UBS Virtual Museum

1909-1930

1909

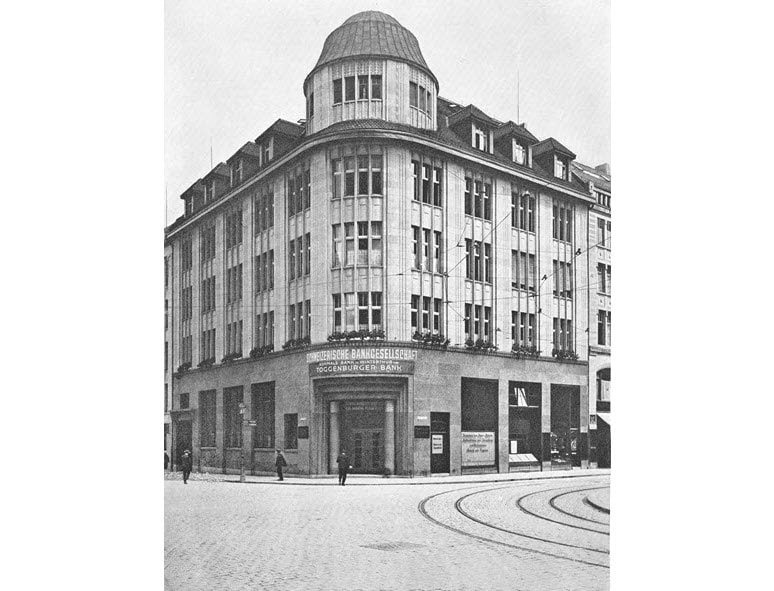

New Swiss Bank Corporation headquarters located at Aeschenvorstadt 1

In 1909, Swiss Bank Corporation (SBC) moved its headquarters, previously at Aeschenvorstadt 72, St. Alban-Graben, to Aeschenvorstadt 1. SBC’s new headquarters added a fresh accent to the cityscape with its striking structure, the historic facade of which dominates two streets. The bank retained the office at Aeschenvorstadt 72 for an additional four years before leasing it to affiliated businesses.

1912

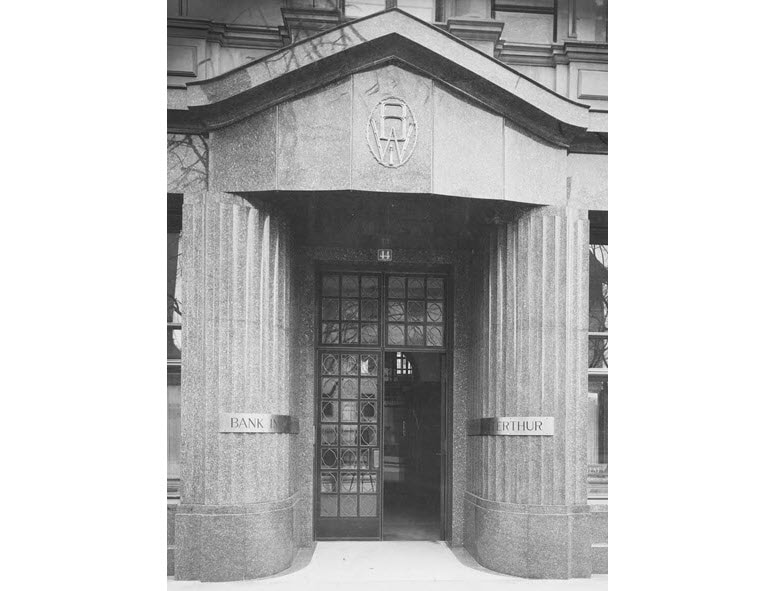

Merger of Toggenburger Bank and the Bank in Winterthur to form Union Bank of Switzerland

Toggenburger Bank focused on business in Eastern Switzerland and St. Gallen specializing in the embroidery industry. However, that meant it was also affected by crises in this industry. The Bank in Winterthur had a broad-based business and ties to various industries. However, its size and capital base increasingly prevented it from catching up with the banks it was competing with. It therefore decided to increase its capital stock and business and customer base by merging with Toggenburger Bank.

