in interest rates, are reflected in the reference interest rate with a certain time lag.

Population growth also supports commercial markets – despite structural challenges

In addition to the turnaround in interest rates, the market for commercial space was also affected by the ongoing uncertainty regarding future space requirements in light of hybrid working models and the growth of online shopping. The undynamic economic situation, to which the commercial segment is inherently more sensitive than the housing market, also plays a role. Despite these adverse circumstances, the commercial segments of the Swiss real estate market are relatively robust.

Employment growth is having a stabilizing effect on the office space market. At +26,900 full-time equivalents, growth slowed somewhat in the first half of 2024 compared to 2023, but it remained positive. It also helps that, according to the real estate service provider CBRE, Swiss companies have an above-average office presence by international standards. As a result, the supply ratio in Swiss office locations remains largely stable. Demand for office space in prime locations in particular remains high. As secondary properties are in an increasingly difficult situation in the wake of space consolidation, the result is a polarization of the rental market. This is reflected in the varying development of rents: while prime rents have risen by 4.1% since the start of the pandemic, average rents have fallen by 5%.

Retail spaces are facing structural and economic challenges due to online retail. However, consumer sentiment is brightening again thanks to real wage growth, although growth in retail sales remains subdued. The situation on the retail market is similar: according to Wüest Partner, rents for retail space fell by another 0.3% in 3Q24 quarter on quarter. By contrast, rents in prime locations, which are also supported by the return of tourists, have risen significantly, particularly in Zurich.

Despite global turmoil environment Switzerland has a solid performance.

Head Real Estate DACH

Head Portfolio Management/ Listed Funds CH

Head Investment Foundations CH

Head International & non-listed Products CH and RE-DA

Head Acquisition & Disposition CH

Head Market Specialists Real Estate DACH