Christopher Sims’ work touches a number of wide-ranging topics, but whatever it is he’s researching, his main focus is usually on policy effects. As a professor of econometrics, his lectures are said to be hard to follow and on a personal level he’s rather shy. He’s a macroeconomist, and the world pays attention to his work, especially when it comes to monetary policy and the causal relationship to variables such as GDP, inflation, employment and investments.

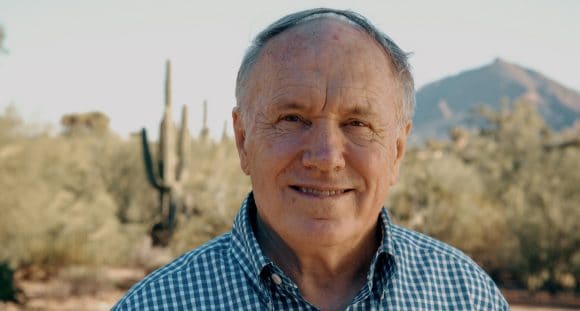

Christopher A. Sims

The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, 2011 (shared)

Improving the world

Improving the world

When Sims speaks, he likes to put his hands in his lap and his shoulders often hang down. In his all grey office at Princeton University, he’s surrounded by notes and books and papers. His blue polo shirt is the only thing displaying a hint of color today. But make no mistake, Sims is passionately, albeit quietly, trying to make the world a better place.

Has this question inspired you?

Get the latest Nobel perspectives delivered to you.

What generates big crises?

What generates big crises?

“Do you want to know what fascinates me?" he asks not wasting any time on small talk. “Rational inattention. Economists model people as optimizing, always doing the optimal thing and always watching all prices in the economy.”

But people can’t process arbitrarily large amounts of information in a small amount of time and that actually means they don’t behave the way some of our models predict.

Sims explains that a secure model is needed to formulate how a central bank can stabilize the economy for example or for people to decide how to regulate the financial system. "There are gaps, and those gaps are probably what generate big crises," he says.

What are the disadvantages of a central bank?

What are the disadvantages of a central bank?

Sims has focused on the policy effects of macroeconomics for most of his life. This should come as no surprise as he was born into a family of economists and politicians.

As his colleague and good friend, Markus Brunnermeier describes, Sims always went against the grain and didn’t accept the predominant view in the profession that central banks can be independent and can control inflation. "He says the central banks also need the governments to control inflation,” says Brunnermeier. “And the fiscal theory of the price level, which he invented, says there are two regimes."

"There’s one where the central bank is in power and the central bank can actually determine this, but you can also end up in another regime where the government is in power and controls the inflation. Then the central bank cannot really do much. And he was the first one pointing this weakness out."

How does monetary policy work?

In the 1960s and early 1970s, the views of Nobel Laureate Milton Friedman dominated monetary policy. His main argument was that money would move because policy makers moved it, and GDP would move in response with only a little delay. Sims showed that this wasn’t a sustainable view of how monetary policy worked and he developed a way of using data that incorporates the interaction and relation of multiple variables.

"Most people in central banks were actually quite sure that they didn’t move the money stock around," Sims says. "They moved interest rates around. And when you recognize that what policy makers actually act on is the interest rate, then you see that interest rates predict money stock movements, but also that interest rates generally move in the same direction as inflation. And yet, monetary policy makers are quite sure that when they raise interest rates, it lowers inflation."

What’s the relationship between interest rates and inflation?

What’s the relationship between interest rates and inflation?

Using Bayesian statistics – a field of statistics that tries to interpret the real state of the world by formulating probabilities on the basis of new data available – and data collected from several countries and time periods, he was able to see that there are two different relationships between interest rates and inflation, relationships that are always operating at the same time.

"When policy raised the interest rates, it would lower GDP and inflation, but when interest rates moved for other reasons, they tended to go in the same direction as inflation," he says. His Vector Autoregression Model, which runs simulations to illustrate the effects of macroeconomic policies, has been a game-changer not only in his own career. His model is now used by central banks in nearly all their forecasting models.

How long does it take to make changes using monetary and fiscal policy?

How long does it take to make changes using monetary and fiscal policy?