1912

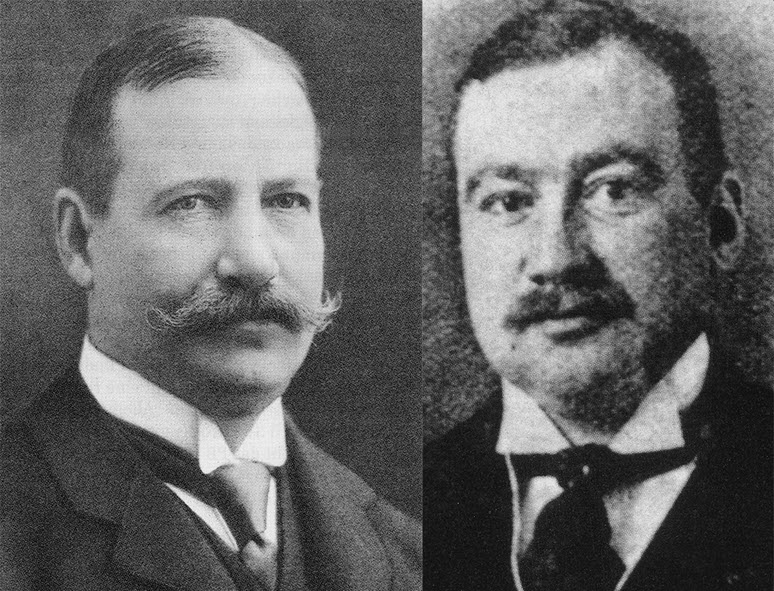

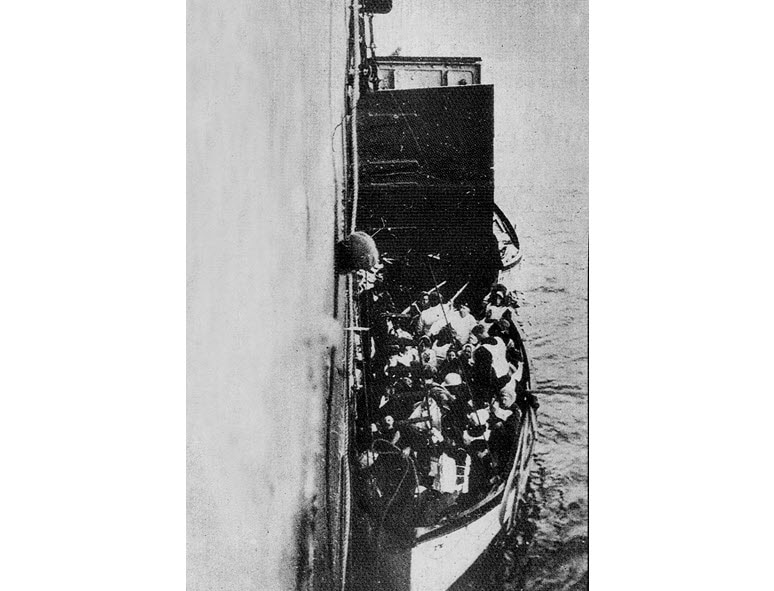

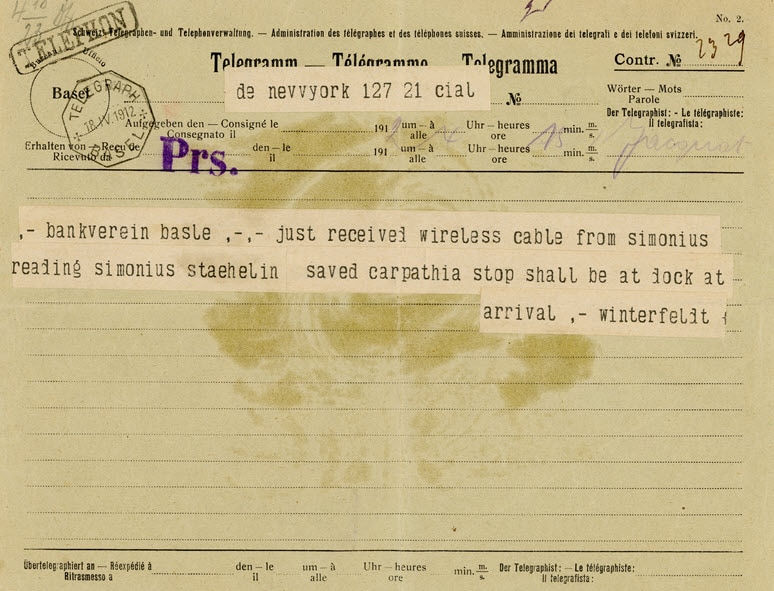

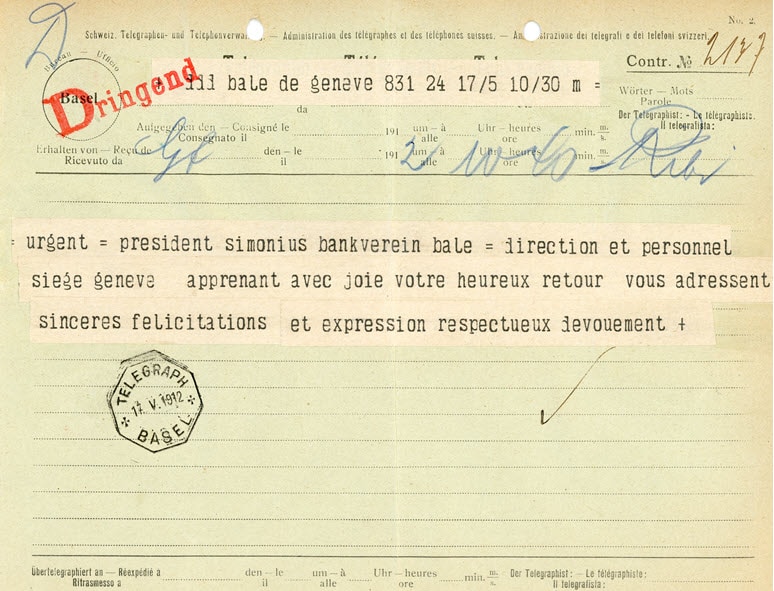

Swiss Bank Corporation’s Chairman and one of his successors survive the sinking of the Titanic

On 15 April 1912, at 2:20 a.m., the luxury liner RMS Titanic sank on its maiden voyage across the North Atlantic. The 255-meter-long steel giant struck an iceberg just before midnight, resulting in a 32-meter-long gash. Of the 2,200 passengers, Alphons Simonius-Blumer (Chairman of the Board of Directors of Swiss Bank Corporation (SBC)) and Max Staehelin (then director of Swiss Trust Company and later himself Chairman of the SBC) were among the 700 survivors. They had been traveling to New York on business to visit a branch of a Swiss embroidery company that needed renovation and the assets of which had been acquired by SBC.

