Consumer Discretionary

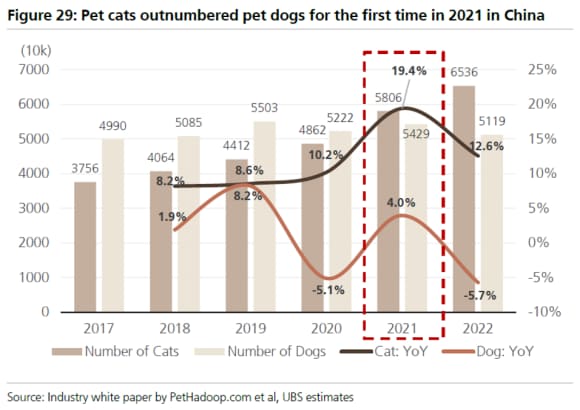

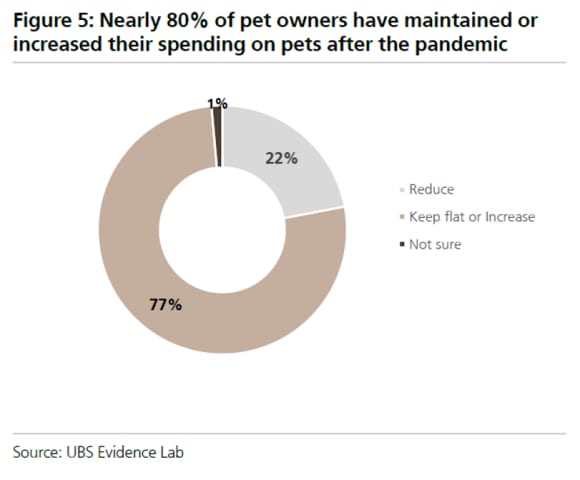

China’s Thriving Pet Market

Our model on China's pet market projects pet sector sales to grow twice as fast as other consumer businesses in 2023-25E. Lessons from Japan point to a multi-decade runway for Chinese pet brands, along with market share consolidation.