Please read the important information of the fund before proceeding

Please read the important information of the fund before proceeding

UBS (Lux) Bond SICAV – Asian High Yield (USD)

1. The Fund, UBS (Lux) Bond SICAV – Asian High Yield (USD) (or “ UBS Asian High Yield Bond Fund”), may mainly invest in debt securities issued by international and supranational organisations, public and semi-public bodies, and companies based in Asia or that are predominantly active in that region. At least two-thirds of the Fund’s investments in debt securities have a maximum rating of BBB by Standard & Poor’s, a comparable rating from another internationally recognised rating agency or are unrated.

Asia remains the key driver for global economic growth. With significant monetary and fiscal measures by central banks in Asia, particularly China, Asian high yield fundamentals are solid with attractive yield to offer.

Attractive return potential

Attractive return potential

Supportive macro-trends

Supportive macro-trends

Low exposure to commodities

Low exposure to commodities

1. Attractive return potential

1. Attractive return potential

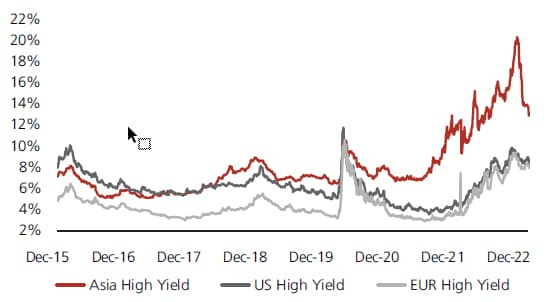

The yields in credit markets offer attractive carry returns. The current spread and yield levels offer an attractive entry point into the Asian high yield market.

Asian USD Credit Market: Yields

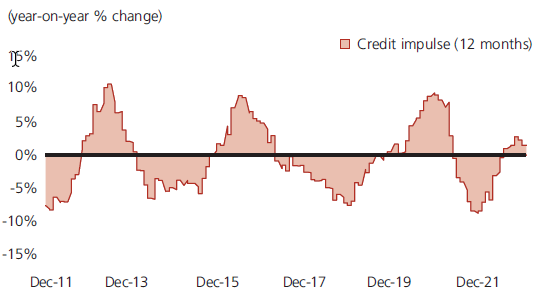

Bloomberg China Credit Impulse

(year-on-year % change)

2. Supportive macro-trends in Asia

2. Supportive macro-trends in Asia

China’s credit impulse growth has been picking up. The Asia markets are supported by significant policy measures and more flexibility in monetary and fiscal policy.

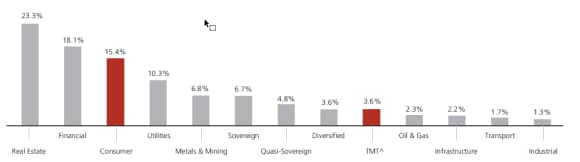

3. Low exposure to commodities

3. Low exposure to commodities

The Asian high yield universe has low exposure to commodity markets. The sector is under pressure from oil price volatility and movement lockdowns. Therefore, default rates in the Asian High Yield space are expected to remain low compared to broader emerging markets and US High Yield. China high yield bonds have shorter duration, so typically they are less sensitive to interest rate changes.

Comparatively stable income potential

Comparatively stable income potential

>6% p.a.1, 2

Yield distribution of UBS Asian High Yield Bond Fund (USD) P-mdist

Distribution Month | Distribution Month | Equivalent Yield (p.a.) 1, 2 | Equivalent Yield (p.a.) 1, 2 |

|---|---|---|---|

Distribution Month | 12/2022 | Equivalent Yield (p.a.) 1, 2 | 7.0% |

Distribution Month | 09/2022 | Equivalent Yield (p.a.) 1, 2 | 6.8% |

Distribution Month | 08/2022 | Equivalent Yield (p.a.) 1, 2 | 6.9% |

Distribution Month | 07/2022 | Equivalent Yield (p.a.) 1, 2 | 6.9% |

Distribution Month | 06/2022 | Equivalent Yield (p.a.) 1, 2 | 6.7% |

Distribution Month | 05/2022 | Equivalent Yield (p.a.) 1, 2 | 6.7% |

Distribution Month | 04/2022 | Equivalent Yield (p.a.) 1, 2 | 6.8% |

Distribution Month | 03/2022 | Equivalent Yield (p.a.) 1, 2 | 6.7% |

Distribution Month | 02/2022 | Equivalent Yield (p.a.) 1, 2 | 6.7% |

Distribution Month | 01/2022 | Equivalent Yield (p.a.) 1, 2 | 6.8% |

Valuations in the Asian High Yield space look attractive as investors get a substantial yield pick-up with lower duration.

More funds

More funds