1914

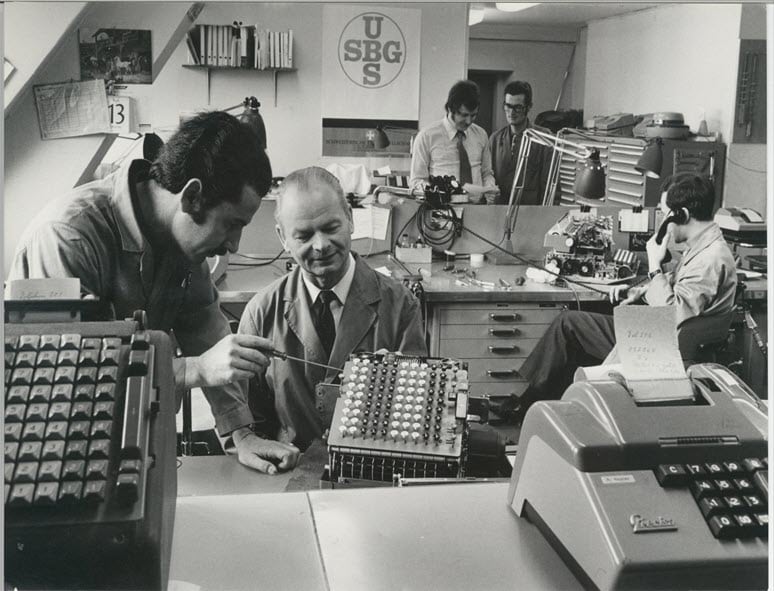

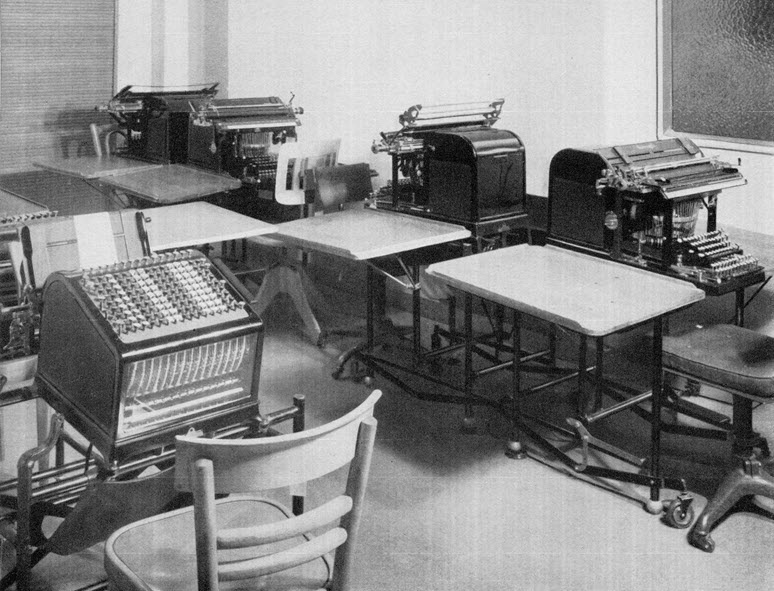

The first adding machine marks the beginning of mechanization

In the early years of the last century, Union Bank of Switzerland was automating as many of its work processes as it could. A lack of qualified personnel and the desire to free workers from burdensome tasks while boosting productivity were the motivations behind this. The first adding machine was purchased in 1914, and, 12 years later, the accounting department had 8 adding machines, 16 accounting machines, 7 electric relay machines, 22 mechanical calculators and 2 typewriters at its disposal.