“A tightening of monetary policy, in ordinary times, takes about a year to have its full effect on the level of business activity,” says Sims. “And longer than that to have its full effect on inflation," explains Sims.

Making changes using monetary and fiscal policy

Certain types of fiscal policy have a more immediate impact. "If there are lots of unused resources in the economy, the government can hire people and start building things quite promptly,” he says. “There the delay isn’t so much in the effect of the action on the economy, as it is in the political process for actually getting any fiscal policy changes implemented."

Why recessions can’t be avoided

Why recessions can’t be avoided

"When an economy goes into recession and that growth has started to decline, we usually don’t know for sure that this has happened until around six months after it’s actually happened," he says. Sims explains that this is because there are gaps in the data and shows that fiscal policy, even if it’s applied quickly, tends to come a little late. "That’s why we have recessions, because if we knew when they were coming, we could take an action to avoid them."

In the aftermath of the 2008 financial crisis, the US pursued a policy of quantitative easing, where the central bank injected more cash into the economy. In the days since the crash, Sims’ work has become more important showing how causality goes both ways and how interest rates, inflation and other variables lead to changes in the money supply. Sims and Thomas Sargent were honored with the Nobel Prize in Economics in 2011 for their work.

How can we resolve the financial situation in Europe?

How can we resolve the financial situation in Europe?

An American by birth, he has Estonian heritage and was raised in Germany shortly after World War II. Today, he has an opinion on what should be done to help European economies.

"What’s needed to really get economies that have interest rates that are at zero, or close to zero, is fiscal expansion," he says. "And that means not just running deficits but making people confident that these deficits aren’t going to all be unwound with tax increases a few years down the road. It has to be a commitment that there’s fiscal expansion because inflation is too low and the economy is growing too slowly. And the expansion will continue until the targets are met."

Do Eurobonds help Europe?

What’s necessary, according to Sims, is a Eurobond that is exchangeable in all financial markets but that “requires a minimal commitment to shared fiscal risk.”

“European politicians just can’t bring themselves to sign any agreement that shows that under some circumstances, taxes from country A might end up benefiting people in country B, but there’s no way to really preserve the Euro area without such agreements,” he says.

Debt and guilt are different things

Debt and guilt are different things

That Germany is frightened of having too much debt, and campaigns for a rigid austerity policy is, in Sims’s eyes incomprehensible; especially when countries like Greece perish by it. In his opinion, this problem goes back to an incorrect cultural evaluation of debt. "Germany is so averse to debt, which may be to do with the fact that the word for debt in German is guilt," he says and laughs. "Which is not true in other countries of the world."

When could public debt become a threat?

In Sims’ opinion, public debt is not as shameful as it may seem to some people or countries, but he warns that even public debt can be a problem when it becomes too large because it requires higher tax rates.

"Even if we took debt to 200 percent of GDP, it’s something that could be paid for by an increase in taxation that wouldn’t be off the charts, that would not kill the economy,” he says. “It’s a good idea not to plan to let your debt go higher because it forces you to tax to finance the debt, rather than to finance productive government activity like schools and bridges and so on. When you want to get it down, have a plan to get it down smoothly over the long-run."

Has this question inspired you?

Get the latest Nobel perspectives delivered to you.

Make the world a better place

Make the world a better place

After our interview, Sims invites us to his house to meet his wife, Cathie. Mrs. Sims is very outgoing and tells us that her husband sent friends at Harvard’s economics department, where they both worked, to get to know her and find out if she was single. "He woke me up to thinking about political issues," she says.

Sims’ advice to young people is simple, find something you enjoy doing and pursue it with passion and, hopefully, you’ll make the world a better place. This is a point his wife supports. "Our children have grown up with this,” she says. “They all learned to do things that they enjoy and that they feel like is making a real contribution to the social good. I think that Chris has a lot to do with that." Then she smiles and says "Maybe me too."

Why do countries have to find better ways to grow?

Hear Michael Spence's view on how countries can grow sustainably while having a long-lasting positive impact.

More Nobel Laureate stories

Has this question inspired you?

Get the latest Nobel Perspectives updates delivered to you.