1917

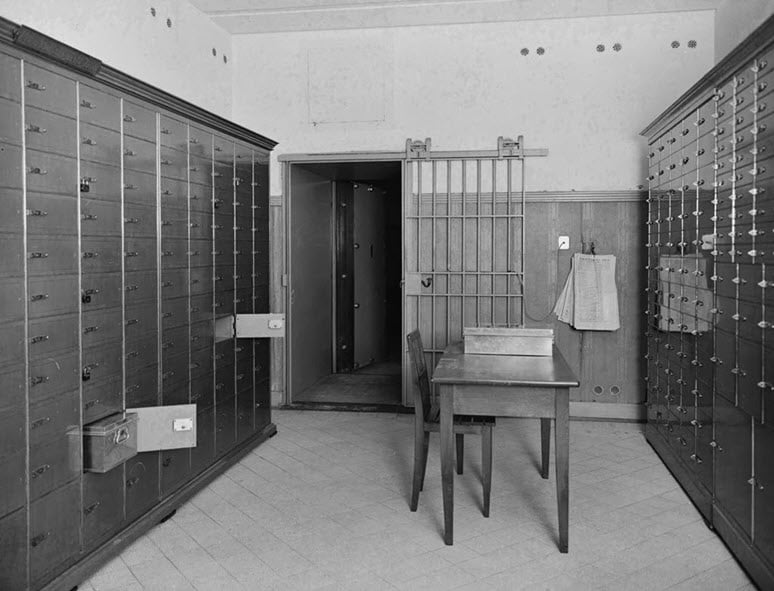

Union Bank of Switzerland moves to Münzhof

The Zurich branch of the Bank in Winterthur had 25 employees in 1906; ten years later, this number had increased tenfold. Due to the limited amount of space available, the Board of Directors decided to purchase a property formerly owned by the Schinz family (textile manufacturers and merchants), on the other side of the street, for a new bank building. In 1917, Union Bank of Switzerland opened its new Münzhof building at Bahnhofstrasse 45 after two years of construction. The bank relocated its headquarters from Winterthur and St. Gallen to this location in 1945.

1919

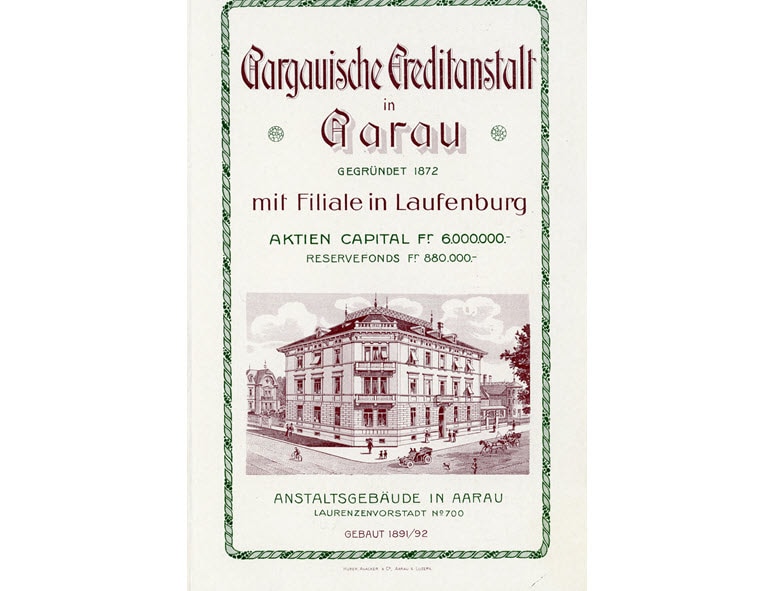

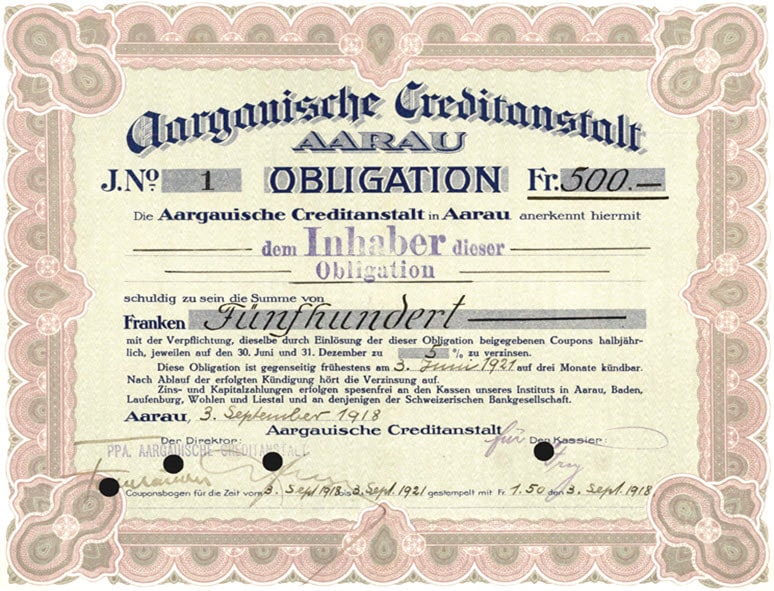

Union Bank of Switzerland merges with Aargauische Creditanstalt

The merger of Union Bank of Switzerland with Aargauische Creditanstalt (founded in 1872) was approved by the shareholders of the former at a general meeting held on 8 March 1919. The share capital was raised to CHF 60 million, an increase of CHF 10 million. The branch network of Union Bank of Switzerland was further expanded by the merger with Aargauische Creditanstalt, adding branches in Aarau, Baden, Laufenburg, Wohlen, and Liestal. The relationship between the two banks had been in place for some time. In 1913 they considered a formal community of interest, but at the time independence and its reputation was crucial to the Aargauische Creditanstalt. But soon after the First World War things had changed, and a merger presented a new opportunity.

1922

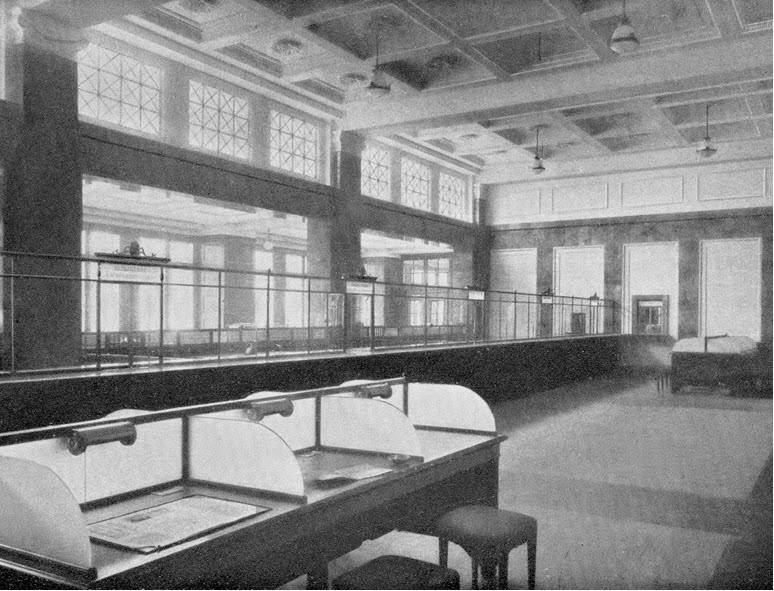

The opening of the new Union Bank of Switzerland office in Aarau

The Aargauische Creditanstalt had begun looking for a suitable location for a bigger and (most importantly) more centrally located new building as early as 1910. A favorable chance emerged when a property close to the train station and originally intended to serve as a post office came up for sale. In 1916, the new structure’s foundations were laid. Construction lasted from 1920 to the end of 1921 and saw tower cranes being used for the first time in Aarau. Following the relocation, Union Bank of Switzerland sold to the National Bank the building on Schlossplatz that had been built by Aargauische Creditanstalt.

The new building was presented in a brochure published to mark the opening.

1922

Swiss Bank Corporation’s low-key celebration of its 50th anniversary

The post-war depression, which was due to the severe effects of the enormous destruction of the first world war, started at the same time as the 50th anniversary of Swiss Bank Corporation (SBC). It wasn’t just Swiss businesses and industry that were affected, the railroads and the hotel sector also faced crises. Due to pressure from sovereign defaults and currency disruption, financial institutions had to be supported and restructured.

1922

A revolution in accounting

Prior to the introduction of the accounting machine, all accounting was done by hand, using pen and ink on bound, heavy books. Both Union Bank of Switzerland and Swiss Bank Corporation (SBC) experienced the wave of automation at the same time in 1922. The fiche system (card indexing), which was introduced along with the technological advancement of the accounting machine, allowed bookkeeping to be done on loose sheets. Over the following ten years, this caused the accounting department’s output to more than double.

1930

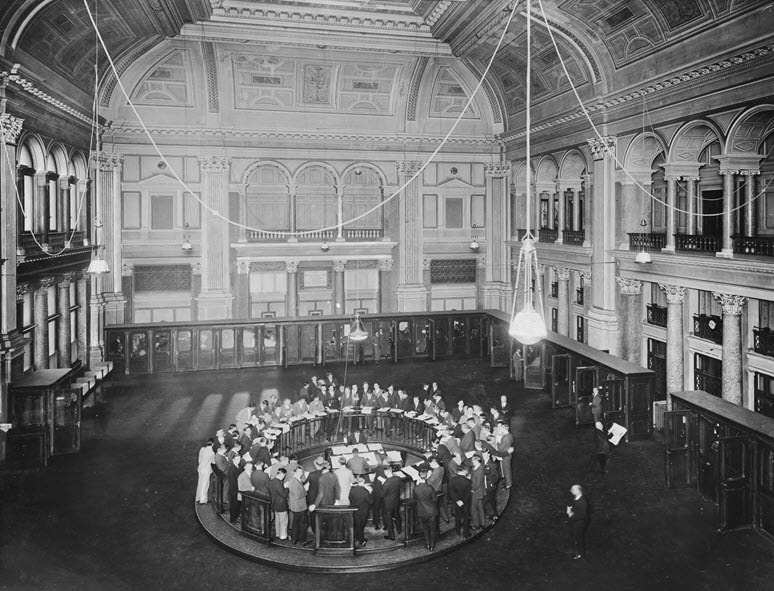

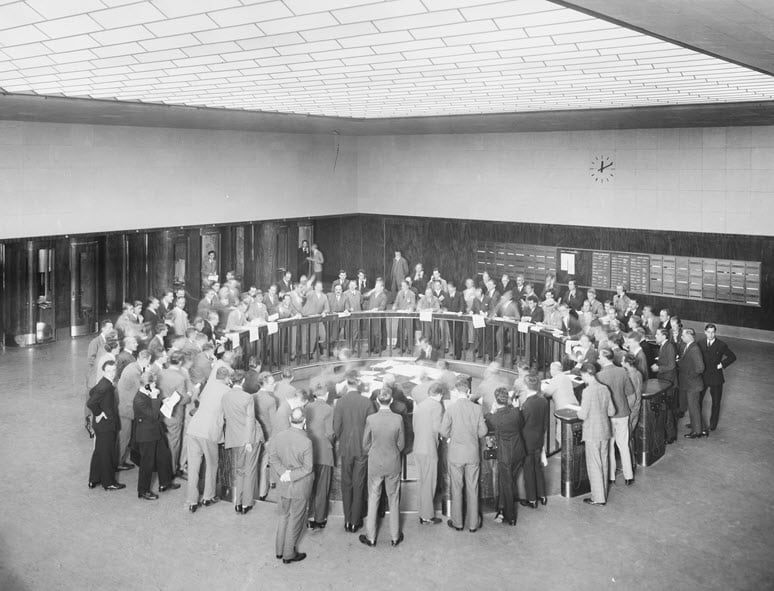

Swiss Bank Corporation offices at the Zurich stock exchange

As one of the most significant stock exchange banks, Swiss Bank Corporation (SBC) already had a stock exchange room in the magnificent, historic former Zurich Stock Exchange building at Bahnhofstrasse 3. Dealers could place orders “à la criée” in the trading ring while taking orders from clients over the phone. In 1928, work on building a new stock exchange began, due to the increasingly congested conditions and the antiquated technical infrastructure. SBC also had a separate exchange room, located just a few steps away from the trading rings.